Nintendo FY2025 Report - In-depth Analysis of Business Performance, Strategic Layout, and Corporate Governance - 任天堂 - 2025财年报告深度分析:业务表现、战略布局与公司治理

Click to see a more reader friendly version of this content (点击查看视觉效果更好的版本)

EN

Key Logic

Nintendo's performance in fiscal year 2025 (ended March 31, 2025) was lackluster, with significant declines in net sales and various profit metrics, including a 46.6% year-on-year drop in operating profit. This was primarily due to the absence of a powerful blockbuster game, unlike the preceding fiscal year. Despite the core Nintendo Switch platform entering its eighth year of operation, it maintained stable sales, and the next-generation console, Nintendo Switch 2, was released on June 5, 2025, which is expected to provide new growth momentum for the company. To address increasing market competition and technological advancements, Nintendo adheres to its unique entertainment product strategy and actively expands the application of Nintendo IP beyond gaming platforms (e.g., visual content, mobile applications, theme parks), while continuously investing in research and development. The company demonstrates clear policies and actions in sustainability and corporate governance, including a robust CSR system, diversified board composition, and transparent compensation policies, to maintain long-term corporate value and address various risks in global operations.

Company Overview

Key Financial Data and Trends

Consolidated Financial Data Overview

- For the fiscal year ended March 31, 2025, Nintendo's net sales decreased 30.3% year-on-year to ¥1,164,922 million JPY ($7,818 million USD). Net assets and total assets continued to grow, but operating profit, ordinary profit, and profit attributable to owners of parent all significantly declined, with operating profit decreasing 46.6% year-on-year to ¥282,553 million JPY ($1,896 million USD).

- Operating cash flow significantly decreased from last year's ¥462,097 million JPY to ¥12,069 million JPY ($81 million USD), while cash flow from investing activities turned positive, becoming an inflow of ¥753,063 million JPY ($5,054 million USD), primarily due to the withdrawal of time deposits and the sale and redemption of securities.

- Return on equity (ROE) decreased from last year's 20.15% to 10.47%, while the price-to-earnings ratio (PER) increased from 19.45 times to 42.22 times.

- The number of employees increased from 7,724 in the previous fiscal year to 8,205.

Company History

Company History

- Nintendo was originally founded in November 1947 as Marufuku Co., Ltd., engaging in the manufacturing and distribution of Japanese playing cards (karuta) and Western playing cards.

- The company's name changed multiple times, eventually being renamed Nintendo Co., Ltd. in October 1963, which is its current trade name.

- The company's listing evolved over time, including listing on the Second Section of the Osaka Securities Exchange and Kyoto Stock Exchange in January 1962, then transferring to the First Section of the Osaka Securities Exchange in July 1970, and listing on the First Section of the Tokyo Stock Exchange in July 1983, finally transferring to the Prime Market as part of the Tokyo Stock Exchange's market restructuring in April 2022.

- The company expanded its business globally, successively establishing Nintendo of America Inc. in New York in April 1980 (later merged into a Washington subsidiary in February 1982), Nintendo of Europe GmbH in Germany in February 1990, and Nintendo of Korea Co., Ltd. in Korea in July 2006.

- The company's headquarters moved multiple times, finally relocating to its current headquarters address in Kyoto in November 2000.

Business Description

- Nintendo Co., Ltd. and its subsidiaries and affiliates (as of March 31, 2025, including 29 subsidiaries and 5 affiliates) are primarily engaged in the development, manufacturing, and sale of entertainment products.

- Core Products: Primarily include computer-enhanced "Dedicated video game platforms" (hardware and software), character merchandise, and playing cards.

- IP Utilization: The company is also involved in businesses utilizing IP, such as visual content and mobile applications.

- Key Participants and Their Functions:

- Development: Nintendo Co., Ltd., Nintendo Technology Development Inc., Nintendo Software Technology Corporation, Retro Studios, Inc., Next Level Games Inc., Shiver Entertainment, Inc., Nintendo European Research and Development SAS, iQue (China) Ltd., Nintendo Cube Co., Ltd., 1-UP Studio Inc., MONOLITH SOFTWARE INC., Mario Club Co., Ltd., SRD Co., Ltd., Nintendo Pictures Co., Ltd., Nintendo Systems Co., Ltd..

- Manufacturing: Nintendo Co., Ltd..

- Sales: Nintendo Co., Ltd., Nintendo of America Inc., Nintendo of Canada Ltd., Nintendo of Europe SE, Nintendo Australia Pty Limited, Nintendo of Korea Co., Ltd., Nintendo (Hong Kong) Limited, Nintendo of Taiwan Co., Ltd., Nintendo Sales Co., Ltd..

- Single Business Segment: Nintendo operates as a single business segment, therefore segment information is omitted.

Subsidiaries and Affiliates

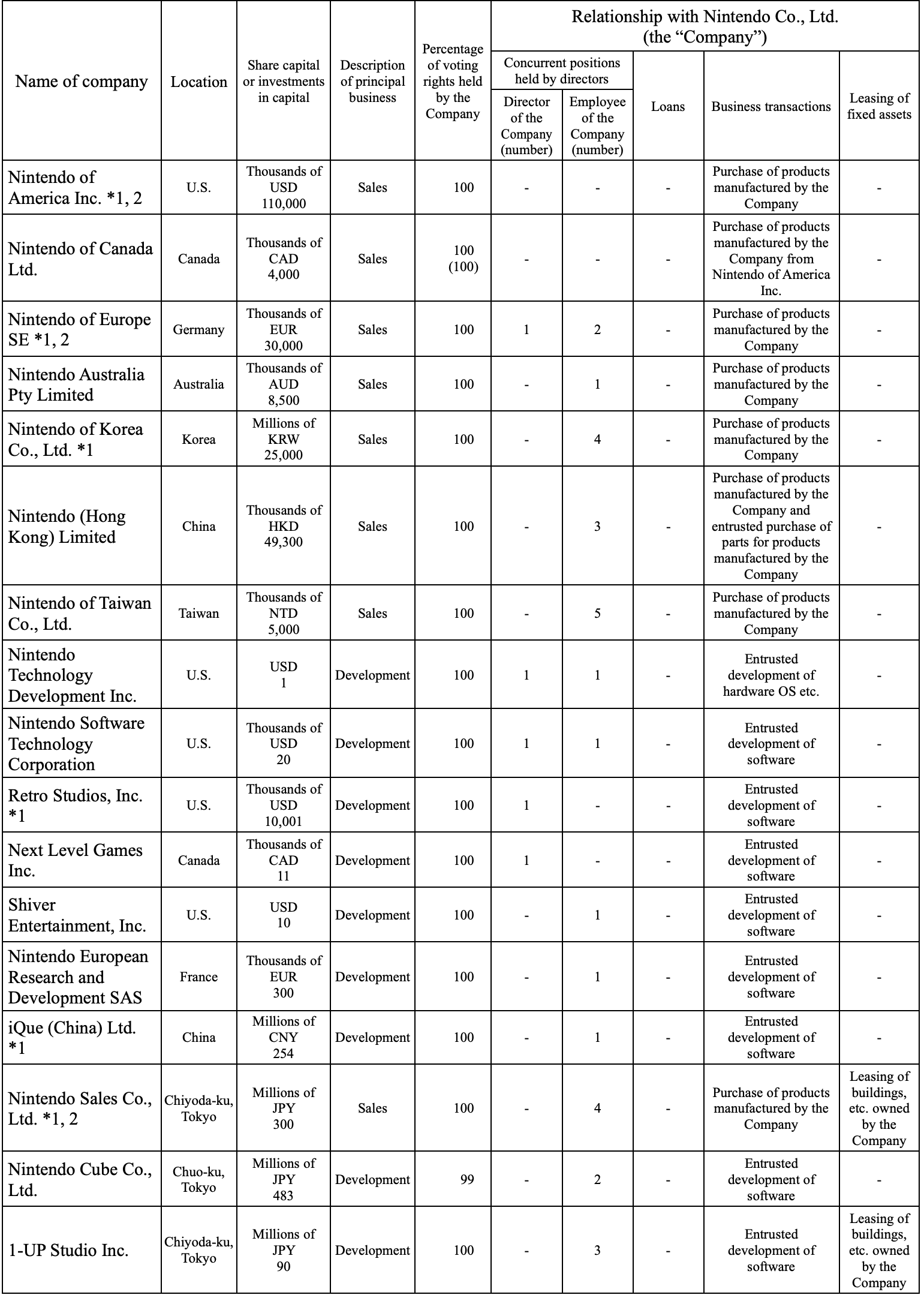

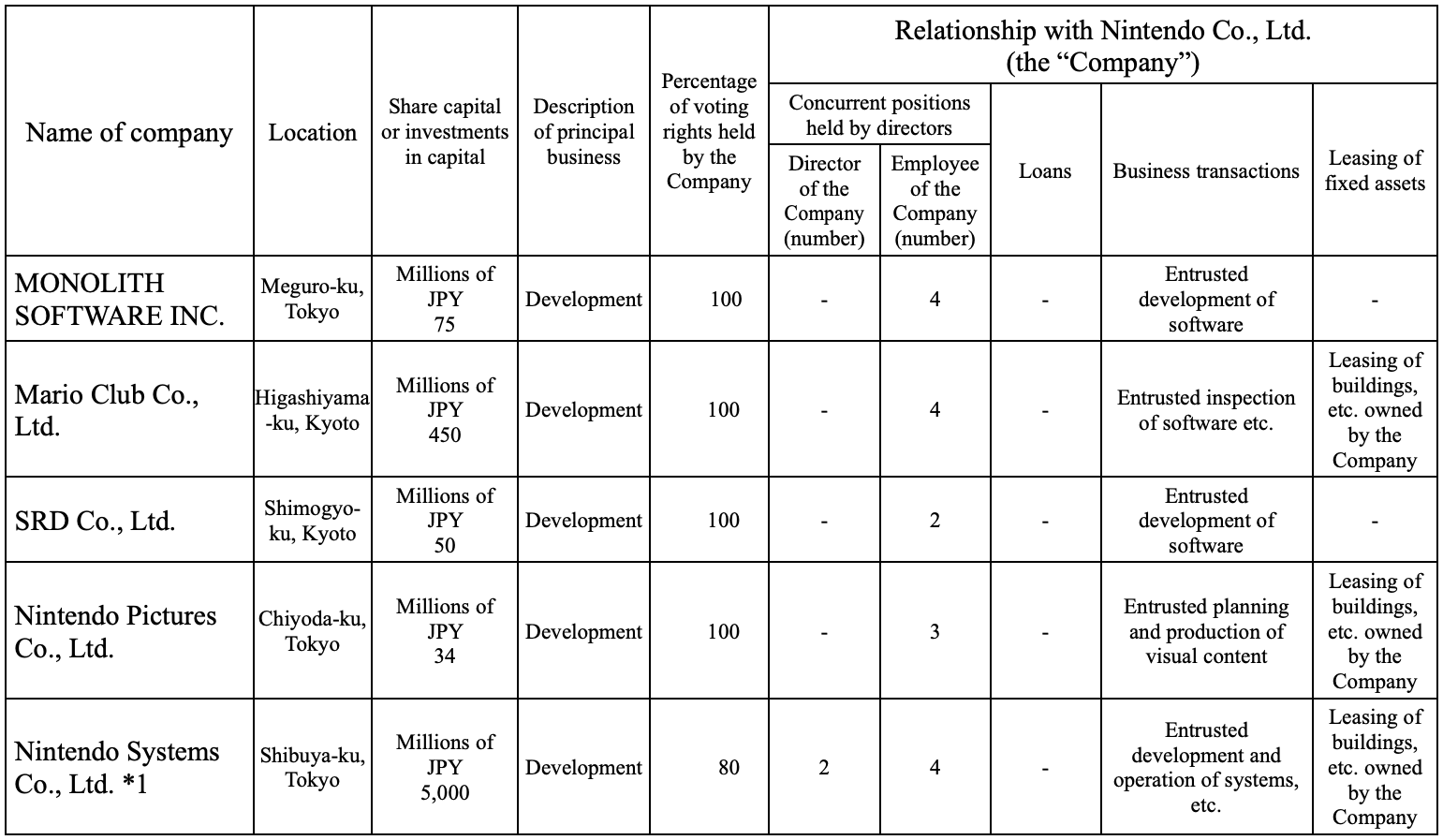

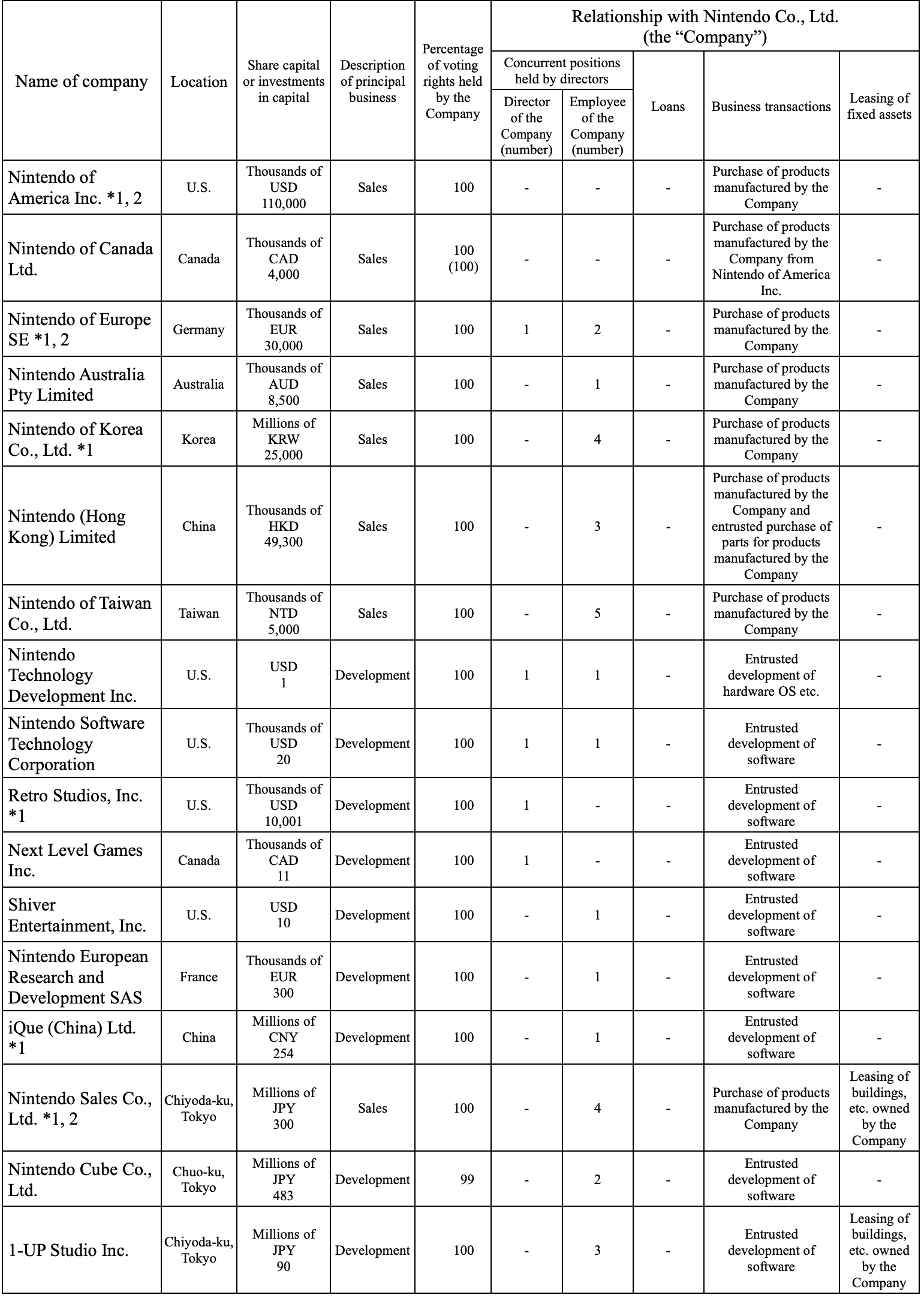

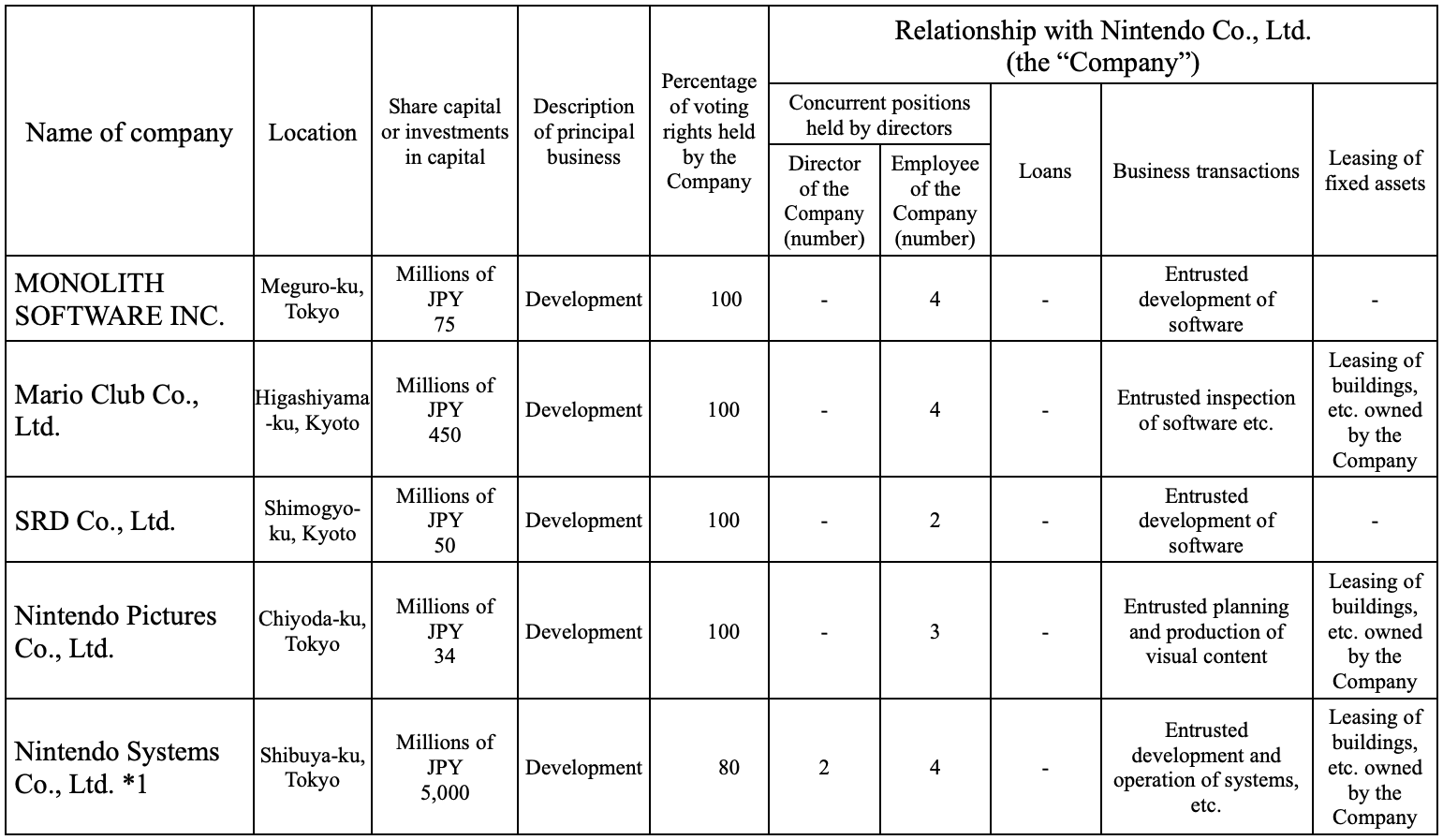

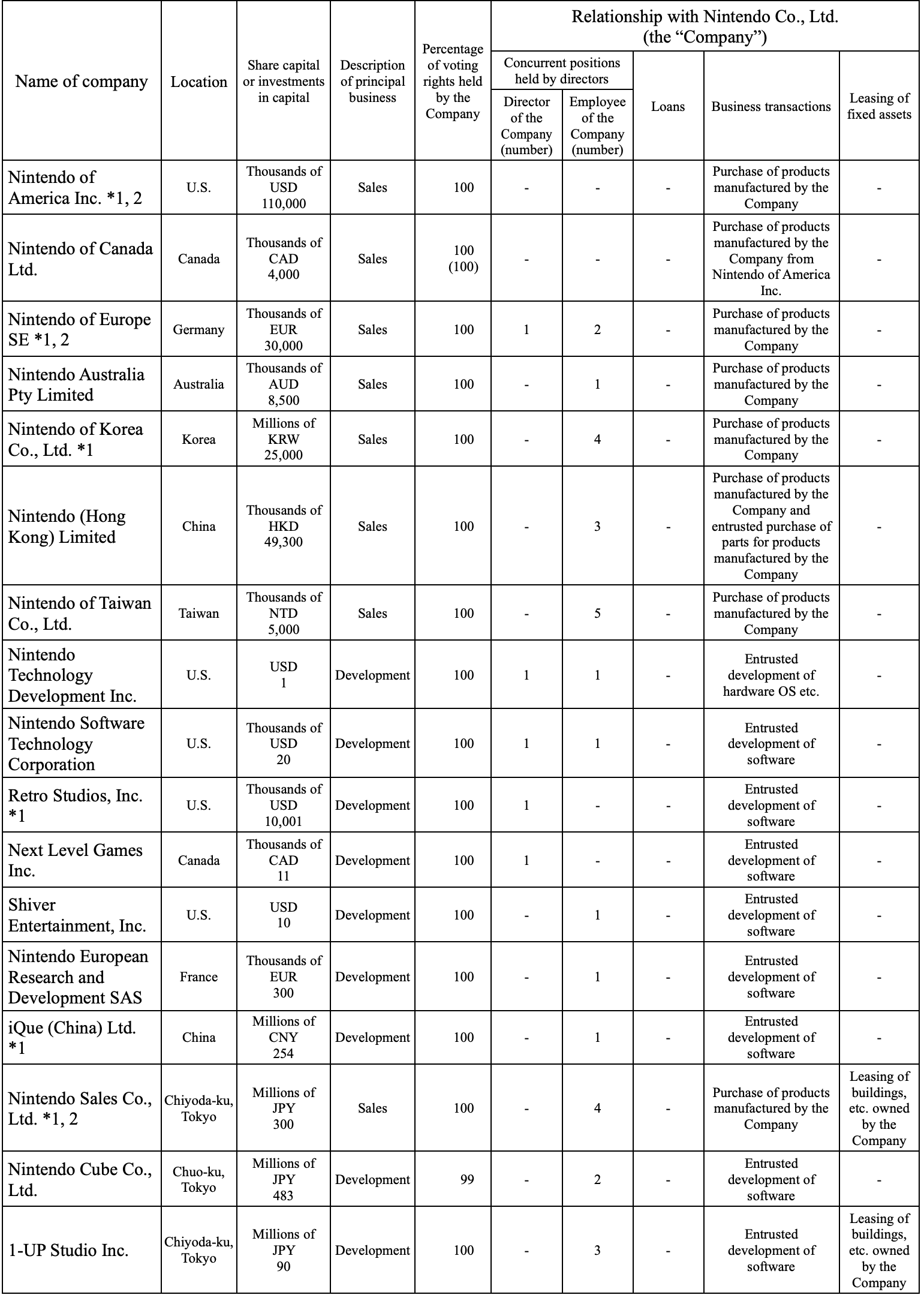

- Consolidated Subsidiaries:

- As of March 31, 2025, there are 29 consolidated subsidiaries, of which 24 are listed in the attached figures.

- Key Subsidiary Details:

- Nintendo of America Inc. (U.S.): Sales business, Nintendo Co., Ltd. holds 100% of its voting rights, and there are product manufacturing and procurement transactions with other Nintendo entities.

- Nintendo of Europe SE (Germany): Sales business, Nintendo Co., Ltd. holds 100% of its voting rights, and there are consigned manufacturing and procurement transactions with Nintendo entities.

- Nintendo Technology Development Inc. (U.S.): Development business, Nintendo Co., Ltd. holds 100% of its voting rights, responsible for consigned development of hardware OS, etc.

- iQue (China) Ltd. (China): Development business, Nintendo Co., Ltd. holds 100% of its voting rights, responsible for consigned software development.

- Subsidiaries with Strong Financial Performance:Financial Information of Major Consolidated Subsidiaries- Nintendo of America Inc. has the highest sales, reaching ¥462,202 million JPY ($3,102 million USD), and is also the most profitable subsidiary, with net profit of ¥44,110 million JPY ($296 million USD).

- Nintendo of Europe SE has the second highest sales, at ¥272,893 million JPY ($1,831 million USD), but recorded a net loss of ¥4,101 million JPY ($27 million USD).

- Nintendo Sales Co., Ltd. is lower than the former two in both sales and profit.

- Consolidated Subsidiaries Information (Partial)

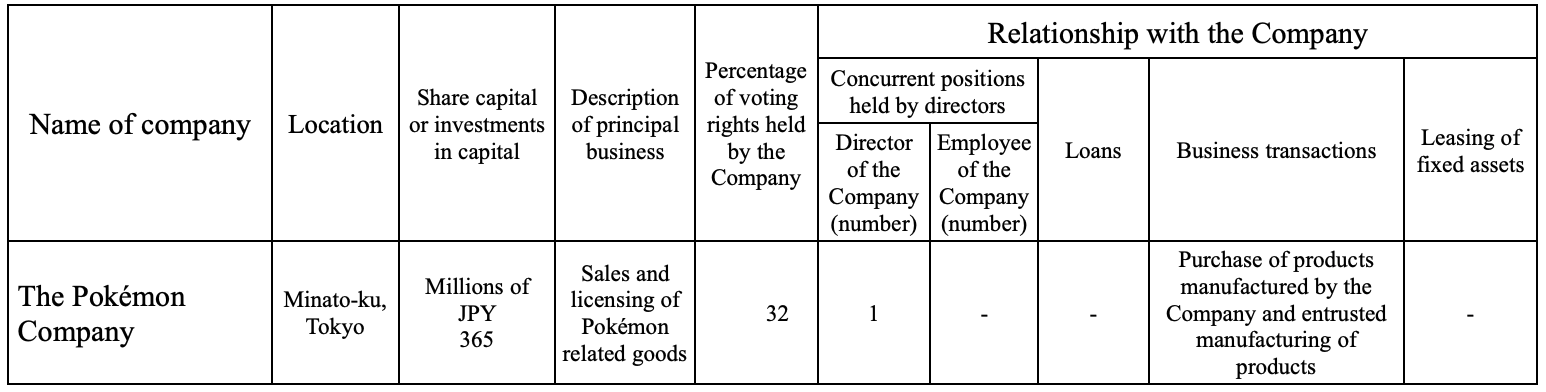

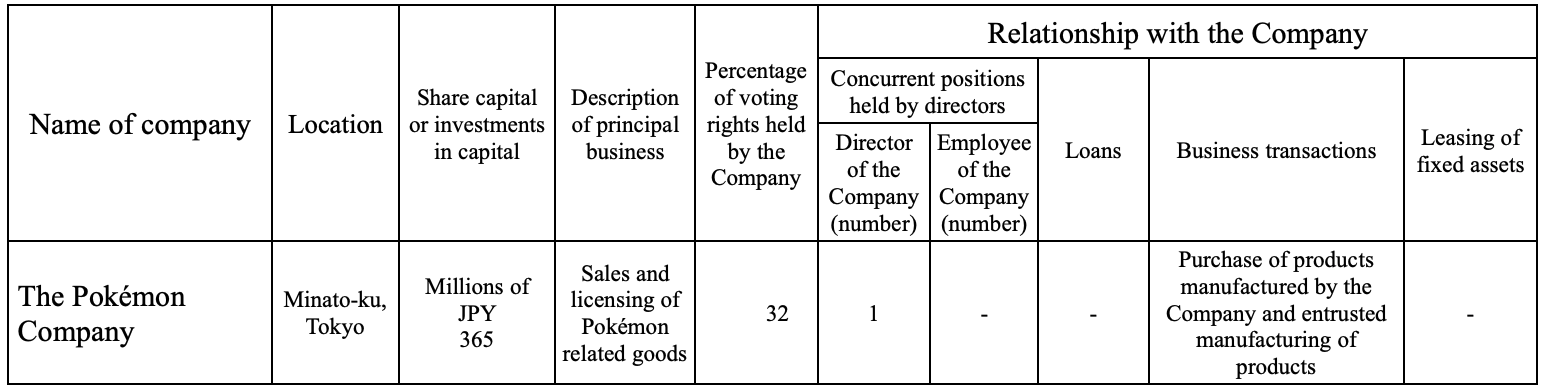

- Affiliates Accounted for by the Equity Method:

- In addition to The Pokémon Company, there are 3 other affiliates accounted for by the equity method.

- The Pokémon Company (Japan): Sales and licensing of Pokémon related goods business, Nintendo Co., Ltd. holds a 32% stake, and there are product procurement and consigned manufacturing transactions with it.

- Affiliates Information

Employees

- Total Group Employees:Total Group Employees

- As of March 31, 2025, the Nintendo Group had a total of 8,205 employees.

- Company Employees Information:Average Information for Company Employees

- As of March 31, 2025, Nintendo Co., Ltd. had a total of 2,962 employees, with an average age of 40.2 years, average length of service of 14.4 years, and average annual salary of ¥9,666,256 JPY ($64,874 USD).

- Labor Relations:

- Nintendo Co., Ltd. does not have a labor union internally, but some consolidated subsidiaries do. Labor relations are good, with no noteworthy issues.

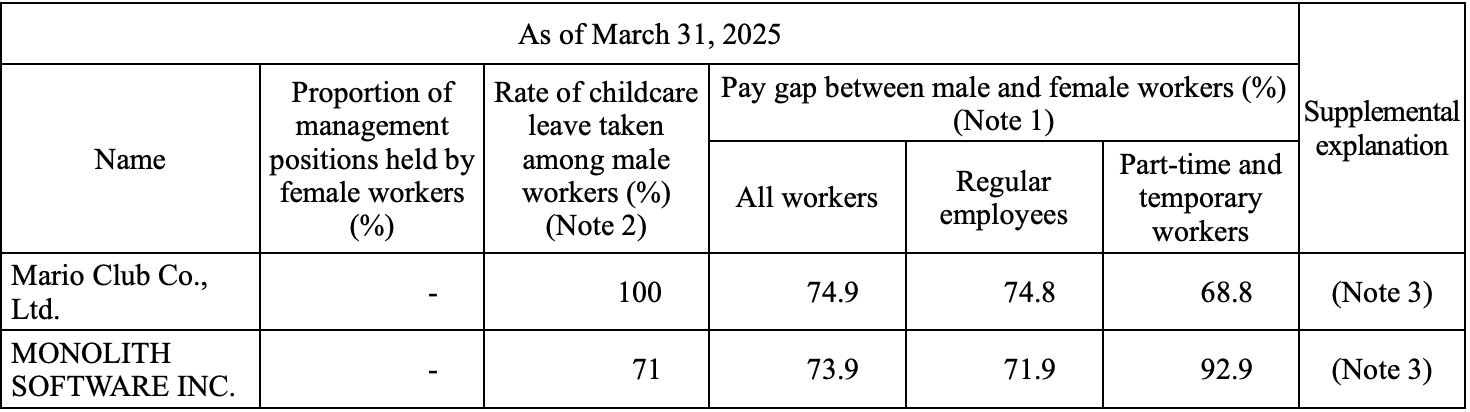

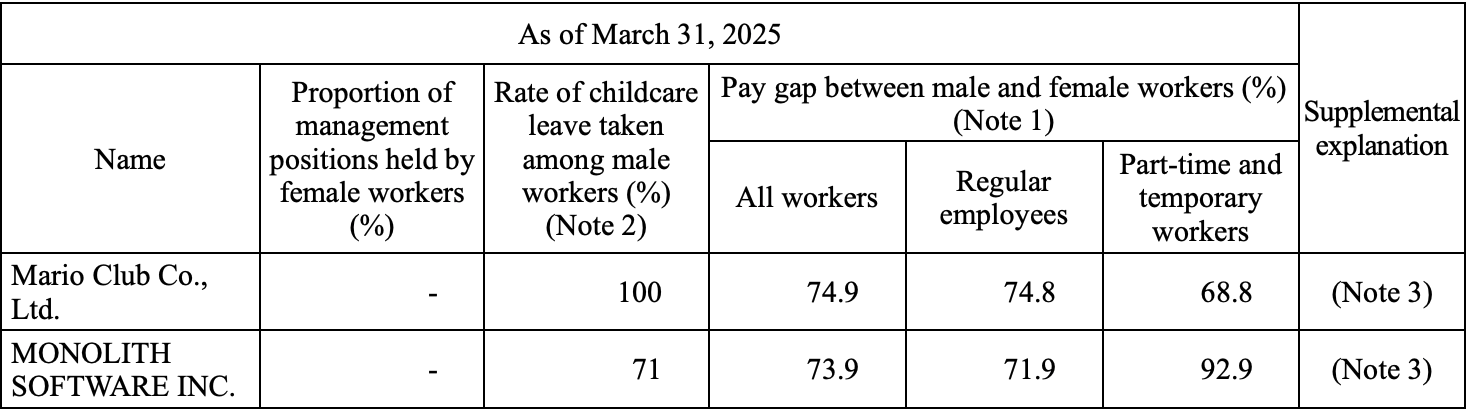

- Gender Composition and Pay Gap:

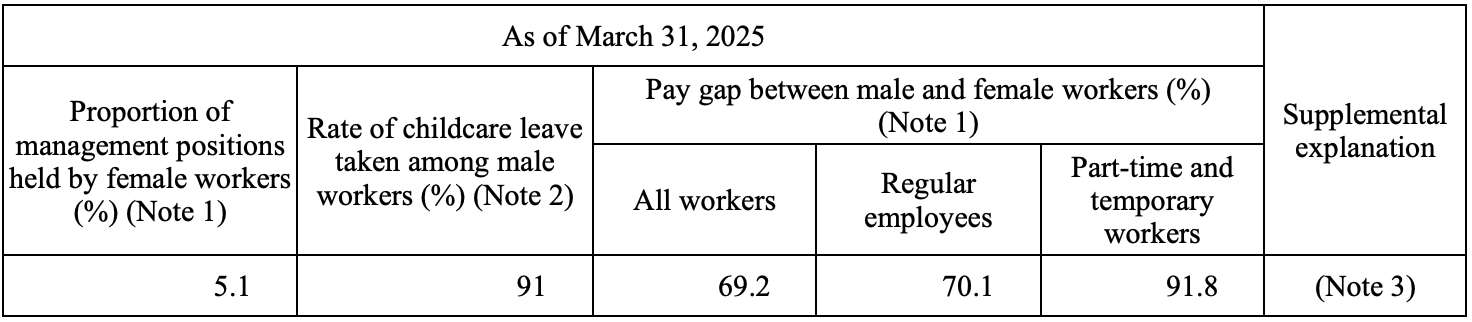

- The Company:Proportion of Female Managers, Male Childcare Leave, and Pay Gap at the Company- As of March 31, 2025, the proportion of female managers at Nintendo Co., Ltd. was 5.1%.

- The usage rate of childcare leave by male employees was 91%.

- The overall gender pay gap for employees was 69.2%, for regular employees 70.1%, and for part-time and temporary workers 91.8%.

- The company explains the pay gap primarily due to differences in length of service and average age, rather than gender differences in compensation or evaluation systems.

- Proportion of Female Managers, Male Childcare Leave, and Pay Gap at the Company

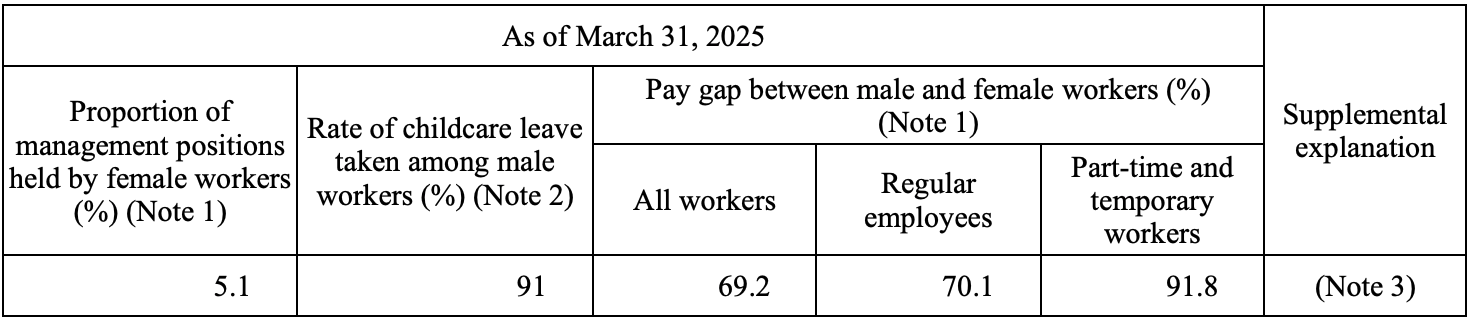

- Consolidated Subsidiaries:Proportion of Female Managers, Male Childcare Leave, and Pay Gap at Major Subsidiaries

- The usage rate of male childcare leave at Mario Club Co., Ltd. was 100%, and at MONOLITH SOFTWARE INC. was 71%.

- The explanation for the pay gap is consistent with that of the parent company, primarily attributed to differences in length of service and average age.

- Proportion of Female Managers, Male Childcare Leave, and Pay Gap at Major Subsidiaries

Business Overview

Management Policies, Management Environment, Issues to Address

- Basic Management Policy:

- Nintendo is committed to being an "entertainment company that creates smiles," providing exciting experiences to consumers worldwide by introducing unprecedented forms of entertainment, while maintaining sound corporate management.

- Target Management Indicators:

- The company aims to continuously provide novel and entertaining products and services, enhancing corporate value by maintaining strong growth and increasing profits.

- Since there is inherent uncertainty in R&D for entertainment products and content, Nintendo does not set specific management indicator targets to maintain decision-making flexibility in a highly competitive industry.

- Management Environment and Mid-to-Long-Term Strategy:

- Market Environment: Growing global demand for entertainment, diversification of entertainment forms due to technological advancements, and intensification of competition in the gaming industry.

- Core Strategy:

- Centered on the Dedicated video game platform business that integrates hardware and software, providing unique, original, and intuitive entertainment experiences for all ages, genders, and gaming experience levels.

- Continuously expand the audience for Nintendo IP through various fields such as visual content, mobile applications, theme parks, and peripheral products, thereby deepening consumer affection for Nintendo IP and stimulating their interest in the core game platform business.

- Maintain long-term relationships with consumers through Nintendo Account, which is a key connection point that spans platform generations and connects various entertainment experiences.

- New Product Release: The new generation game console, Nintendo Switch 2, was released on June 5, 2025, aiming to inherit the successful user base of Nintendo Switch and further expand the global user group.

- Core Philosophy: The true value of entertainment lies in its uniqueness, and Nintendo aims to achieve sustainable growth and enhance corporate value by leveraging its strengths, adapting to changing times, and valuing creativity.

Sustainability Approach and Initiatives

- Goal: To promote comprehensive CSR activities with the goal of "bringing smiles to everyone touched by Nintendo".

- Four Key CSR Priority Areas: Consumers, Supply Chain, Employees, and Environment.

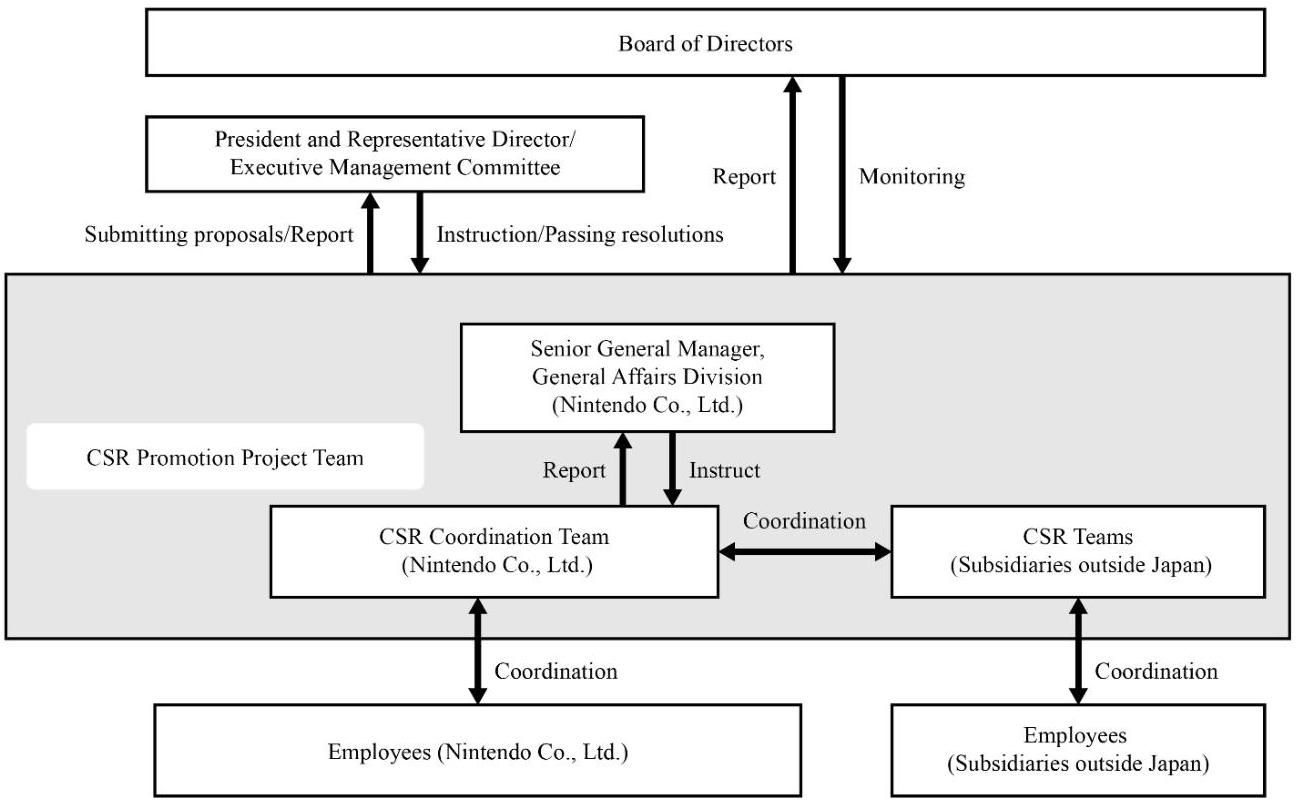

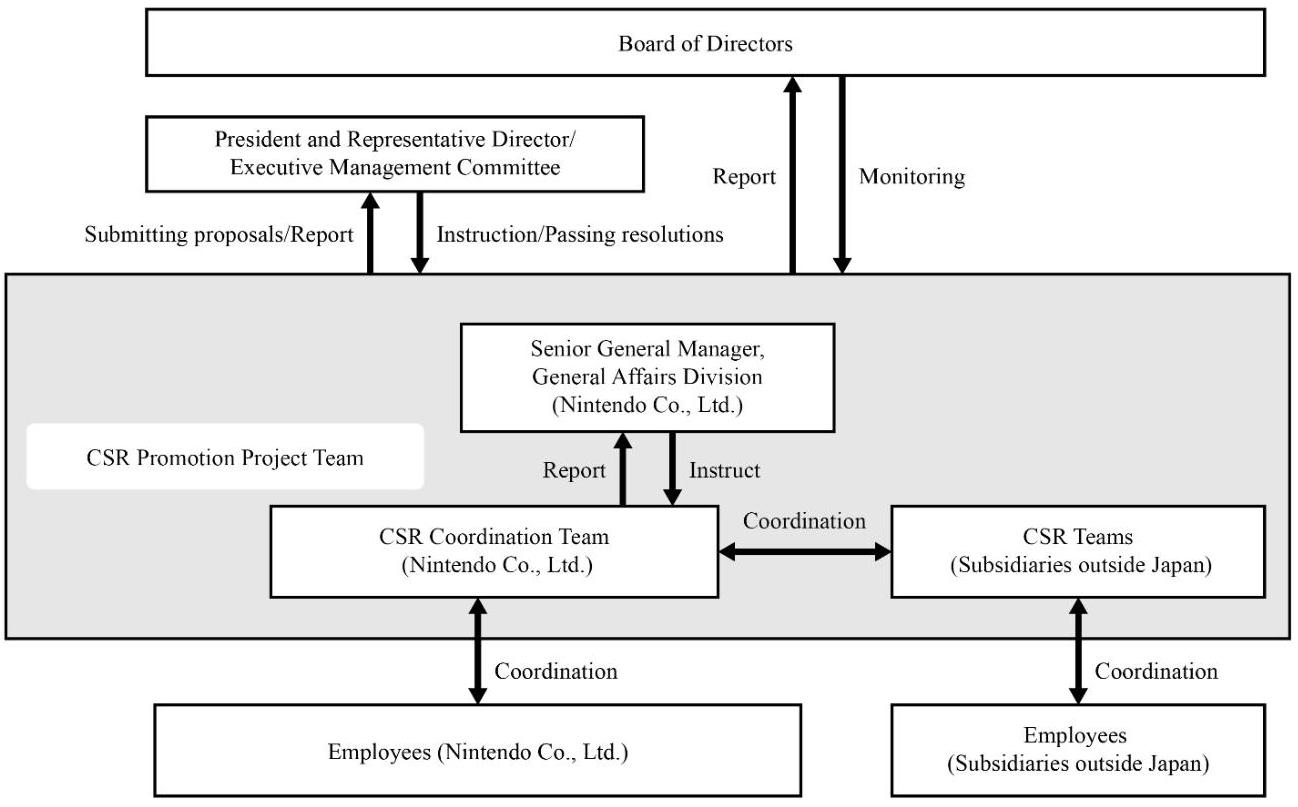

- Governance System:

- CSR Promotion Project Team: The company has established a CSR Promotion Project Team, under the supervision of the Senior General Manager of the General Affairs Division, responsible for coordinating and supporting CSR activities.

- Global Coordination: Major overseas subsidiaries have CSR teams that share activity information.

- Reporting Path: The CSR Promotion Project Team reports important CSR matters to the Executive Management Committee and conducts activities based on their instructions. The Board of Directors receives CSR reports and monitors progress.

- Company CSR Activity Governance Structure

- Specific Initiatives for Each CSR Priority Area:

- Consumers:

- Ensure product quality and safety: Implement extensive measures in development, production, and after-sales service.

- Child-friendly: Emphasize safety in game software development, create parent/guardian usage check functions, and eliminate inappropriate content in communication features.

- Supply Chain:

- Collaborate with partners: Cooperate with global production partners to improve quality, technical capabilities, and production efficiency.

- CSR Procurement: Formulate basic procurement and business partner selection policies, ensuring through Nintendo CSR Procurement Guidelines that procurement complies with laws, regulations, and social standards, respecting human rights and the environment.

- Employees:

- Talent Development: Based on Nintendo DNA (originality, flexibility, sincerity), maximize employee personal development through work experience, emphasize teamwork, and encourage employees to act independently, flexibly respond to changes, and challenge themselves.

- Diversity: Actively recruit and promote talent regardless of gender, age, nationality, disability, sexual orientation, or gender identity.

- Work Environment Optimization: Encourage idea exchange, provide timely suggestions, promote collaboration and communication; actively improve support systems, including encouraging employees to utilize childcare leave to balance work and life.

- Environment:

- Reduce environmental footprint: Reduce environmental impact at both office and product levels, from design phase to after-sales repair and recycling.

- Specific Measures: Design considerations for energy and resource efficiency, selection of easily recyclable packaging materials, efficient transportation, and provision of after-sales repair support.

- Addressing Climate Change: Identify risks and opportunities based on 1.5°C and 4.0°C global warming scenarios, assess financial impact, and disclose information according to the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD).

- Consumers:

- CSR Risk Management:

- The CSR Coordination Team collaborates with CSR leaders of overseas subsidiaries to identify CSR issues, analyze the degree of risks and opportunities, and prioritize them based on their impact on society and Nintendo.

- Regular assessment, flexible response to social and environmental changes.

- CSR Indicators and Targets:CSR Related Indicators and Targets

- Target for Female Employee Childcare Leave Usage Rate: Maintain 100% usage rate over a cumulative period of 5 years starting from the fiscal year ended March 31, 2022.

- Actual Result: As of March 31, 2025, the cumulative usage rate was 105%, achieving and exceeding the target.

- Target for Male Employee Childcare Leave Usage Rate: Achieve 50% or more over a cumulative period of 5 years starting from the fiscal year ended March 31, 2022.

- Actual Result: As of March 31, 2025, the cumulative usage rate was 81%, achieving and exceeding the target.

- Note: The calculation method for childcare leave usage rate may result in values above 100%, as it is based on the ratio of "number of employees who started childcare leave" to "number of births in the same year."

- Target for Female Employee Childcare Leave Usage Rate: Maintain 100% usage rate over a cumulative period of 5 years starting from the fiscal year ended March 31, 2022.

Risk Factors

- Economic Environment Risks:

- Foreign Exchange Rate Fluctuations: Over 70% of Nintendo's sales are from outside Japan, with most transactions conducted in local currencies, and the company holds a large amount of foreign currency assets. Exchange rate fluctuations may adversely affect its financial condition, operating results, and cash flow. The company mitigates the impact by continuously engaging in foreign currency procurement.

- Business Activity Risks:

- Market Environment Fluctuations and Competition:

- The entertainment market is highly competitive, and shifts in consumer preferences towards other forms of entertainment or technological innovations leading to new competitors may adversely affect the video game market.

- Nintendo addresses this by focusing on its unique hardware-software integrated Dedicated video game platform business and expanding Nintendo IP touchpoints (such as Nintendo Account).

- New Product Development:

- Software development involves high costs, long cycles, and uncertain consumer preferences, making it impossible to guarantee the success of all new products.

- Hardware development is time-consuming, and technology updates rapidly, potentially hindering timely acquisition of necessary technologies.

- Product launch delays, development disruptions, or changes in plans may adversely affect financial performance.

- The company continuously strives to develop unique and attractive new products.

- Product Valuation and Inventory Procurement:

- Game products have a relatively short life cycle and are heavily influenced by consumer preferences and seasonality, so excess or obsolete inventory may have an adverse impact.

- Inaccurate demand forecasts may lead to lost business opportunities or supply shortages.

- Nintendo ensures supply by forecasting production and promoting downloadable software versions.

- Reliance on External Manufacturers:

- Reliance on external companies for key components and product assembly may expose the company to risks such as supplier bankruptcy, insufficient timely supply, rising costs, and quality issues, which could harm Nintendo's relationship with consumers.

- Many suppliers are located overseas, potentially affected by local security, natural disasters, epidemics, and other factors.

- The company diversifies risks by procuring components and materials from multiple suppliers and outsourcing production to multiple companies.

- Seasonal Fluctuations:

- Sales are highly concentrated during the year-end and New Year sales seasons. Failure to release attractive new products or ensure timely supply during these periods may affect performance.

- Nintendo strives for stable performance throughout the year by developing games with long-term playability and offering paid services in digital businesses.

- System Issues:

- Online games, digital software sales, and information services provided via the internet face risks such as cyberattacks, system outages, and data breaches, which may affect performance, reputation, and financial condition.

- Nintendo strengthens its ability to address system issues by increasing internal resources, recruiting talent, and collaborating with external experts.

- Other Factors Influencing Business Activities:

- Global operations face risks such as political and economic factors, inconsistent tax systems, difficulties in talent recruitment, labor disputes, terrorist attacks, wars, and natural disasters, which may hinder the planning, development, manufacturing, distribution, and sale of products and services.

- Market Environment Fluctuations and Competition:

- Legal and Regulatory and Litigation Risks:

- Product Liability: Product defects may lead to large-scale recalls or product liability compensation, affecting the company's reputation and financial performance.

- Intellectual Property Enforcement Limitations: In some regions, it is difficult to effectively combat unauthorized online uploads and counterfeit products, which may negatively impact performance.

- Unauthorized System Access and Confidential Information Leaks: Consumer personal information and company confidential information may be leaked or misused due to unauthorized access, affecting performance, stock price, and financial condition.

- Changes in Laws and Regulations: Unexpected enactment or changes in laws, accounting standards, or tax systems, as well as disputes with tax authorities, may affect performance and financial condition.

- Litigation: Global operations may face lawsuits, disputes, and other legal proceedings.

- Other Risks:

- Uncollectible accounts receivable, financial institution failures, environmental regulations, damage to corporate brand, changes in political situations, climate change, natural disasters, or unpredictable factors such as epidemics.

Management's Discussion and Analysis of Financial Condition, Operating Results, and Cash Flow

- Assumptions for Important Accounting Procedures and Estimates:

- Consolidated financial statements are prepared in accordance with Japanese Generally Accepted Accounting Principles, and management makes reasonable estimates based on historical performance and the likelihood of future events. Actual results may differ from these estimates.

- Operating Results Description and Analysis:

- Sales Performance:

- Nintendo Switch Business: For the fiscal year ended March 31, 2025, Nintendo Switch hardware sales were 10.80 million units (down 31.2% year-on-year), and software sales were 155.41 million units (down 22.2% year-on-year).

- Bestselling Games:

- 《Super Mario Party Jamboree》 sold 7.48 million units.

- 《The Legend of Zelda: Echoes of Wisdom》 sold 4.09 million units.

- 《Paper Mario: The Thousand-Year Door》 sold 2.10 million units.

- 《Mario Kart 8 Deluxe》 sold 6.23 million units in this fiscal year (cumulative sales reached 68.20 million units).

- In this fiscal year, 24 million-selling titles were released (including those from third-party publishers).

- Reasons for Performance Decline: The decline in sales was mainly due to the strong performance of blockbuster titles in the previous fiscal year, such as 《The Legend of Zelda: Tears of the Kingdom》 (released in May 2023) and 《Super Mario Bros. Wonder》 (released in October 2023).

- Digital Business: Digital sales were ¥32.60 billion JPY ($2,187 million USD), down 26.5% year-on-year, primarily affected by a decrease in sales of downloadable packaged software for Nintendo Switch.

- Mobile and IP Related Business: Sales decreased 27.0% year-on-year to ¥6.76 billion JPY ($453 million USD), mainly due to reduced revenue from 《The Super Mario Bros. Movie》 (released in April 2023).

- Financial Overview:

- Net Sales: ¥1,164.9 billion JPY ($7,818 million USD), down 30.3% year-on-year.

- Operating Profit: ¥282.5 billion JPY ($1,895 million USD), down 46.6% year-on-year.

- Ordinary Profit: ¥372.3 billion JPY ($2,498 million USD), down 45.3% year-on-year.

- Profit Attributable to Owners of Parent: ¥278.8 billion JPY ($1,871 million USD), down 43.2% year-on-year.

- Sales Outside Japan: ¥890.0 billion JPY ($5,973 million USD), down 32.0% year-on-year, accounting for 76.4% of total sales.

- Gross Profit: Down 25.6% year-on-year to ¥710.1 billion JPY ($4,765 million USD).

- Selling, General and Administrative Expenses: Increased by ¥2.2 billion JPY ($14 million USD) year-on-year, mainly due to increased research and development expenses and retirement benefit expenses.

- Non-Operating Income: Net non-operating income was ¥89.7 billion JPY ($602 million USD), primarily from interest income.

- Sales Performance:

- Financial Condition Description and Analysis:

- Total Assets: Increased by ¥247.1 billion JPY ($1,658 million USD) to ¥3,398.5 billion JPY ($22,808 million USD), mainly due to increases in cash and deposits and inventories.

- Total Liabilities: Increased by ¥126.6 billion JPY ($849 million USD) to ¥673.0 billion JPY ($4,516 million USD), mainly due to increases in notes and accounts payable.

- Net Assets: Increased by ¥120.4 billion JPY ($808 million USD) to ¥2,725.4 billion JPY ($18,291 million USD), mainly due to an increase in retained earnings.

- Cash Flow Description and Analysis:

- As of March 31, 2025, cash and cash equivalents balance was ¥1,414.1 billion JPY ($9,490 million USD), an increase of ¥560.6 billion JPY ($3,762 million USD) for the fiscal year.

- Cash Flow from Operating Activities: Increased by ¥12.0 billion JPY ($80 million USD), mainly negatively impacted by increases in inventory and income tax payments, but positively influenced by factors such as interest and dividends received.

- Cash Flow from Investing Activities: Increased by ¥753.0 billion JPY ($5,053 million USD), primarily due to withdrawals of time deposits, and proceeds from sale and redemption of short-term and long-term investment securities exceeding related payments and purchases.

- Cash Flow from Financing Activities: Decreased by ¥195.1 billion JPY ($1,309 million USD), mainly due to dividend payments.

Production, Order Receipt, and Sales Information

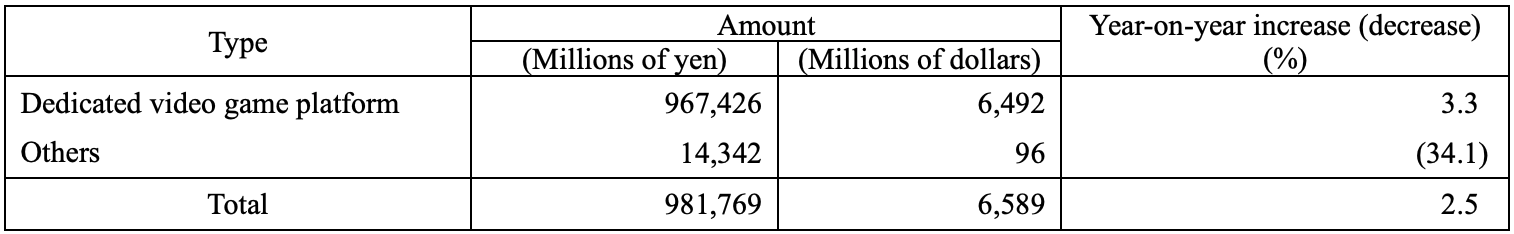

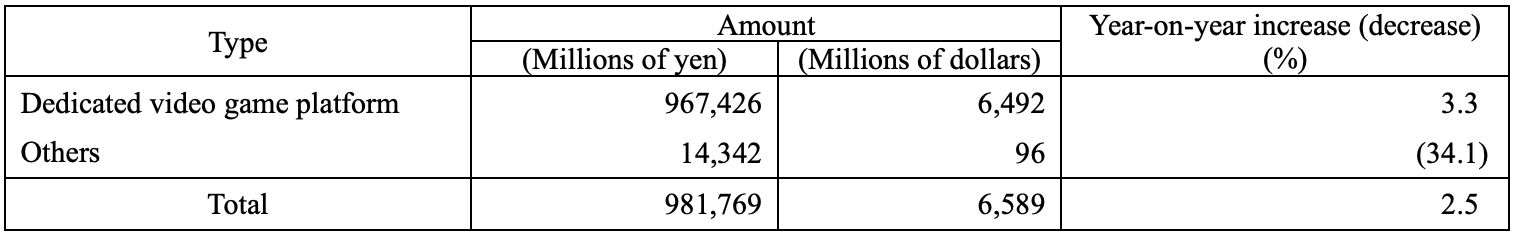

- Production Performance:Production Performance Overview

- As of March 31, 2025, Dedicated video game platform production amounted to ¥967,426 million JPY ($6,492 million USD), an increase of 3.3% year-on-year.

- Other products production amounted to ¥14,342 million JPY ($96 million USD), a decrease of 34.1% year-on-year.

- Total production amounted to ¥981,769 million JPY ($6,589 million USD), an increase of 2.5% year-on-year.

- Production Performance

- Order Receipt Status:

- Production is primarily "make-to-stock" except for some Dedicated video game platform software, therefore information on order receipt is omitted.

- Sales Performance:Sales Performance Overview

- Dedicated video game platform sales amounted to ¥1,083,534 million JPY ($7,272 million USD), a decrease of 30.9% year-on-year, of which Nintendo Switch platform sales were ¥1,050,296 million JPY ($7,048 million USD), a decrease of 31.5% year-on-year.

- Mobile, IP-related revenue, etc., amounted to ¥67,673 million JPY ($454 million USD), a decrease of 27.0% year-on-year.

- Total sales are consistent with previous financial data, at ¥1,164,922 million JPY ($7,818 million USD), a decrease of 30.3% year-on-year.

Factors Significantly Affecting Operating Results

- Core Business Impact: In the home entertainment sector, the emergence and sales of blockbuster products have a significant impact on operating results. The popularity of other non-gaming entertainment forms may also have an impact.

- Exchange Rate Fluctuations: Over 70% of total sales come from markets outside Japan, primarily settled in local currencies. Although Nintendo hedges exchange rate risks through foreign currency procurement, etc., it is still difficult to completely eliminate their impact on financial performance.

- Product Mix Profit Differences: Dedicated video game platforms and their compatible software are Nintendo's primary products, but hardware and software have vastly different profit margins, and fluctuations in their proportion of total sales may affect gross profit and gross margin.

Research and Development Activities

- R&D Focus: Primarily dedicated to hardware and software development for Dedicated video game systems, and expanding the planning, development, and operation of amiibo, visual content, and smart device applications.

- Hardware R&D:

- Continuous research into underlying technologies such as semiconductor memory, liquid crystal displays, and electronic components.

- Exploration of the applicability of technologies like touch panels, sensors, wireless communication networks, security, cloud computing, VR, AR, MR, deep learning, and big data analytics in the home entertainment sector.

- Emphasis on improving product durability, safety, quality, and performance, and designing and developing various accessories, implementing cost reduction measures.

- Software R&D:

- Full utilization of hardware capabilities for product planning, focusing on game design and program development for graphics, music, and game scripts.

- Promotion of system infrastructure expansion to support network services like Nintendo eShop.

- Establishment of smart device software R&D architecture to facilitate the planning and development of smart device applications and backend server systems.

- Production and Procurement: In the process of component procurement and manufacturing, promoting the adoption of new testing methods and technologies for mass production of components, and collaborating with manufacturing partners on relevant laws and regulations.

- R&D Expenses: R&D expenses for this fiscal year were $14.37 billion JPY ($964 million USD).

- Key R&D Achievements:

- New Console Release: The new video game system, Nintendo Switch 2, was released on June 5, 2025, featuring a larger, more responsive screen, new magnetic Joy-Con 2 controllers, improved processing speed, and graphics performance.

- New Console Companion Software: 《Mario Kart World》 and 《Nintendo Switch 2 Welcome Tour》 were released concurrently with the Nintendo Switch 2 hardware.

- Remakes of Old Games: Released 《The Legend of Zelda: Breath of the Wild - Nintendo Switch 2 Edition》 and 《The Legend of Zelda: Tears of the Kingdom - Nintendo Switch 2 Edition》, enhancing the original games.

- Nintendo Switch Firmware and Services: Provided firmware updates for Nintendo Switch hardware to enhance convenience and operational stability, released special edition game systems, and continuously improved the software development environment and network services.

- Nintendo Switch Compatible Software: Released multiple games, such as:

- 《The Legend of Zelda: Echoes of Wisdom》 (the first action-adventure game in The Legend of Zelda series featuring Princess Zelda as the protagonist).

- 《Nintendo World Championships: NES Edition》 (bringing 1980s Nintendo Entertainment System game competitions online).

- 《Endless Ocean Luminous》, 《Emio - The Smiling Man: Famicom Detective Club》, 《Super Mario Party Jamboree》, and 《Mario & Luigi: Brothership》 (the latest installments in their respective series).

- 《Paper Mario: The Thousand-Year Door》, 《Luigi's Mansion 2 HD》, 《Donkey Kong Country Returns HD》, and 《Xenoblade Chronicles X: Definitive Edition》 (HD remasters).

- Mobile Business: Continued to operate game applications such as 《Fire Emblem Heroes》, 《Pikmin Bloom》, and 《Mario Kart Tour》.

- Nintendo Switch Online: Added more titles to services like Nintendo Entertainment System - Nintendo Classics and Super Nintendo Entertainment System - Nintendo Classics for this service, and continuously improved it.

- Other New Products: Released Nintendo Sound Clock: Alarmo, a unique alarm clock with a motion sensor.

- Developer Support: Provided ongoing support to game creators through the Nintendo Developer Portal.

Property and Facilities

Capital Investment Overview

- For the fiscal year ended March 31, 2025, Nintendo's total capital investment amounted to $39.275 billion JPY ($263 million USD), primarily for research and development facilities, including intangible assets such as computer software for internal use.

- All capital investments were funded internally, without external financing.

Major Facilities

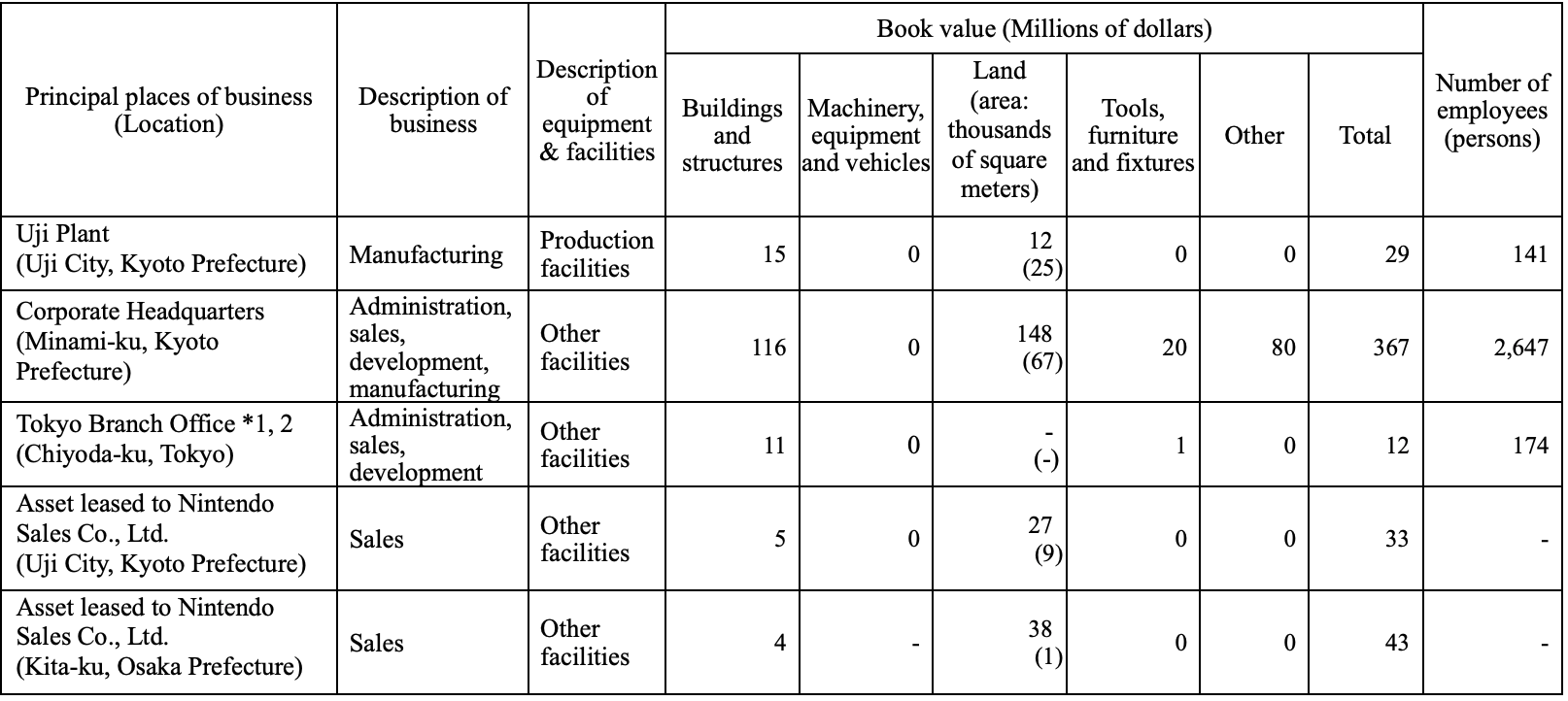

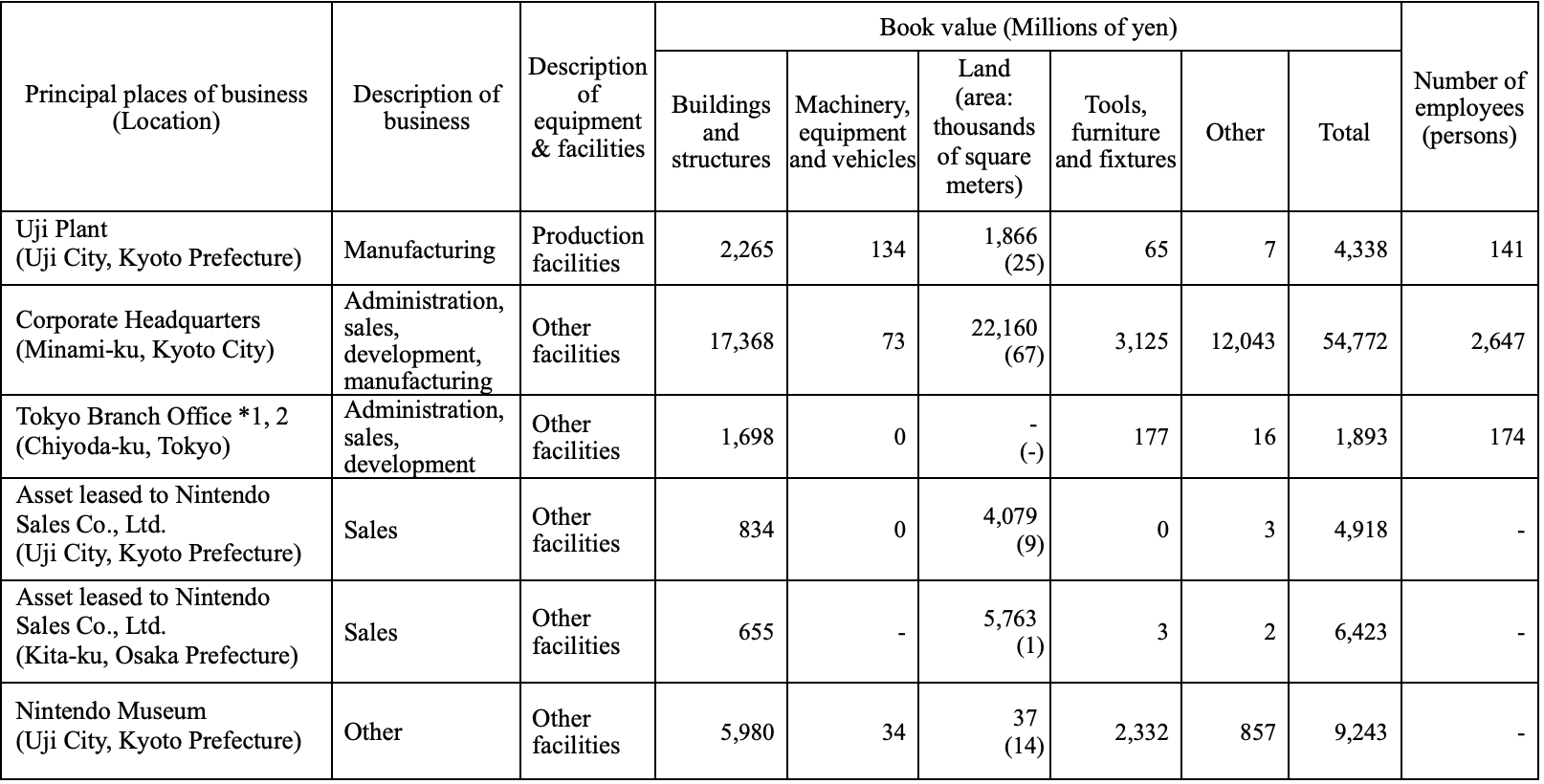

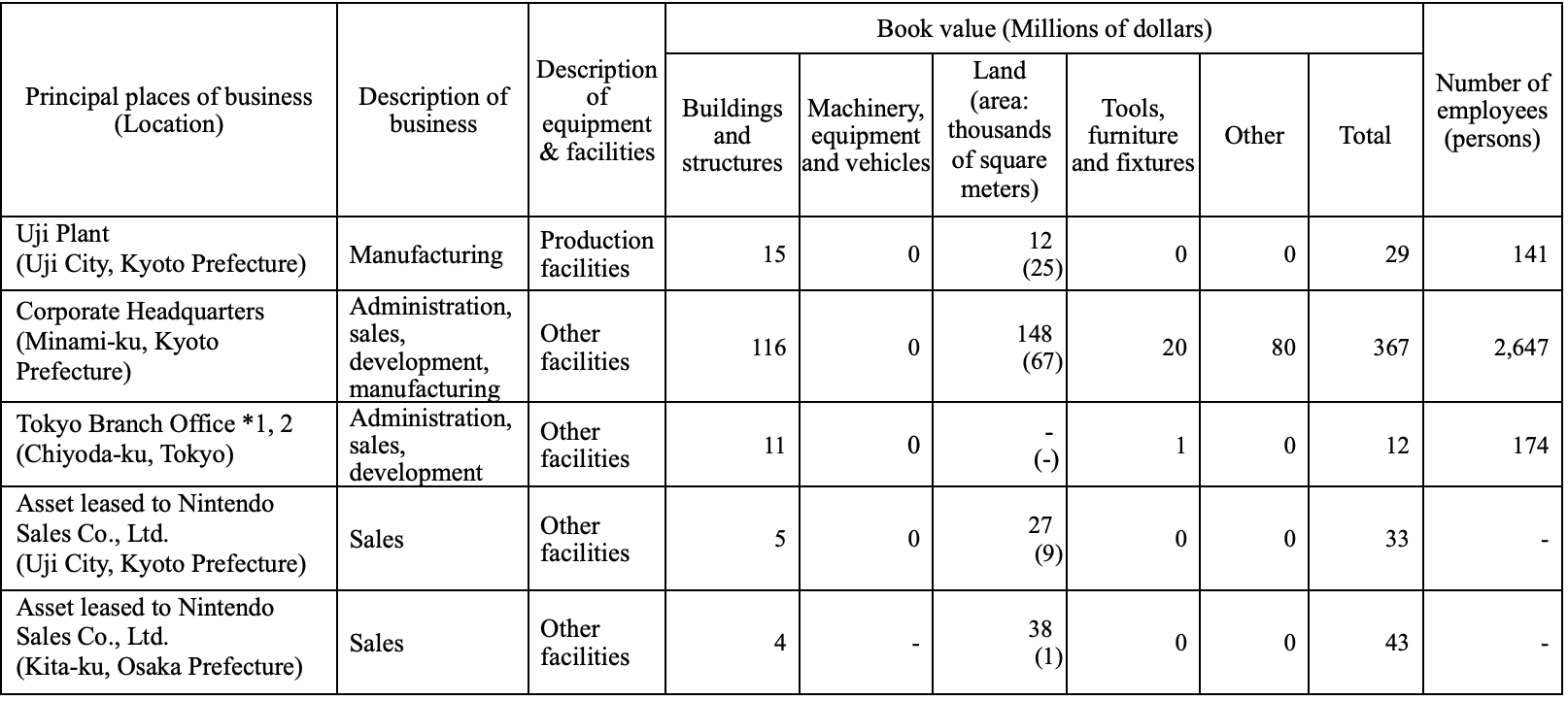

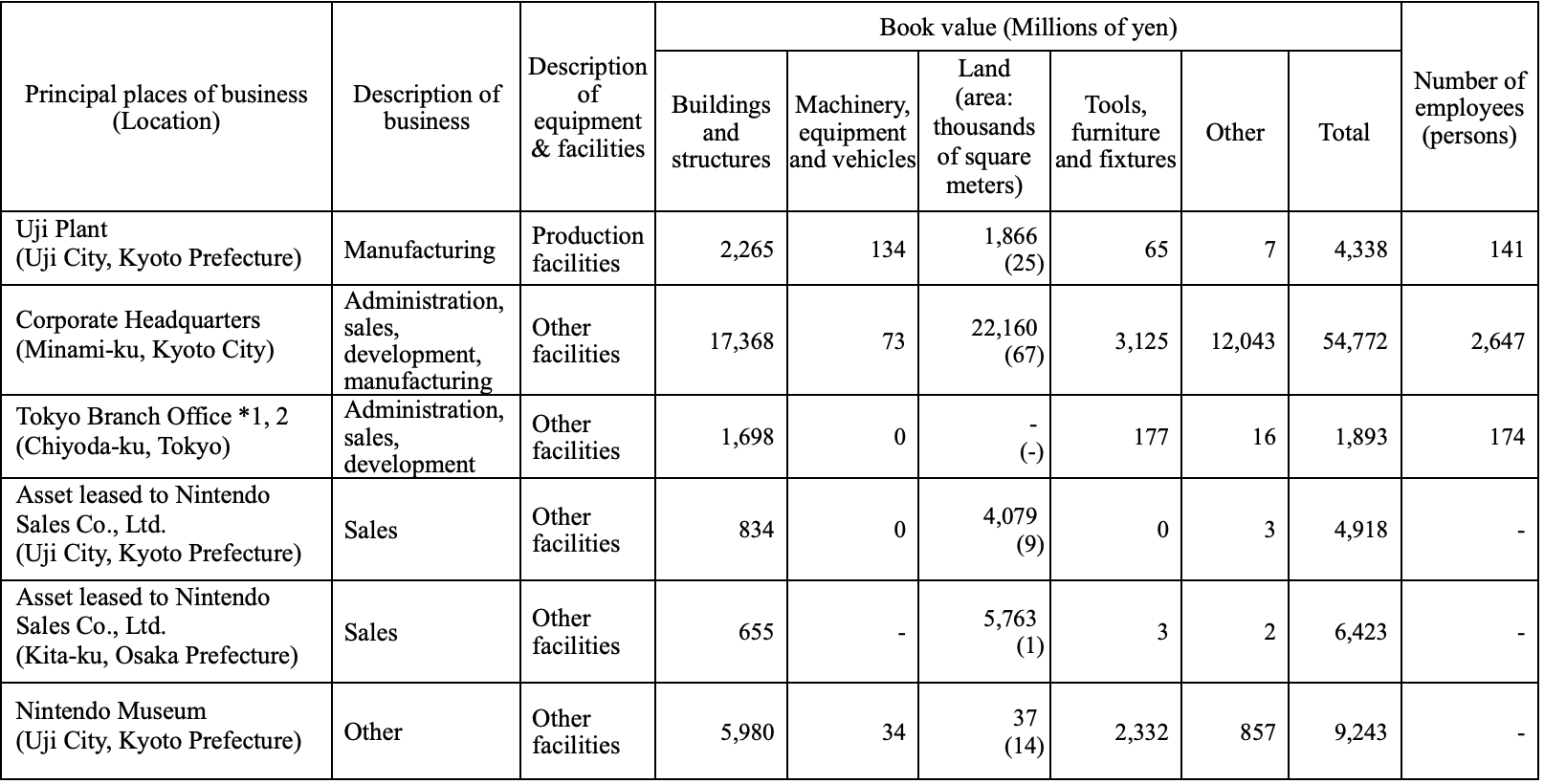

- Company's (Nintendo Co., Ltd.) Major Facilities:Overview of Company's Major Facilities (as of March 31, 2025)

- Corporate Headquarters (Kyoto): Highest total book value, reaching ¥54,772 million JPY ($367 million USD), with the largest number of employees (2,647 people), primarily involved in management, sales, development, and manufacturing.

- Uji Plant (Kyoto): As a main production facility, book value is ¥4,338 million JPY ($29 million USD), with 141 employees.

- Nintendo Museum (Kyoto): Total book value ¥9,243 million JPY ($62 million USD), listed as "other facilities."

- The Tokyo Branch Office leases office space, with an annual rent of ¥1,486 million JPY ($9 million USD).

- Overview of Company's Major Facilities (JPY)

- Overview of Company's Major Facilities (USD)

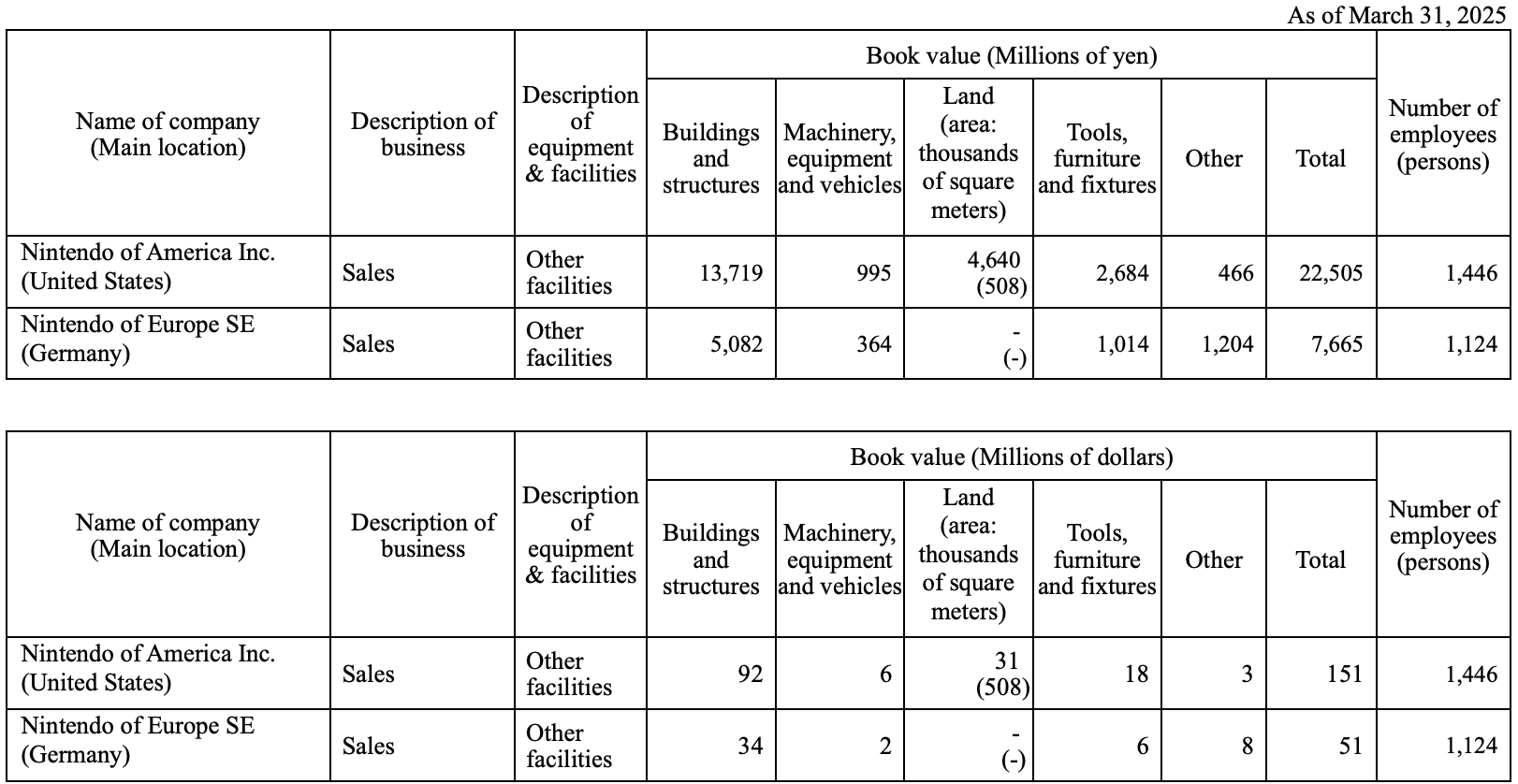

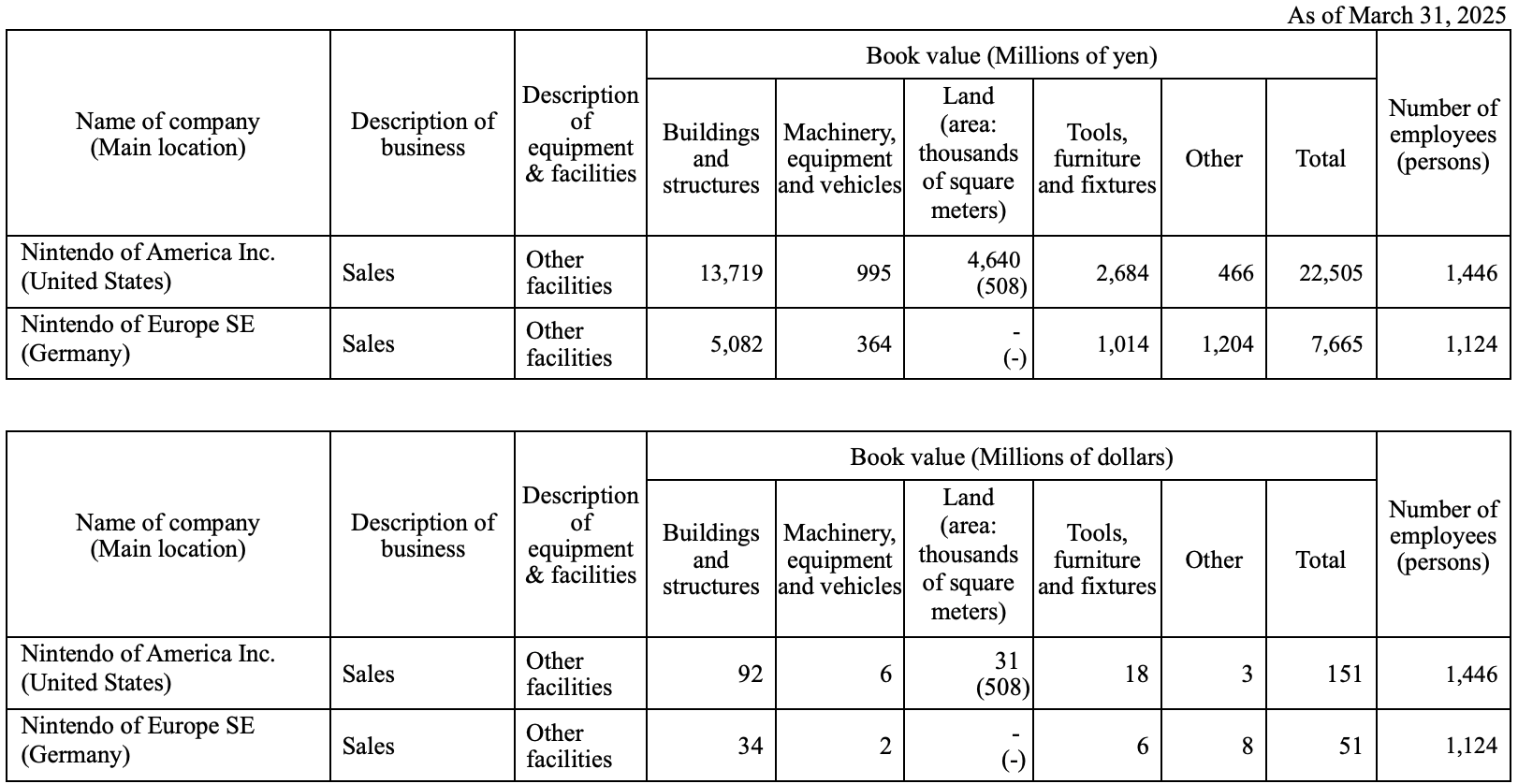

- Overseas Subsidiaries' Major Facilities:Overview of Overseas Subsidiaries' Major Facilities (as of March 31, 2025)

- Nintendo of America Inc. (U.S.) has the highest total book value among overseas subsidiaries' facilities, at ¥22,505 million JPY ($151 million USD).

- Nintendo of Europe SE (Germany) has a total book value of ¥7,665 million JPY ($51 million USD).

- Both major overseas sales subsidiaries have also invested significantly in facilities.

- Overview of Overseas Subsidiaries' Major Facilities

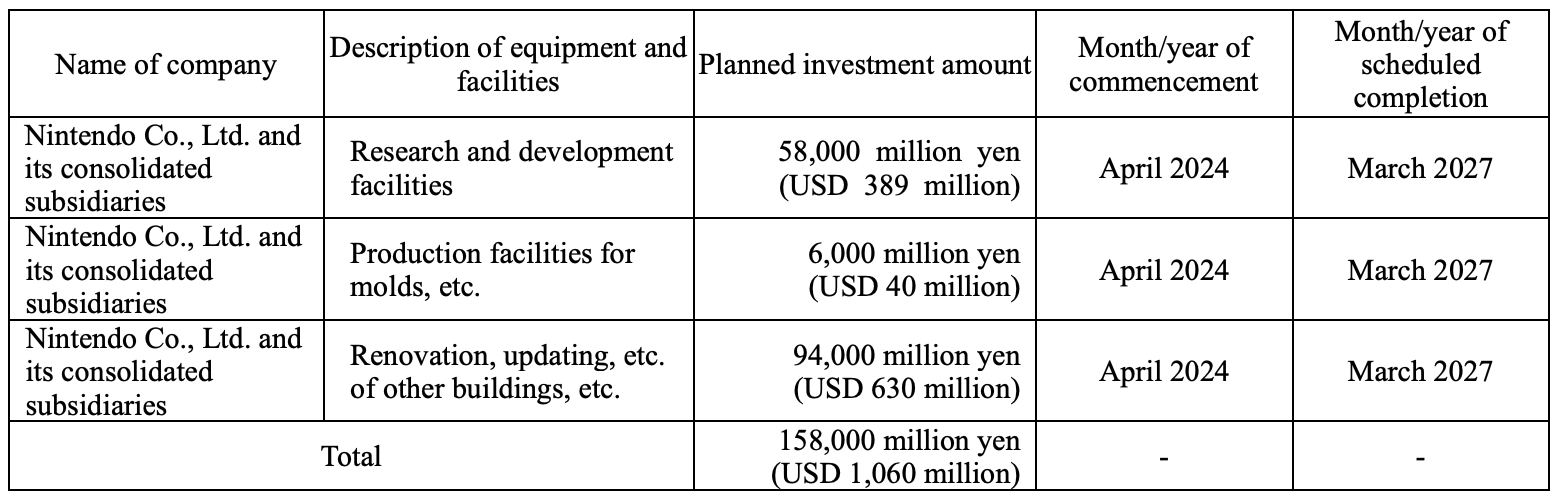

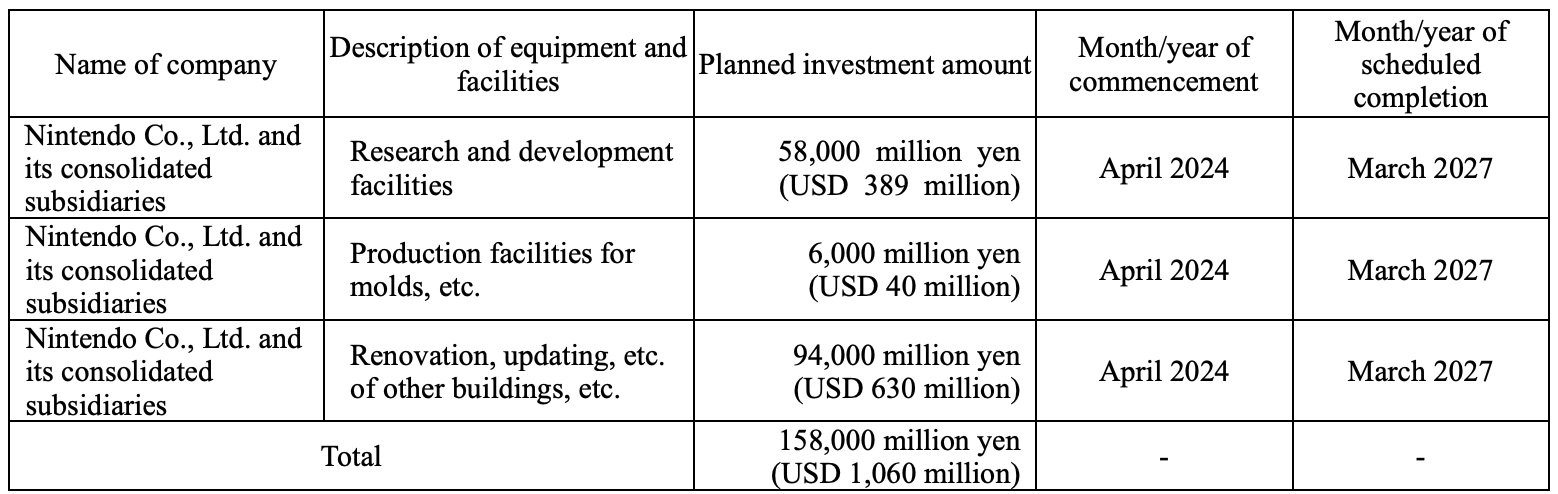

Plans for Installation and Retirement of New Equipment and Facilities

- Future Capital Investment Plans:Future Capital Investment Plans (April 2024 to March 2027)

- Total planned investment of ¥158,000 million JPY ($1,060 million USD).

- Major investments are for research and development facilities (¥58,000 million JPY, $389 million USD), production facilities such as molds (¥6,000 million JPY, $40 million USD), and renovation and updating of other buildings, etc. (¥94,000 million JPY, $630 million USD).

- All future required funds are planned to be covered by internal financing.

- Plans for Installation of New Equipment and Facilities

Corporate Profile

Share Status and Other Related Matters

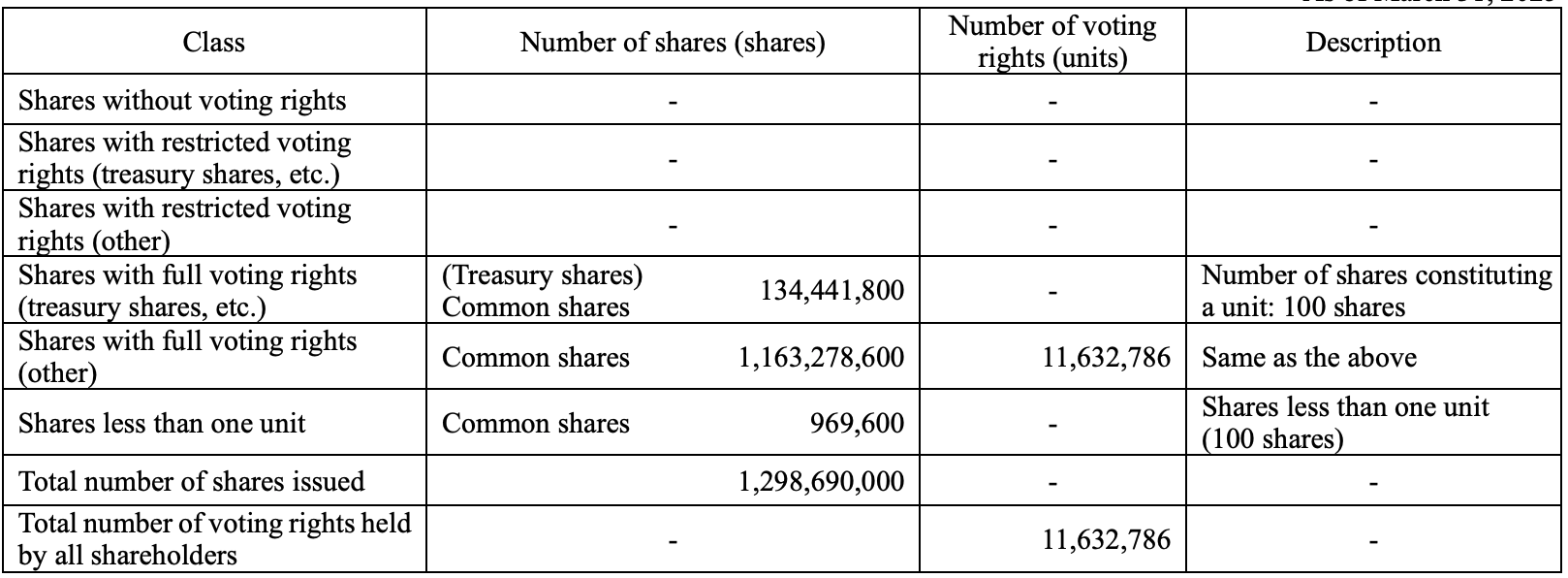

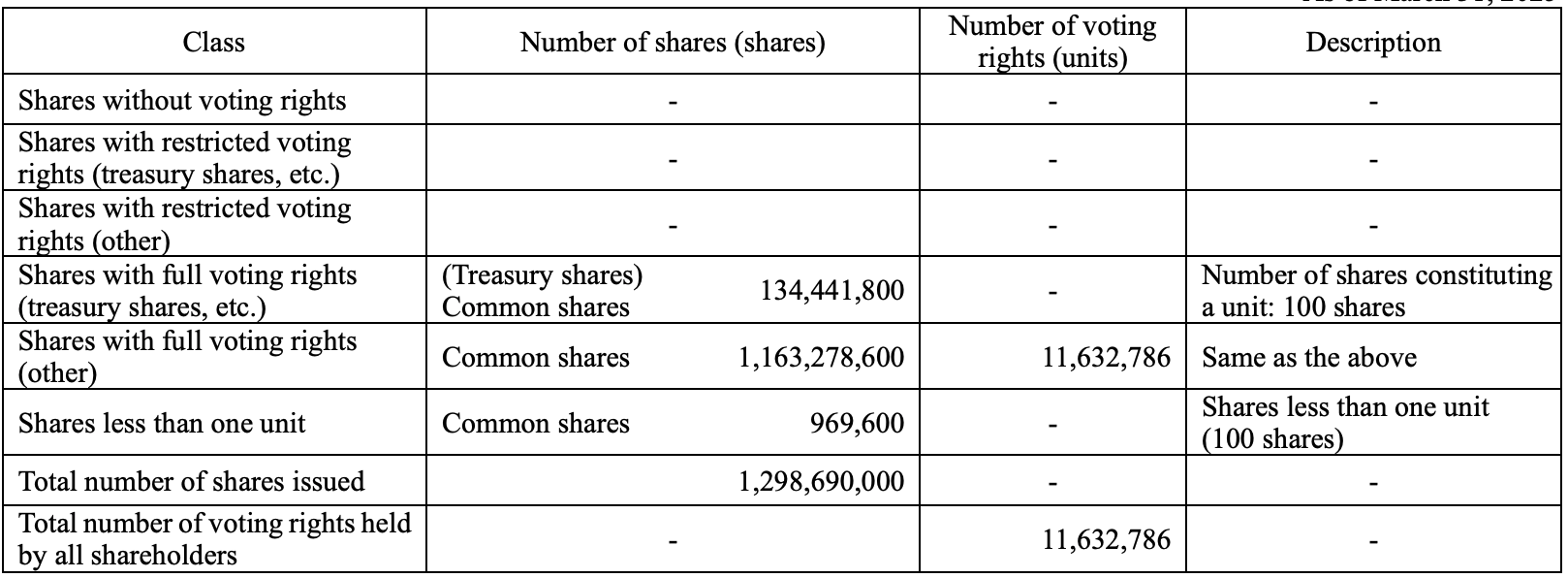

- Total Number of Issued Shares:Total Number of Issued Shares

- The authorized number of common shares is 4,000,000,000 shares.

- As of March 31, 2025, the number of issued shares was 1,298,690,000 shares.

- The company's shares are listed on the Tokyo Stock Exchange Prime Market, with each unit consisting of 100 shares.

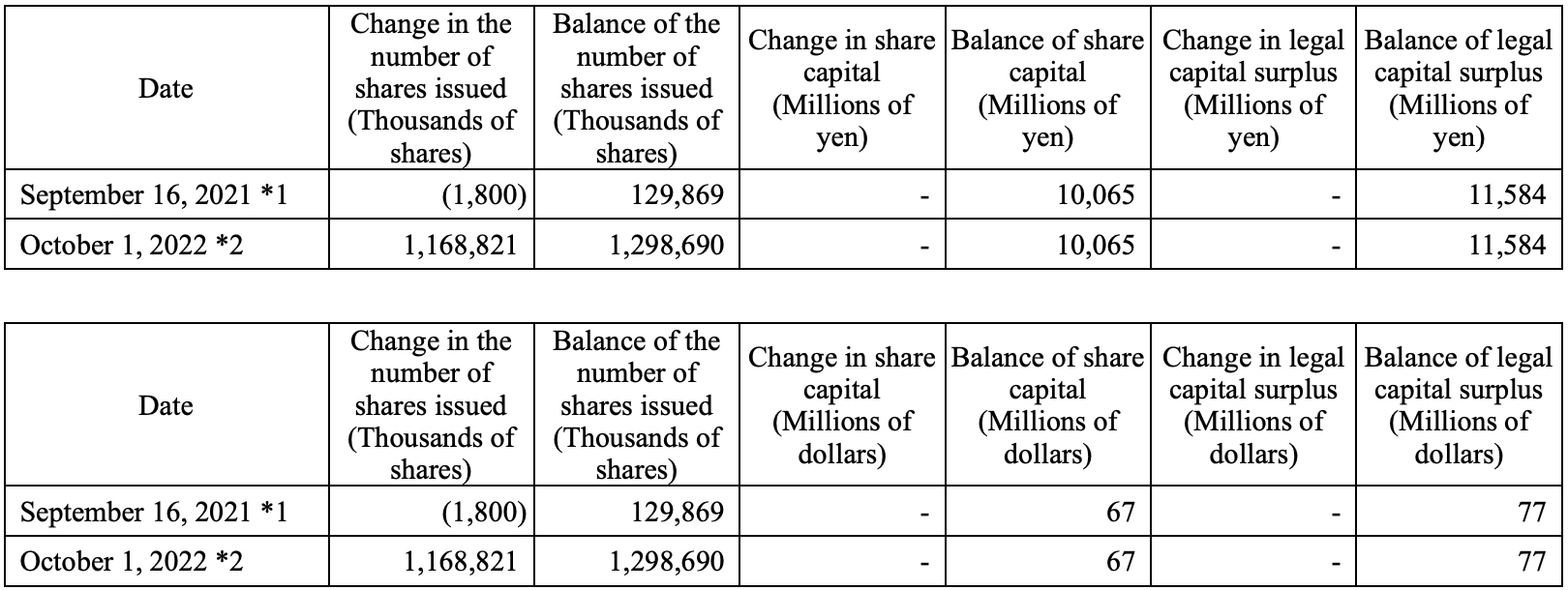

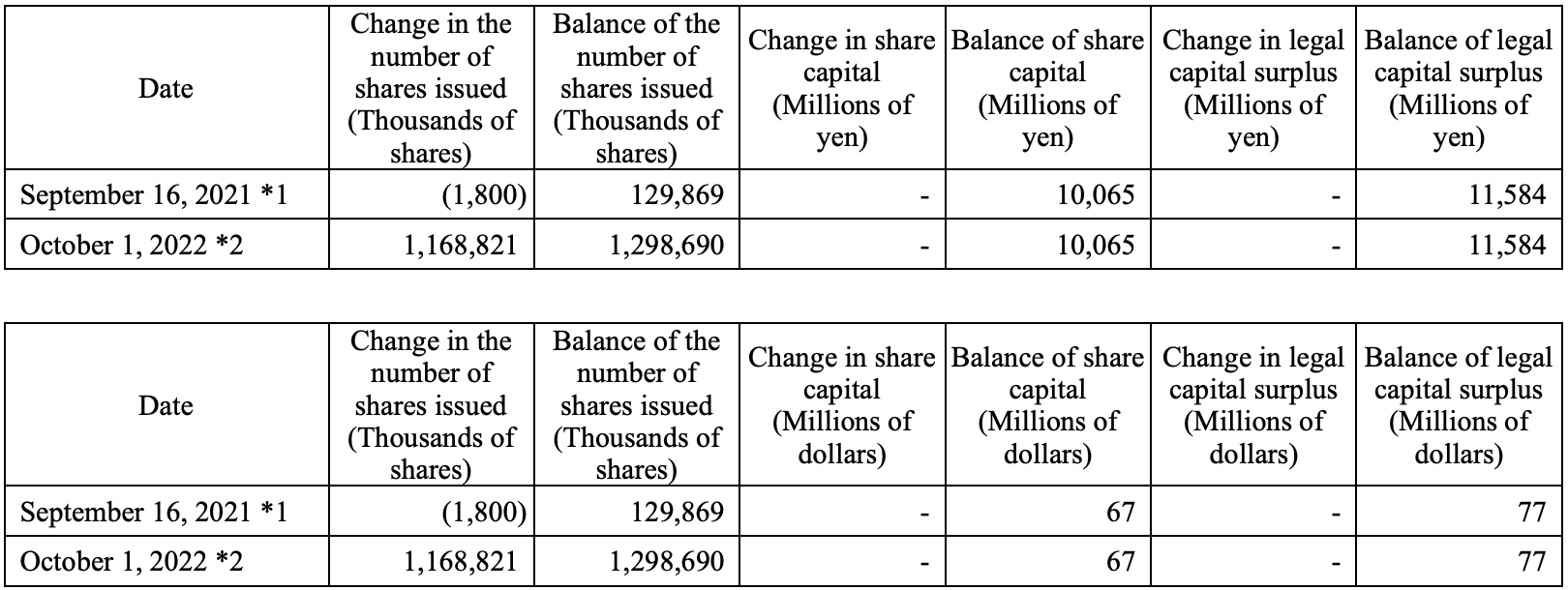

- Share Issuance Trend:Trend in Total Number of Issued Shares

- As of October 1, 2022, due to a 10-for-1 stock split, the number of issued shares increased from 129,869 thousand shares to 1,298,690 thousand shares.

- Share capital and legal capital surplus remained unchanged during this period.

- Trend in Total Number of Issued Shares

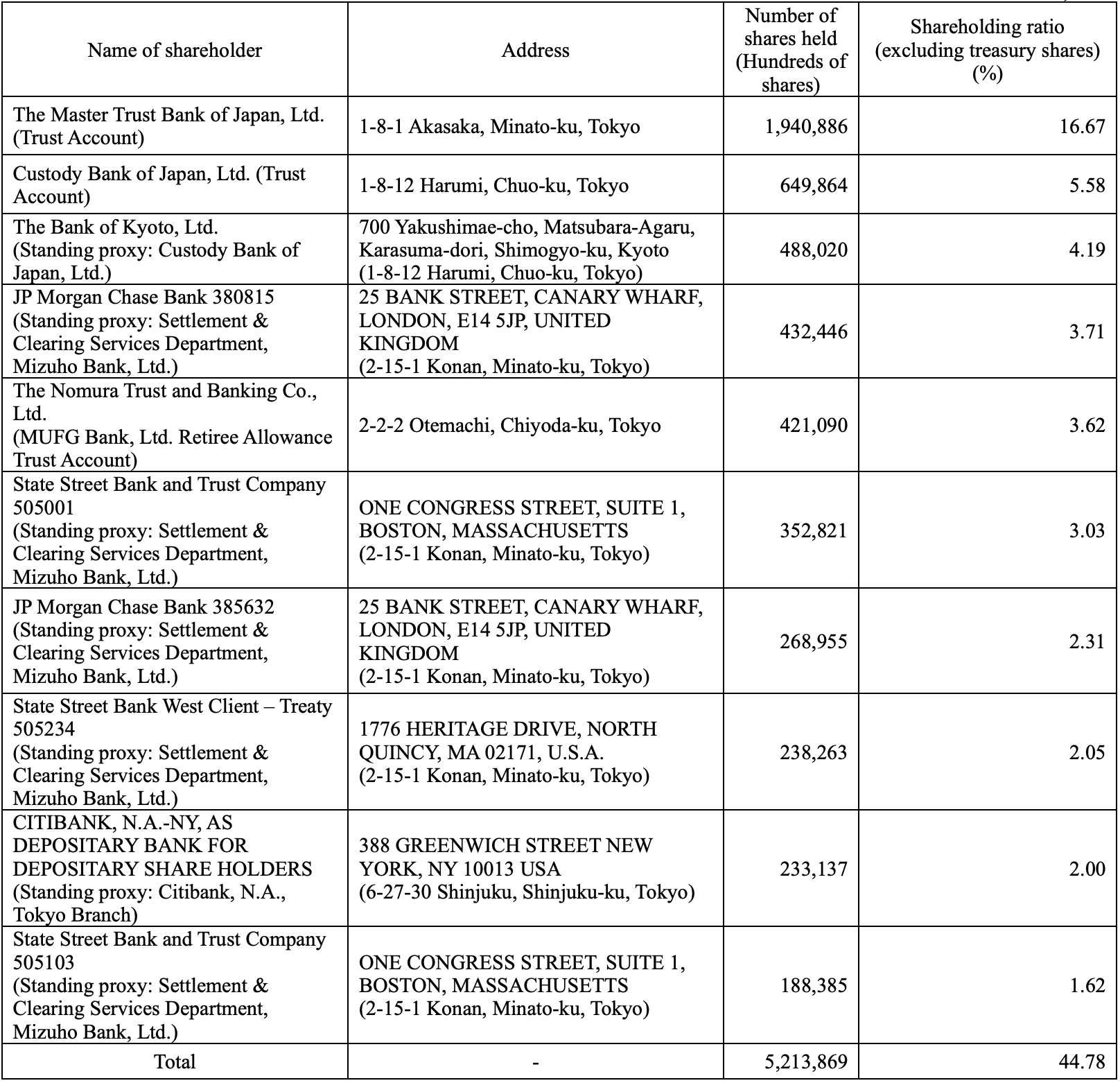

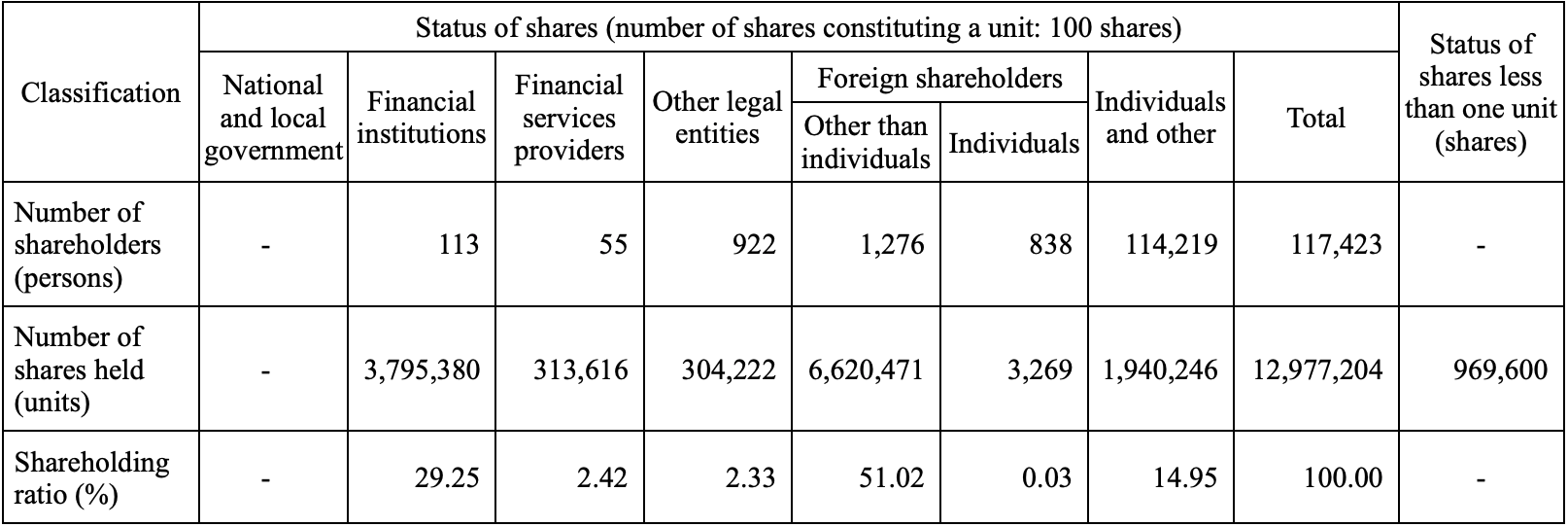

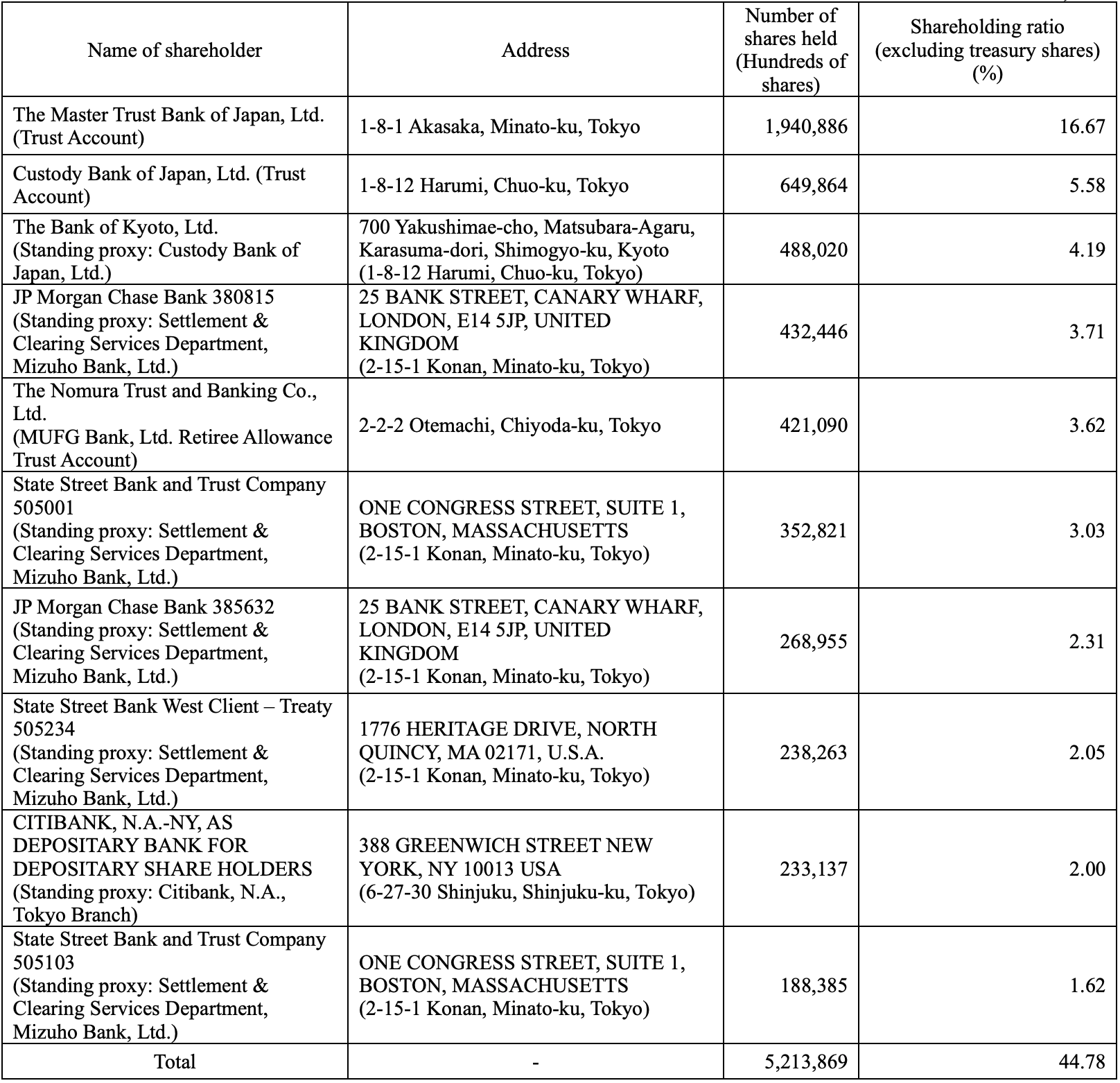

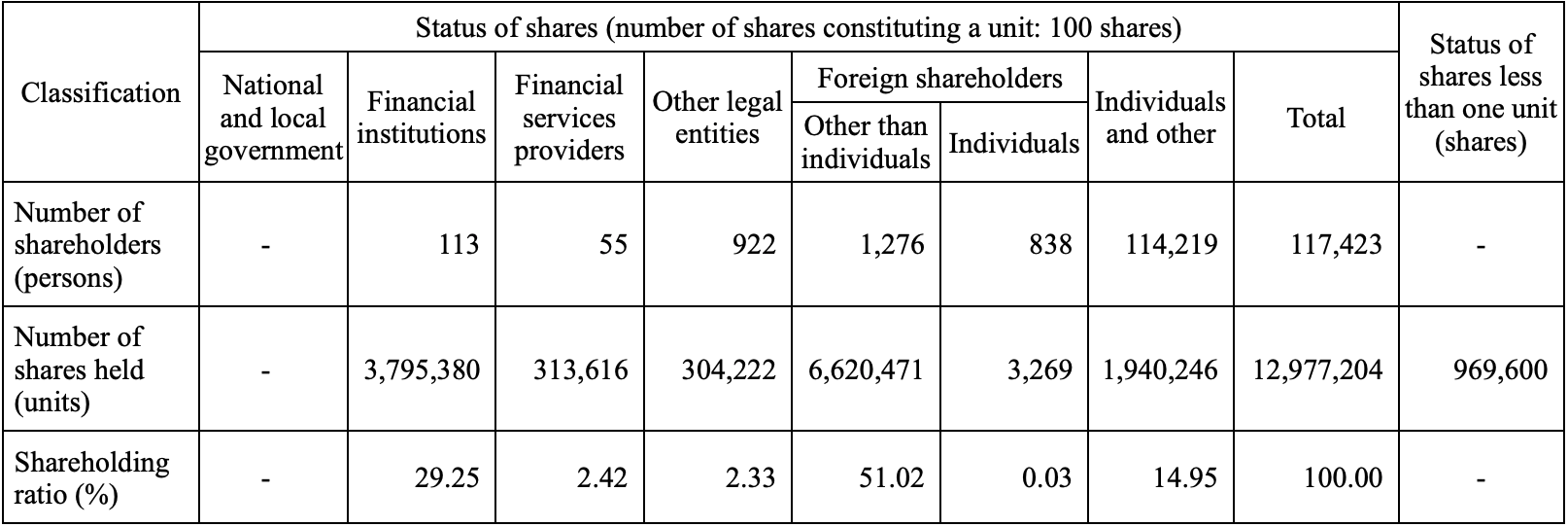

- Shareholder Status:Shareholder Composition (as of March 31, 2025)

- Total number of shareholders is 117,423.

- Foreign shareholders hold the highest proportion, at 51.02%, followed by financial institutions (29.25%) and individuals and others (14.95%).

- Individual shareholders are the most numerous, at 114,219 people.

- Shareholder Composition

- Major Shareholder Status:Major Shareholders (as of March 31, 2025)

- The Master Trust Bank of Japan, Ltd. (Trust Account) is the largest shareholder, with a 16.67% stake.

- The top ten shareholders collectively hold 44.78% of the shares.

- Several foreign institutional investors, such as JP Morgan Chase Bank and State Street Bank and Trust Company, are among the major shareholders.

- Nintendo Co., Ltd.'s 134,441,800 treasury shares are not included in this table.

- Major Shareholders

- Voting Rights Status:Voting Rights Status (as of March 31, 2025)

- The number of common shares with full voting rights is 1,163,278,600 shares, corresponding to 11,632,786 voting units.

- The company holds 134,441,800 treasury shares, which do not have voting rights.

- The total number of voting units is 11,632,786.

- Voting Rights Status

Status of Treasury Share Acquisitions and Other Related Matters

- Treasury Share Acquisition:

- For the fiscal year ended March 31, 2025, the company acquired 306 shares of treasury stock pursuant to Article 155, Paragraph 7 of the Companies Act, with a total acquisition price of ¥2,702,366 JPY ($18,136 USD).

- Treasury Share Disposal and Holding:

- In fiscal year 2025, the company disposed of 10,000 shares of treasury stock through a restricted stock compensation plan, with a total disposal price of ¥20,158,400 JPY ($135,291 USD).

- As of March 31, 2025, the company held 134,441,816 shares of treasury stock.

Dividend Policy

- Basic Policy:

- Internal Financing: The company's basic policy is to meet future growth needs (including capital investments) through internal reserves and maintain a strong liquid financial position.

- Profit Return: Dividend payments are based on the profit level achieved in each fiscal period.

- Twice-Yearly Dividends: The company's basic policy is to pay dividends twice a year, including an interim dividend and a year-end dividend.

- Dividend Calculation Method:

- The annual dividend per share is the higher of the following two:

- 33% of consolidated operating profit divided by the total number of outstanding shares at year-end (excluding treasury shares), rounded up to the nearest Japanese Yen.

- Calculated based on a 50% consolidated profit standard, rounded up to the nearest Japanese Yen.

- Interim dividend per share: 33% of consolidated operating profit for the six-month period divided by the total number of outstanding shares at the end of the six-month period (excluding treasury shares), rounded up to the nearest Japanese Yen.

- The annual dividend per share is the higher of the following two:

- Fiscal Year 2025 Dividend Payments:

- Interim Dividend: ¥35 JPY ($0.23 USD).

- Year-End Dividend: ¥85 JPY ($0.57 USD).

- Use of Retained Earnings: Used for new technology research and new product/service development, capital investment, material procurement, advertising and marketing, strengthening network infrastructure, and timely repurchase of treasury shares.

- Fiscal Year 2025 Dividend Payment Details:Fiscal Year 2025 Dividend Payment Details

- November 5, 2024 Board of Directors' resolution to pay an interim dividend of ¥40,748 million JPY ($273 million USD), ¥35 JPY ($0.23 USD) per share.

- June 27, 2025 General Meeting of Shareholders' resolution (scheduled) to pay a year-end dividend of ¥98,961 million JPY ($664 million USD), ¥85 JPY ($0.57 USD) per share.

Corporate Governance

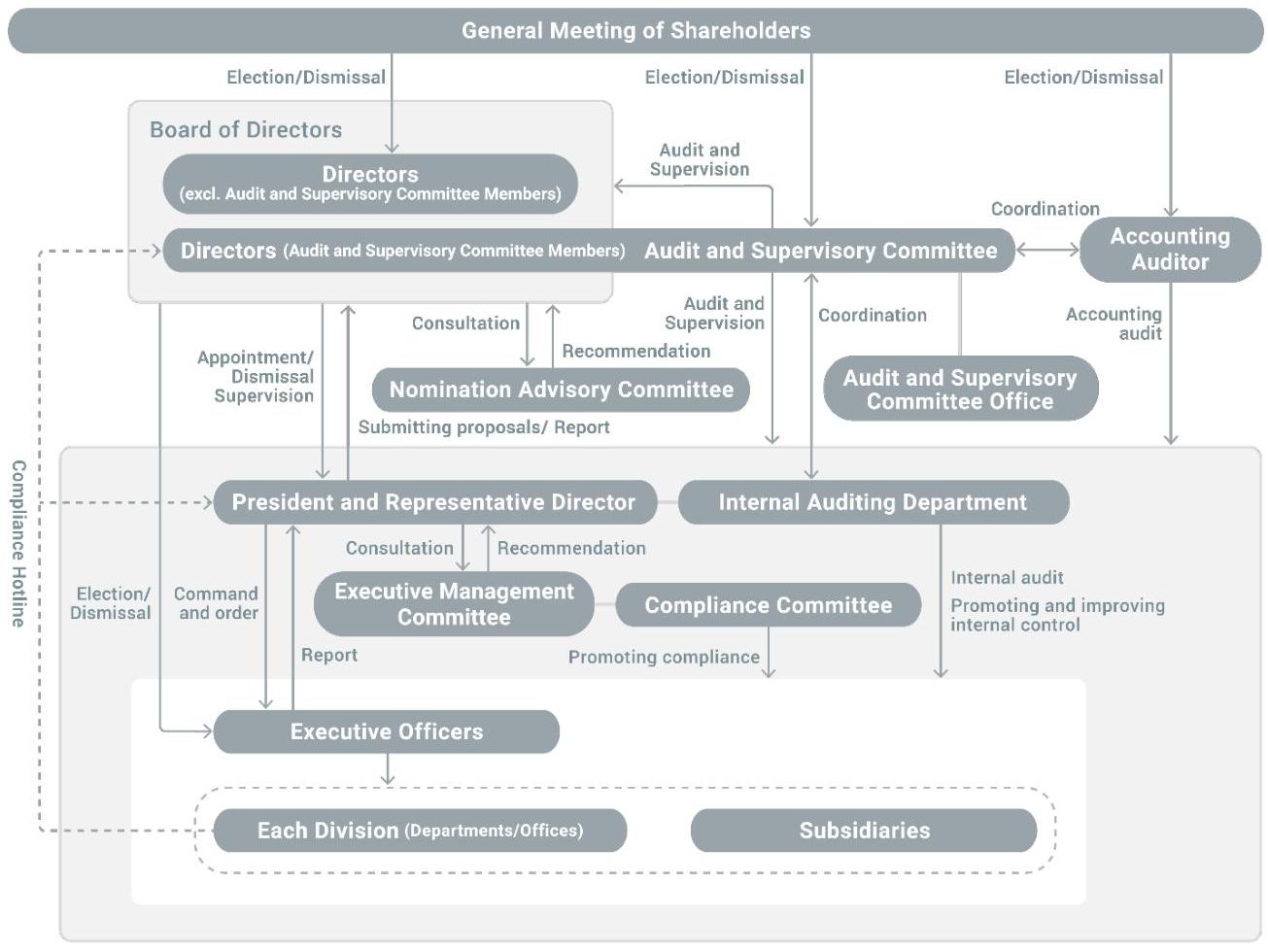

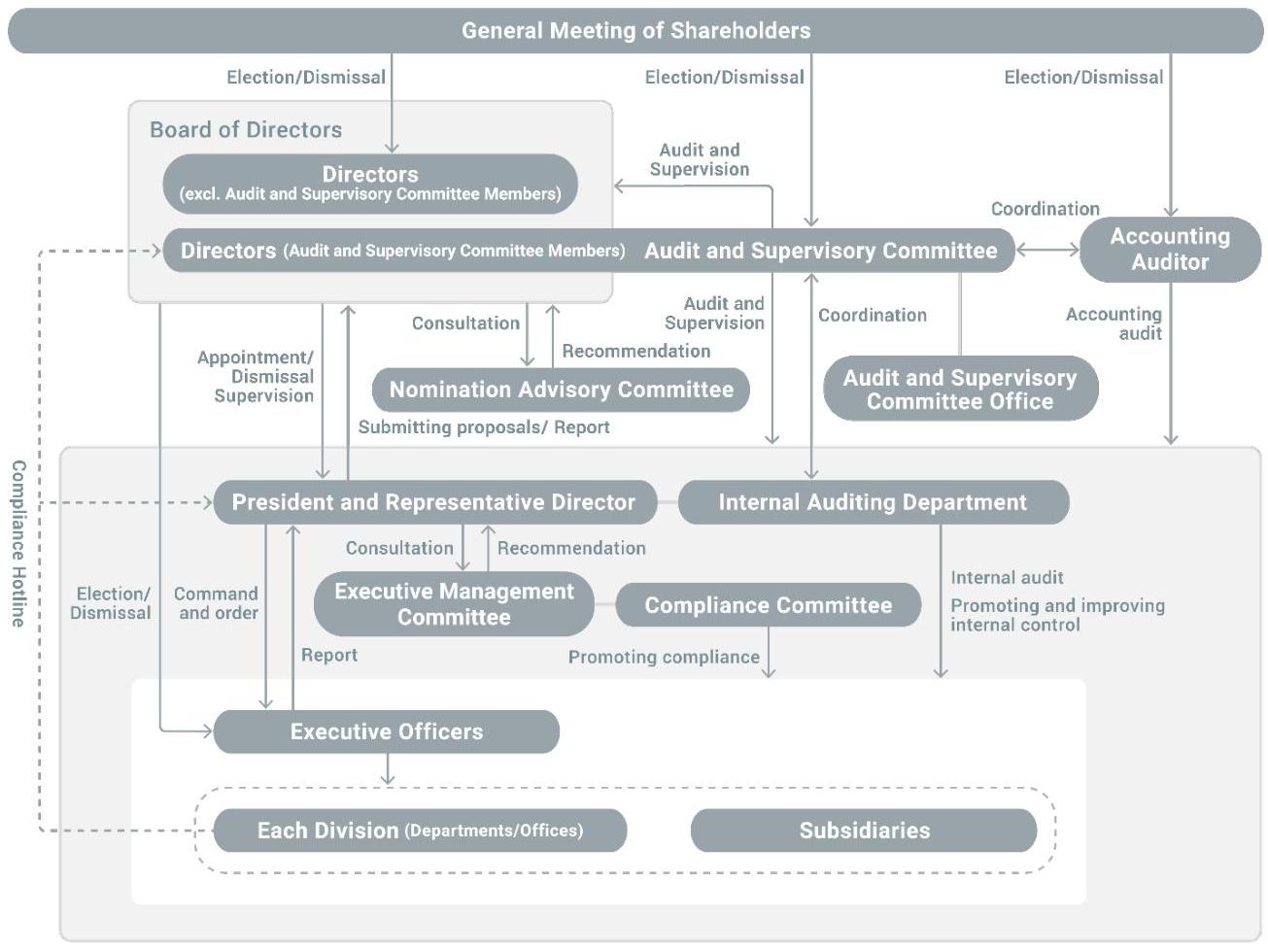

- Corporate Governance Overview:

- Basic View: Nintendo aims to maximize long-term sustainable corporate value, considering the interests of all stakeholders (including shareholders, consumers, business partners, employees, local communities, etc.).

- Governance System Objectives: Establish a highly transparent and sound corporate governance system to enhance corporate ethics.

- Reason for System Adoption: The company adopted the form of a Company with an Audit and Supervisory Committee to strengthen the supervisory function of the Board of Directors, and to clarify responsibilities for business execution through the Executive Officer System, separating management decision-making and supervisory functions from business execution, to adapt more quickly to a rapidly changing business environment.

- Corporate Governance System:

- Board of Directors: Composed of 13 directors (including 5 Audit and Supervisory Committee members), of whom 6 are external directors. Meetings are held monthly, responsible for management decisions and supervision.

- Nomination Advisory Committee: A non-mandatory advisory body, composed of the President and Representative Director and all Audit and Supervisory Committee members, aiming to enhance the objectivity and transparency of director nomination and compensation procedures. Meets at least 3 times a year.

- Audit and Supervisory Committee: Composed of 1 full-time internal director and 4 external directors. Meetings are held monthly, responsible for auditing business execution and exchanging audit opinions.

- Executive Management Committee: Composed of Representative Directors and Corporate Directors who also serve as executive officers, meets twice a month to deliberate on basic policies and business execution policies proposed by the Board of Directors.

- Compliance Committee: Chaired by the Senior General Manager of the General Affairs Division, aims to promote compliance, including the establishment of a Compliance Manual.

- Preparation of Risk Management System:

- Each department manages risks within its jurisdiction.

- Internal Auditing Department: Oversees the risk management system and provides suggestions for improvement.

- Compliance Committee: Promotes compliance work across departments.

- Information Security Committee and Product Safety Committee: Ensure information security and product safety, respectively.

- Subsidiary Risk Management: Internal regulations require subsidiaries to obtain prior approval from the company for important matters, ensuring efficient risk management and business operations.

- Summary of Liability Limitation Agreements with Outside Directors:

- Pursuant to Article 427, Paragraph 1 of the Companies Act, the company has concluded liability limitation agreements with outside directors, limiting the amount of damages to the extent prescribed by laws and regulations, provided that the outside directors performed their duties in good faith and without gross negligence.

- Summary of Directors' and Officers' Liability Insurance Contract:

- The company has concluded a directors' and officers' liability insurance contract with an insurance company, covering damages and litigation expenses that company directors and executive officers and officers of its subsidiaries may incur in the performance of their duties, excluding intentional illegal acts, etc. The premiums are fully borne by the company.

- Number of Directors:

- The company's Articles of Incorporation stipulate that the number of directors (excluding Audit and Supervisory Committee members) shall not exceed 15, and the number of Audit and Supervisory Committee members shall not exceed 5.

- Director Election Resolution Requirements:

- Resolutions for the election of directors require passing by a majority of votes cast by shareholders present (holding 1/3 or more of voting rights), and cumulative voting is not applicable.

- Matters that the Board of Directors can resolve at the General Meeting of Shareholders:

- Acquisition of Treasury Shares: The Board of Directors may resolve to acquire treasury shares in accordance with the Companies Act to flexibly execute capital policy.

- Interim Dividends: The Board of Directors may resolve to pay interim dividends to shareholders recorded in the shareholder register as of September 30 each year.

- Special Resolution Requirements at General Meeting of Shareholders:

- Requires approval by 2/3 or more of votes cast by shareholders present (holding 1/3 or more of voting rights) to ensure the certainty of special resolutions.

- Basic Policy on Company Control:

- The Board of Directors believes that for the company's shares as tradable shares, the decision to accept a takeover bid should ultimately be made by shareholders.

- The company believes that some takeover bids may harm corporate value or the common interests of shareholders, and will take appropriate measures to respond.

- Currently, the company has not formally introduced specific defensive measures but has established internal response mechanisms. If a takeover bid occurs, its potential impact will be carefully assessed, and negotiations will be conducted with external experts, forming a task force if necessary to decide whether to adopt defensive measures.

- Board Members:Board of Directors List as of June 26, 2025

- As of the report submission date, the Board of Directors consists of 9 male directors and 4 female directors, with women comprising 30.8%.

- Shuntaro Furukawa serves as President Representative Director, and Shigeru Miyamoto serves as Executive Fellow Representative Director.

- Outside directors include Chris Meledandri (CEO of Illumination Entertainment) and Miyoko Demay (former Tiffany & Co. executive).

- Multiple directors concurrently hold senior management positions in the company.

- Female outside directors include Miyoko Demay, Asa Shinkawa, Eiko Osawa, and Keiko Akashi, among whom Asa Shinkawa was formerly a lawyer, and Eiko Osawa and Keiko Akashi have backgrounds as certified public accountants or tax accountants.

- Board Meeting Attendance:Board of Directors and Nomination Advisory Committee Meeting Attendance

- For the fiscal year ended March 31, 2025, the Board of Directors held 12 meetings, and the Nomination Advisory Committee held 3 meetings.

- All Representative Director and Corporate Director maintained 100% attendance at Board meetings.

- Outside directors Chris Meledandri and Miyoko Demay's attendance at Board meetings was 10/12 (83.3%).

- Outside Executive Status:

- Appointment of Outside Directors: As of June 26, 2025, the company has appointed 6 outside directors (of whom 4 are Audit and Supervisory Committee members).

- Reasons for Selection:

- Chris Meledandri: Based on his experience and insights as a corporate leader and in the entertainment field (especially as CEO of Illumination Entertainment), he provides valuable advice and supervision for company management.

- Miyoko Demay: Based on her experience and insights as a corporate leader and in global marketing and brand strategy, she provides management advice and supervision.

- Katsuhiro Umeyama and Eiko Osawa: As certified public accountants and certified tax accountants, they possess deep knowledge and experience in corporate accounting and taxation, contributing to ensuring the appropriateness of Board decisions and enriching the audit and supervision system.

- Asa Shinkawa: As a lawyer, she possesses deep knowledge in corporate legal affairs, contributing to ensuring the appropriateness of Board decisions.

- Keiko Akashi: Formerly a tax bureau chief and certified tax accountant, she possesses deep knowledge and experience in corporate taxation, contributing to ensuring the appropriateness of Board decisions.

- Independence: All outside directors have no significant conflicts of interest with the company and are recognized as independent officers as defined by Tokyo Stock Exchange, Inc..

- However, Mr. Chris Meledandri plans that after his reappointment is approved at the General Meeting of Shareholders on June 27, 2025, he will no longer be registered as an independent officer as defined by Tokyo Stock Exchange, Inc.. The reason is that Illumination Entertainment, which he represents, is co-producing a new Super Mario Bros. animated film with Nintendo. Although there are no direct transactions of funds or IP licenses between the two parties, given the importance of the visual content business and Mr. Chris Meledandri's expertise in this field, his relationship with Nintendo has increased in importance, and he no longer meets the independence criteria.

- Collaboration of Outside Directors with Internal Audit, Accounting Audit, and Internal Control Departments:

- Outside directors attend Audit and Supervisory Committee meetings monthly, receive audit briefings from accounting auditors, and exchange opinions.

- At Audit and Supervisory Committee meetings, outside directors receive reports from the internal audit department and regularly exchange opinions.

- Regularly review the accounting auditor's audit plan and results, and provide opinions on audit appropriateness.

Audit Status

- Audit Status by Audit and Supervisory Committee:

- Audit and Supervisory Committee members attend Board meetings and other important meetings, review important documents, and meet regularly with the President.

- Full-time Audit and Supervisory Committee members conduct on-site audits of various departments of the company based on the annual audit plan.

- The Committee collaborates with the internal audit department, regularly receiving internal audit result reports, and cooperates with accounting auditors, conducting physical inventory checks, auditing major subsidiaries, and regularly receiving audit plans and explanations of results.

- For the fiscal year ended March 31, 2025, the Audit and Supervisory Committee held 13 meetings.

- Audit and Supervisory Committee Meeting Attendance:Audit and Supervisory Committee Meeting Attendance- For the fiscal year ended March 31, 2025, the Audit and Supervisory Committee held a total of 13 meetings.

- All Audit and Supervisory Committee members maintained 100% attendance.

- Internal Audit Status:

- The company's internal audit department consists of 7 members, independent of business execution departments, responsible for operational audits of the company and its subsidiaries for efficiency, asset protection, and compliance.

- The internal audit department manages internal controls, assesses compliance, and ensures the appropriateness and reliability of financial reporting. Audit results are reported directly to the President and Representative Director and Audit and Supervisory Committee members.

- Accounting Audit Status:

- The company has had an audit agreement with PricewaterhouseCoopers Japan LLC (formerly Hisaji Miyamura Office) since 1962.

- Accounting auditors work closely with Audit and Supervisory Committee members and the internal audit department, reporting audit plans and results, exchanging information and opinions, to conduct audits efficiently.

- For the fiscal year ended March 31, 2025, the certified public accountants responsible for accounting audits include Keiichiro Kagi, Takuya Urakami, and Yusuke Nishimura.

- Change of Accounting Firm:

- PricewaterhouseCoopers Kyoto merged with PricewaterhouseCoopers Aarata LLC on December 1, 2023. The latter was renamed PricewaterhouseCoopers Japan LLC and became Nintendo's independent auditor. This change does not affect the opinions in the audit report.

- Policy and Reasons for Appointment of Auditors and Evaluation:

- Policy on Termination or Non-renewal of Auditors: If an auditor meets any reason stipulated in Article 340, Paragraph 1 of the Companies Act, the Audit and Supervisory Committee will terminate their appointment. If an auditor cannot appropriately perform their duties or changing auditors helps improve audit appropriateness, the Committee will submit a proposal for non-renewal.

- Reasons for Reappointment: After evaluation, the Audit and Supervisory Committee deems PricewaterhouseCoopers Japan LLC's audit methods and results reasonable, and expects it to continue appropriate audits, thus deciding to reappoint.

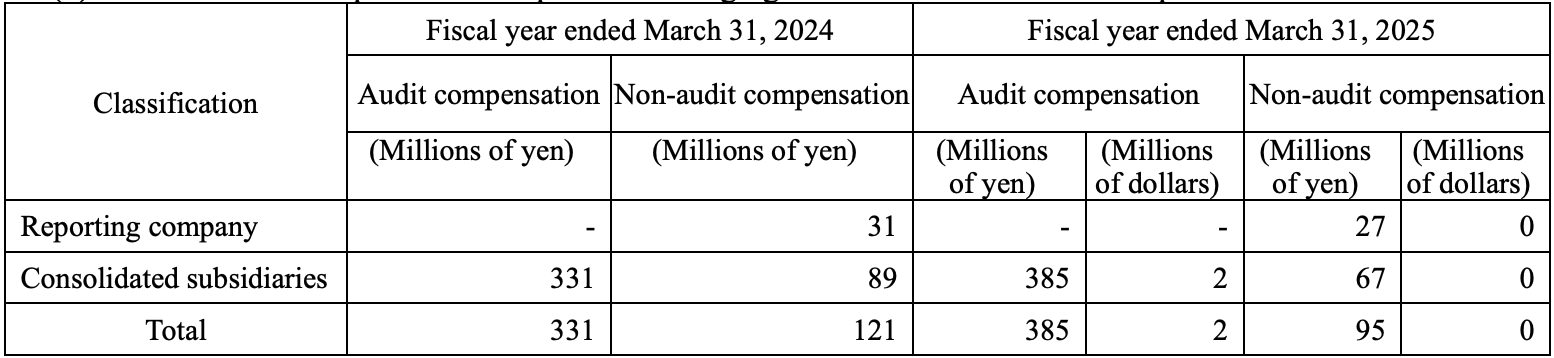

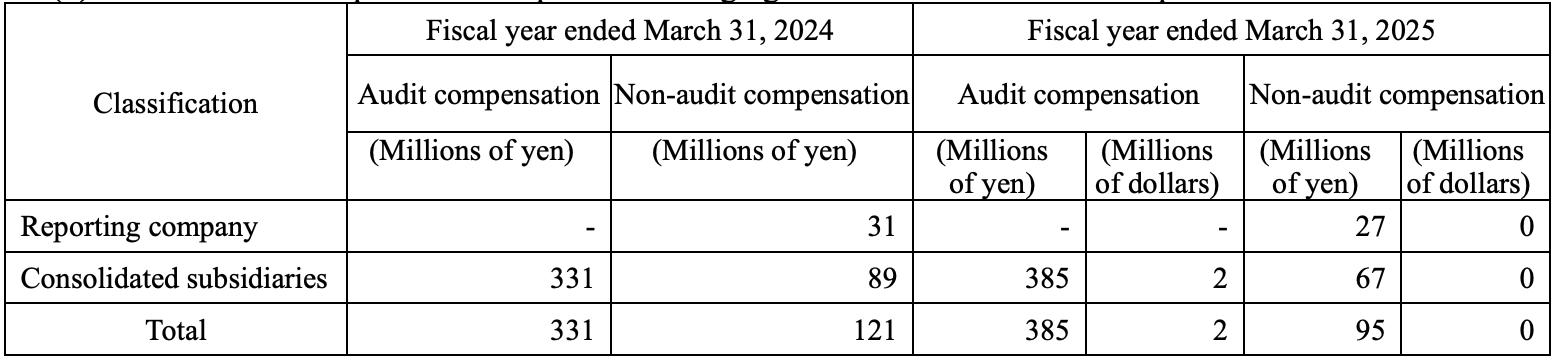

- Audit Fees and Other Compensations:

- Independent Auditor's Audit Compensation Details:Independent Auditor Audit Compensation Details (Units: million JPY/USD)- For fiscal year 2025, the total audit compensation for the independent auditor was ¥120 million JPY ($0 million USD).

- The company's audit compensation was ¥101 million JPY ($0 million USD), and consolidated subsidiaries' audit compensation was ¥19 million JPY ($0 million USD).

- Compared to fiscal year 2024, total audit compensation slightly decreased.

- For fiscal year 2025, the total audit compensation for personnel within the same network was ¥385 million JPY ($2 million USD), and non-audit compensation was ¥95 million JPY ($0 million USD).

- Consolidated subsidiaries' audit compensation in fiscal year 2025 was ¥385 million JPY ($2 million USD), and non-audit compensation was ¥67 million JPY ($0 million USD).

- Audit Compensation Details for Personnel within the Same Network

- Non-Audit Services:

- To the Reporting Company: None in both fiscal years 2024 and 2025.

- To Consolidated Subsidiaries: None in both fiscal years 2024 and 2025.

- Provided by Companies within the Same Network to the Reporting Company: Both fiscal years 2024 and 2025 included tax-related consulting services.

- Provided by Companies within the Same Network to Consolidated Subsidiaries: Both fiscal years 2024 and 2025 included tax-related consulting services.

- Non-Audit Services:

- Policy for Determining Audit Compensation: The company determines audit compensation based on auditor independence, service characteristics, and audit days.

- Reasons for Audit and Supervisory Committee's Agreement to Auditor Compensation: The Committee reviewed the audit plan, basis for compensation estimation, and comparison with previous audits, deeming the auditor compensation appropriate.

Independent Auditor Audit Compensation Details

-

- **Audit Compensation Details for Personnel within the Same Network**:

Audit Compensation Details for Personnel within the Same Network (Units: million JPY/USD)

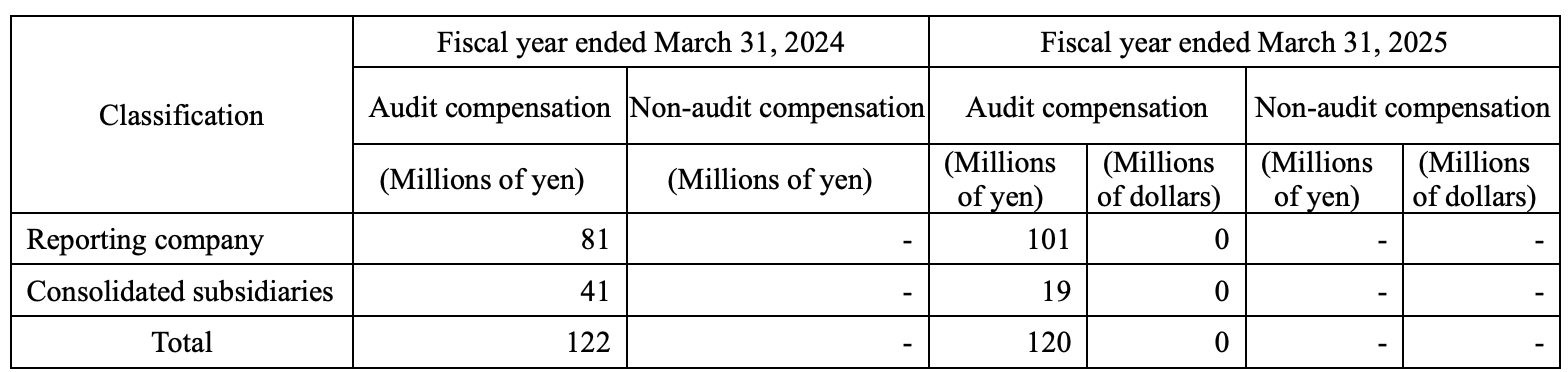

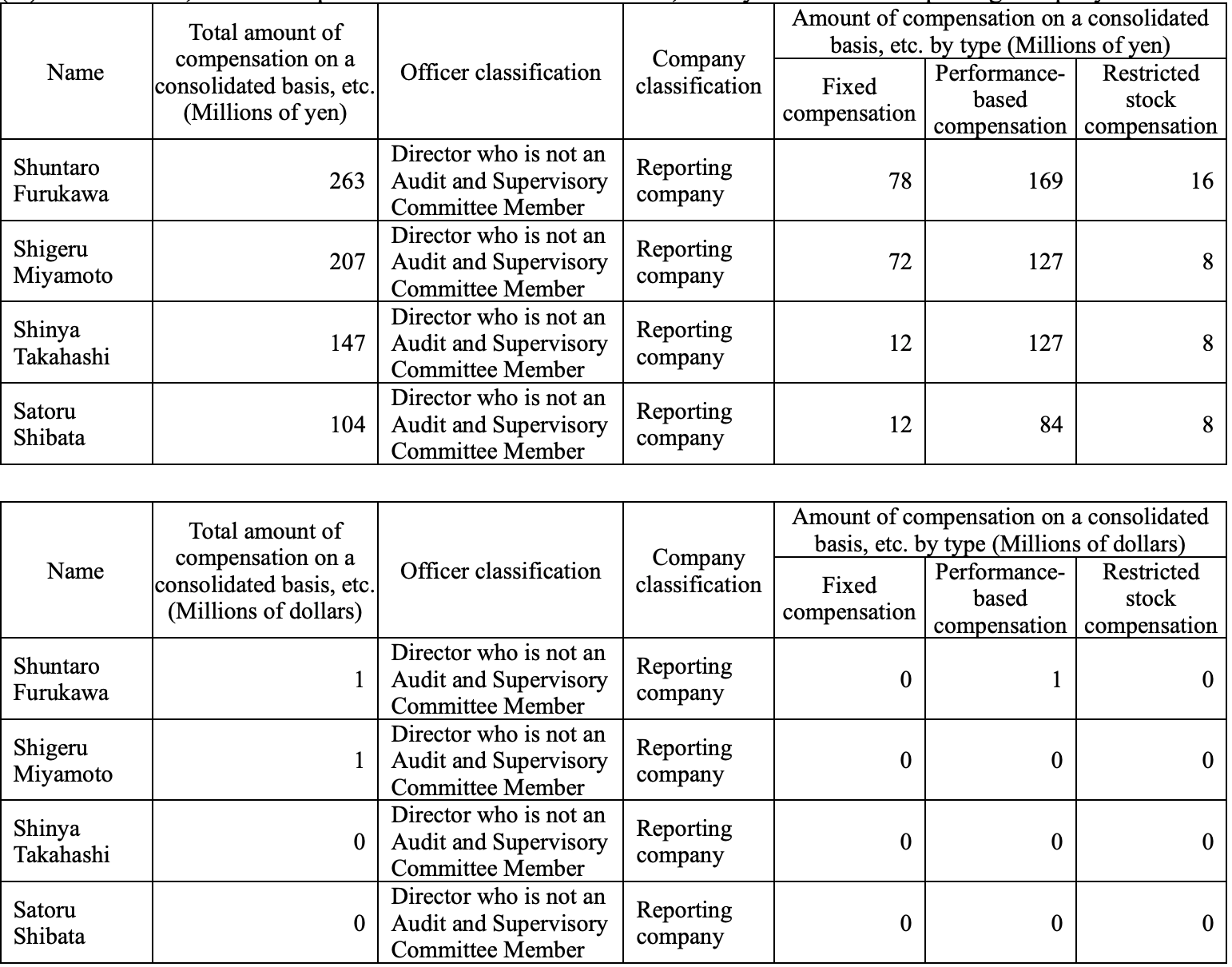

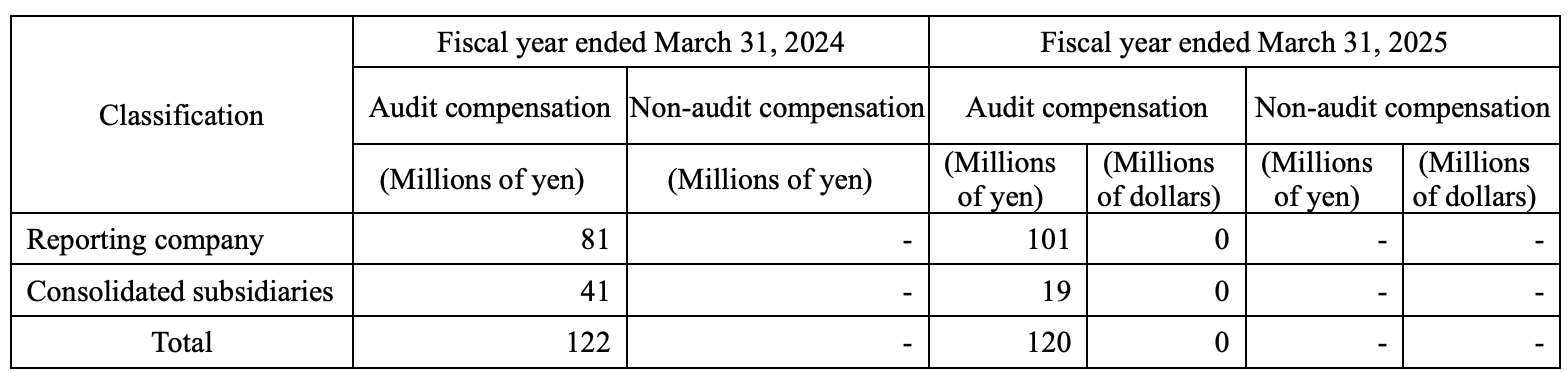

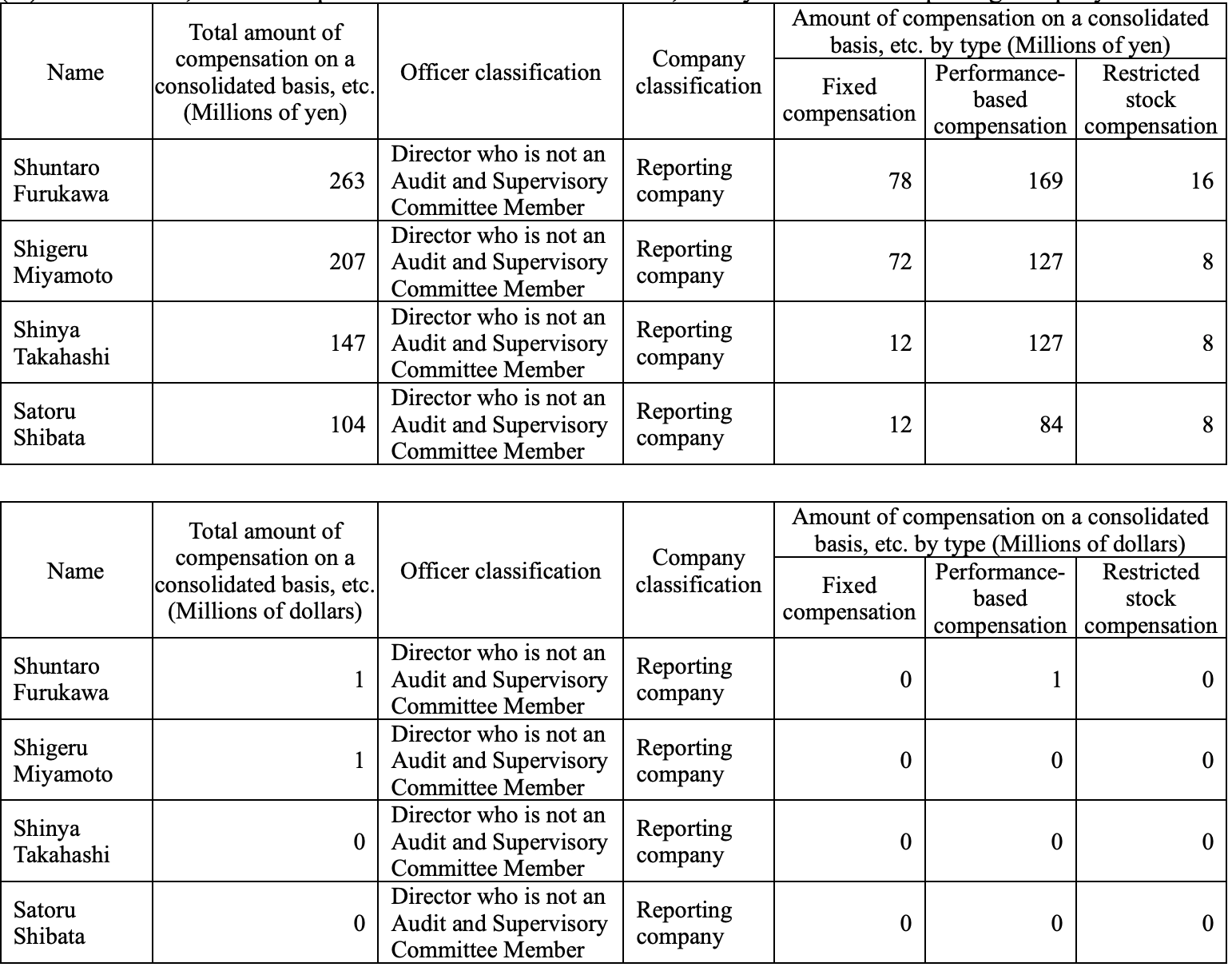

Executive Compensation, etc.

- Executive Compensation Determination Policy:

- Transparency: Determined by resolution of the Board of Directors after deliberation by the Nomination Advisory Committee, aimed at setting individual director compensation details.

- External Referencing: Compensation standards refer to compensation survey results from external research institutions.

- Compensation for Directors (excluding Audit and Supervisory Committee members):

- Includes fixed compensation, performance-based short-term incentive compensation, and stock compensation as long-term incentives.

- Outside directors receive only fixed compensation, as their duties involve management supervision and advice, not participation in business execution.

- Fixed Compensation: Determined by the President and Representative Director based on the director's position and responsibilities, paid monthly in the same amount.

- Performance-Based Compensation: Uses consolidated operating profit as a benchmark, calculated annually at a specified time based on a formula predetermined by the Board of Directors according to each director's position points.

- Additional performance-based compensation will be paid when the average consolidated operating profit for the most recent 3 fiscal years (including the payment fiscal year) and the consolidated operating profit for the payment fiscal year both exceed ¥40,000 million JPY ($2,684 million USD).

- Calculation formula: Consolidated Operating Profit 0.3% Each Director's Points Total Director Points.

- The total upper limit for performance-based compensation is ¥880 million JPY ($5 million USD), reaching the upper limit when consolidated operating profit reaches ¥40,000 million JPY.

- Stock Compensation: Paid in the form of restricted stock, with the number of shares allocated determined by the director's position, paid annually at a specified time. Restrictions are lifted after the director resigns from director and executive officer positions.

- Compensation for Directors (Audit and Supervisory Committee members):

- Includes only fixed compensation, as they are independent of executive directors and perform audit and supervisory duties.

- The amount of compensation is determined through discussions among Audit and Supervisory Committee members, paid monthly in the same amount.

- Resolutions on Executive Compensation at the General Meeting of Shareholders:

- Directors (excluding Audit and Supervisory Committee members): Monetary compensation (including fixed compensation and performance-based compensation) is capped at ¥1,800 million JPY ($12 million USD) annually, of which fixed compensation does not exceed ¥500 million JPY annually (including ¥100 million JPY for outside directors). Stock compensation (restricted stock) is capped at ¥100 million JPY ($0 million USD) and 10,000 shares annually.

- Directors (Audit and Supervisory Committee members): Compensation is capped at ¥100 million JPY ($0 million USD) annually.

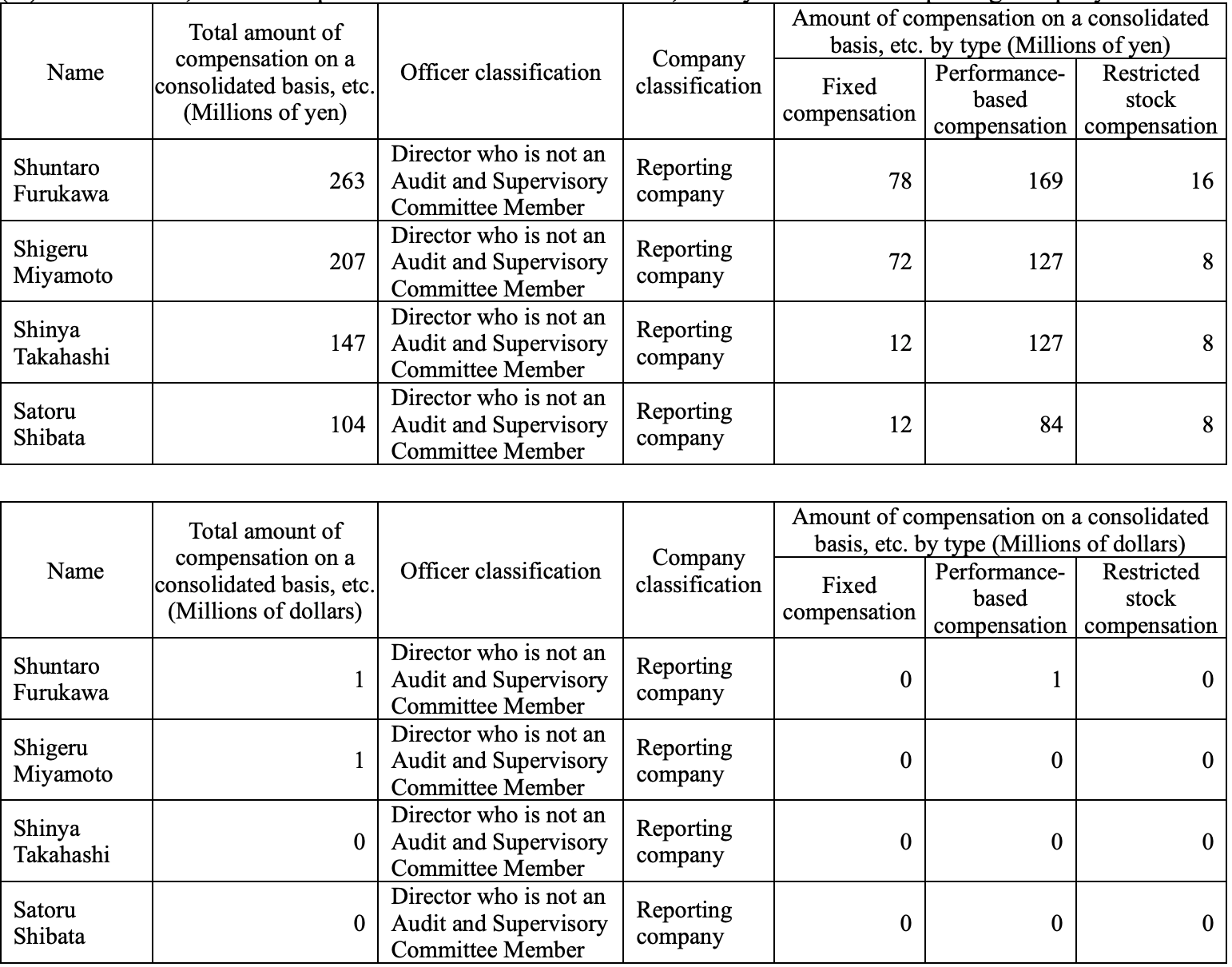

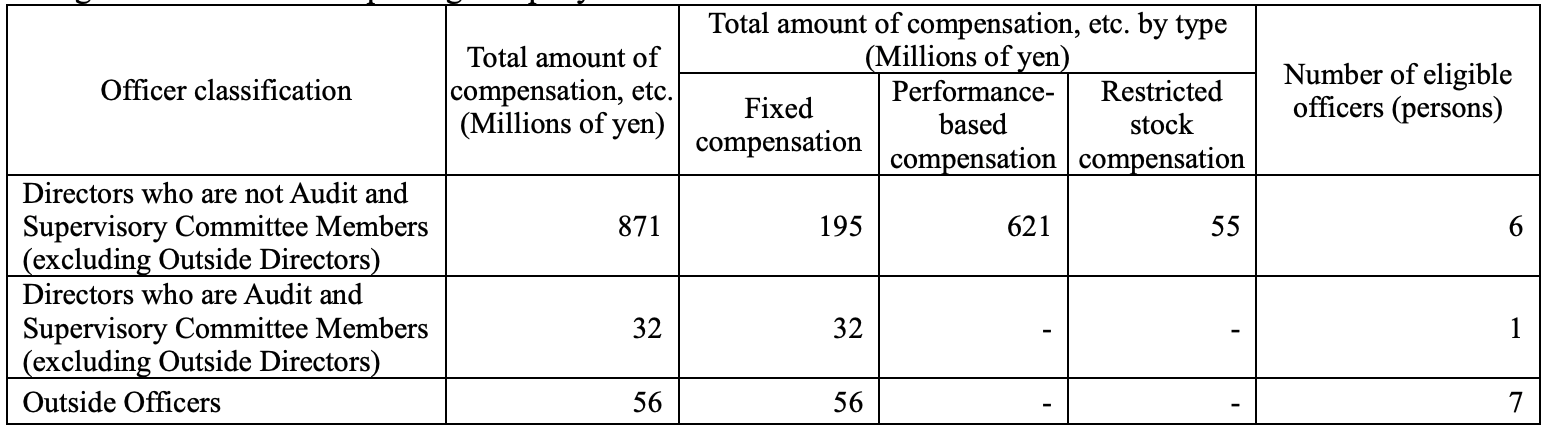

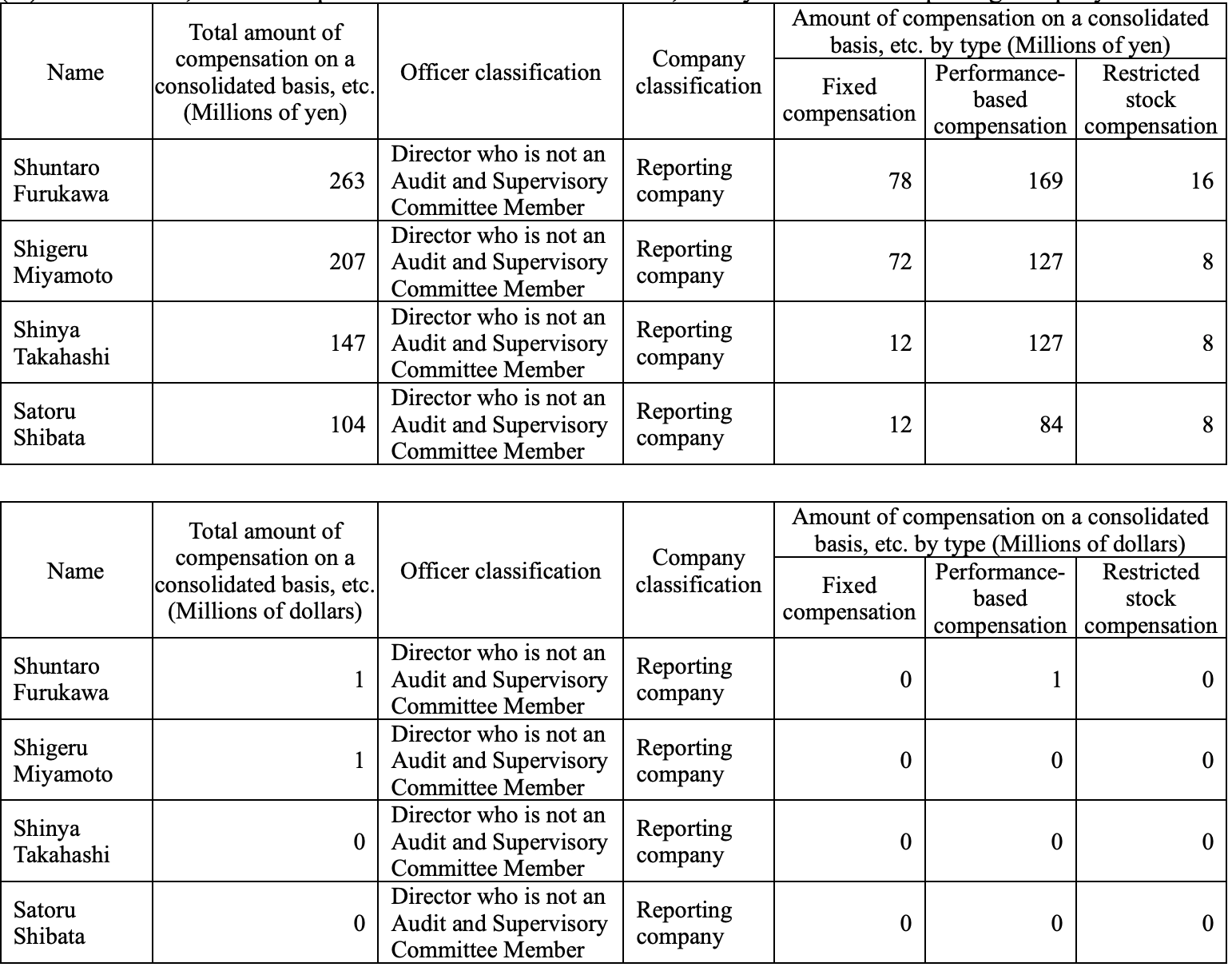

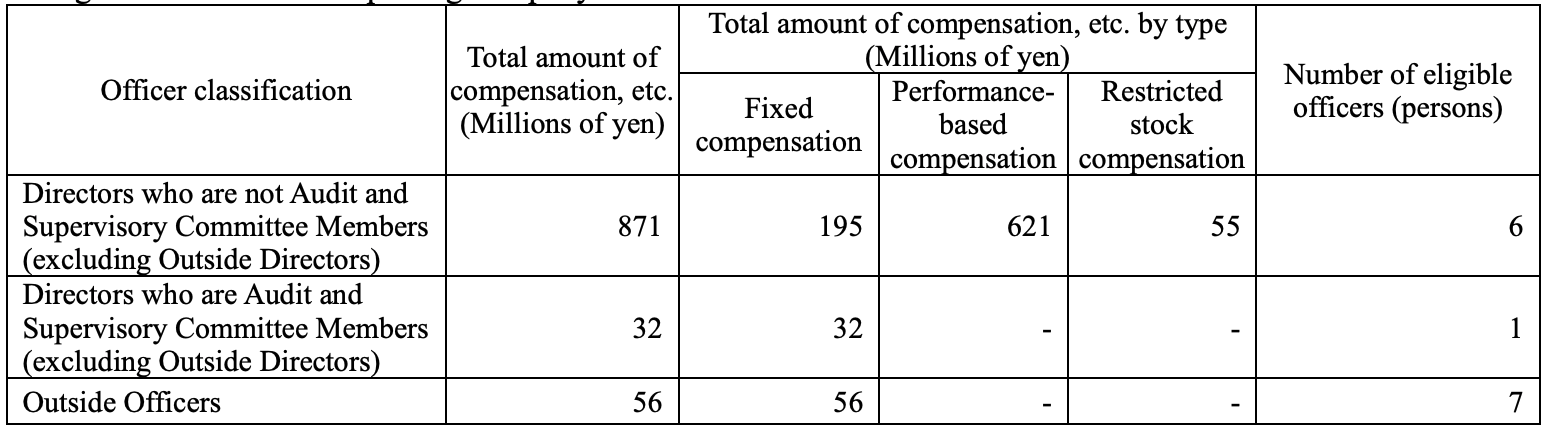

- Total Compensation of Reporting Company by Executive Category:Total Executive Compensation of Reporting Company (as of March 31, 2025)

- Directors (excluding Audit and Supervisory Committee members, excluding outside directors) had total compensation of ¥871 million JPY ($5 million USD), with performance-based compensation accounting for the largest portion (¥621 million JPY).

- Audit and Supervisory Committee members (excluding outside directors) had total compensation of ¥32 million JPY ($0 million USD), all of which was fixed compensation.

- Outside directors had total compensation of ¥56 million JPY ($0 million USD), all of which was fixed compensation.

- Total Executive Compensation of Reporting Company (JPY)

- Total Executive Compensation of Reporting Company (USD)

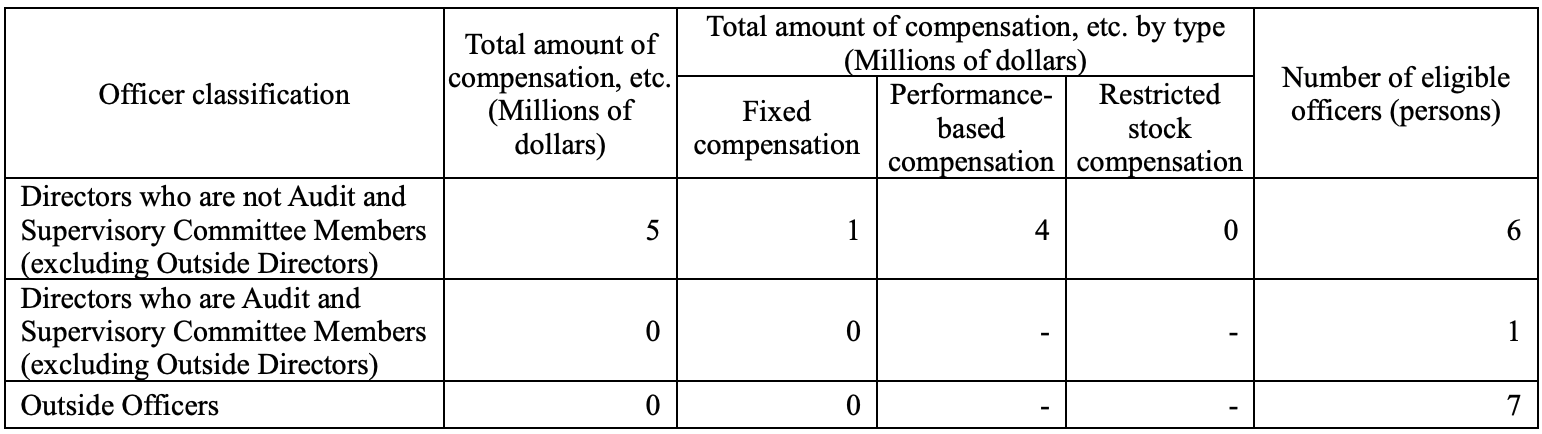

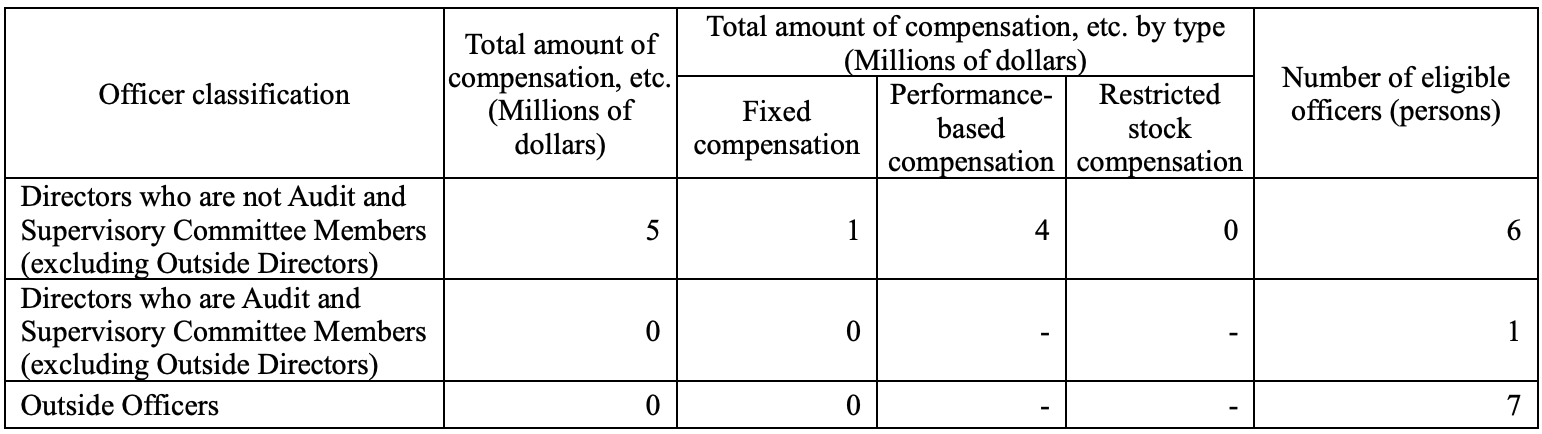

- Total Consolidated Compensation of Major Executives:Total Consolidated Compensation of Major Executives (as of March 31, 2025)

- Shuntaro Furukawa (President Representative Director) had the highest total compensation, at ¥263 million JPY ($1 million USD), with performance-based compensation of ¥169 million JPY.

- Shigeru Miyamoto (Executive Fellow Representative Director) had the second highest total compensation, at ¥207 million JPY ($1 million USD), with performance-based compensation of ¥127 million JPY.

- Performance-based compensation is the main component of executive compensation.

- Total Consolidated Compensation of Major Executives (JPY)

- Total Consolidated Compensation of Major Executives (USD)

Shareholding Status

- Investment Share Classification Standards and Methods:

- The company, in principle, does not hold investment shares for purely investment purposes, only holding investment shares not for purely investment purposes but based on its shareholding policy.

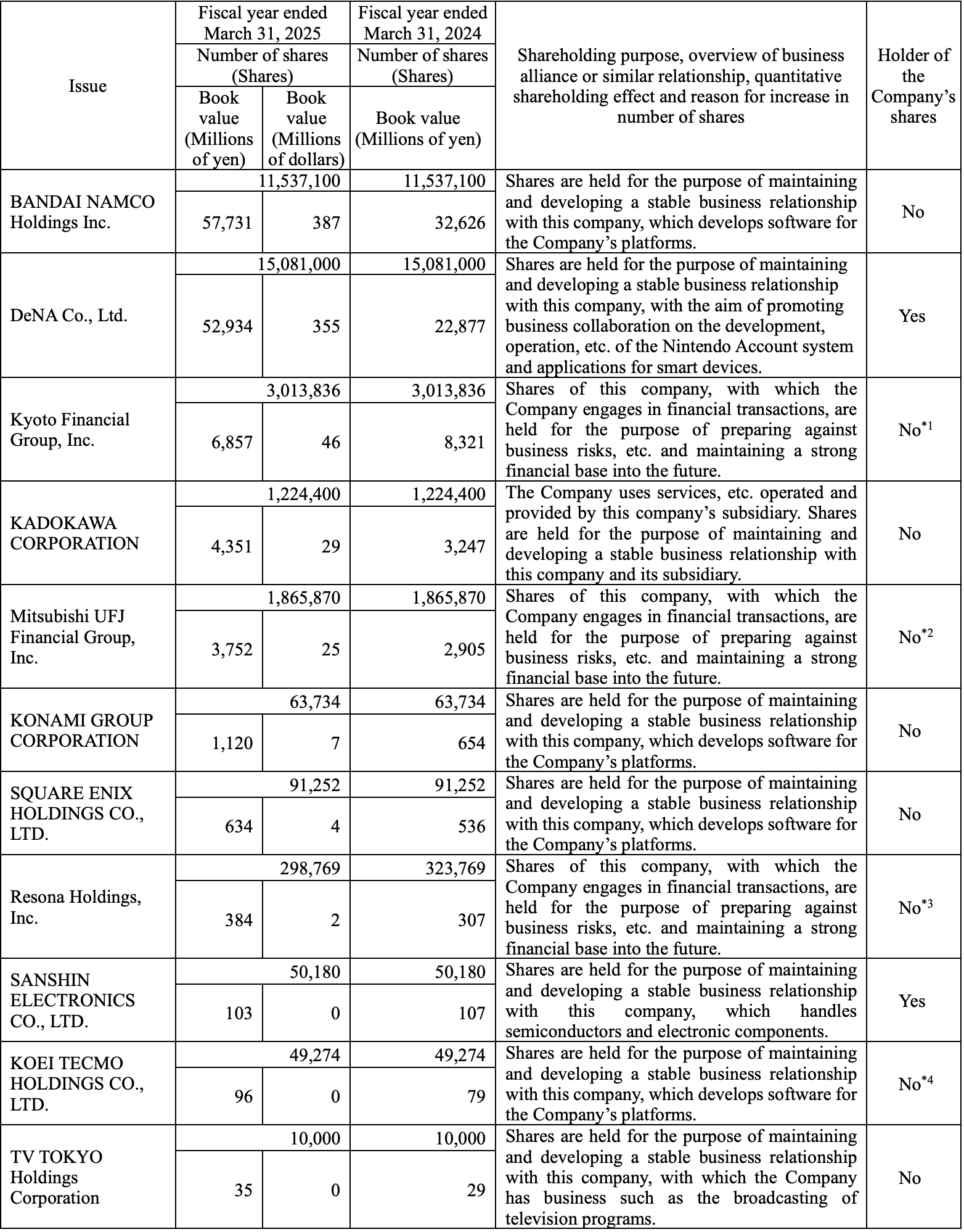

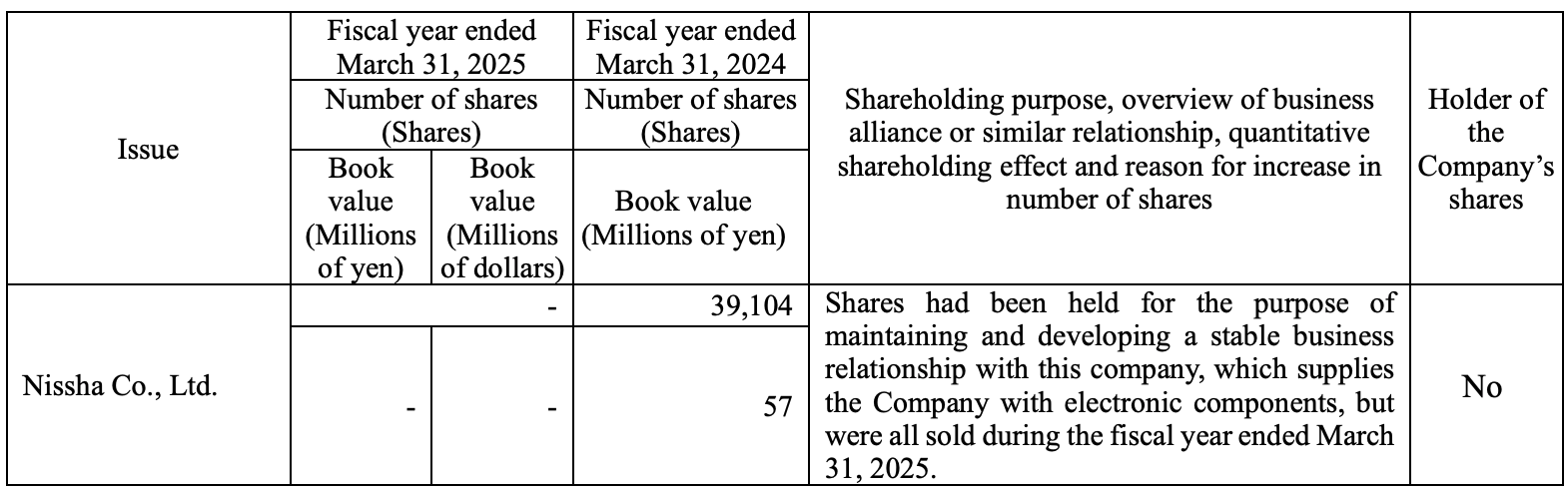

- Investment Shares Not for Purely Investment Purposes:

- Shareholding Policy: Nintendo's purpose for holding shares is to maintain and develop business alliances and business relationships if it contributes to enhancing corporate value in the medium to long term.

- Annual Verification: The Board of Directors annually confirms the purpose and rationality of holding individual investment shares and verifies the appropriateness of their holding. If the significance of holding decreases, the company will consider disposal.

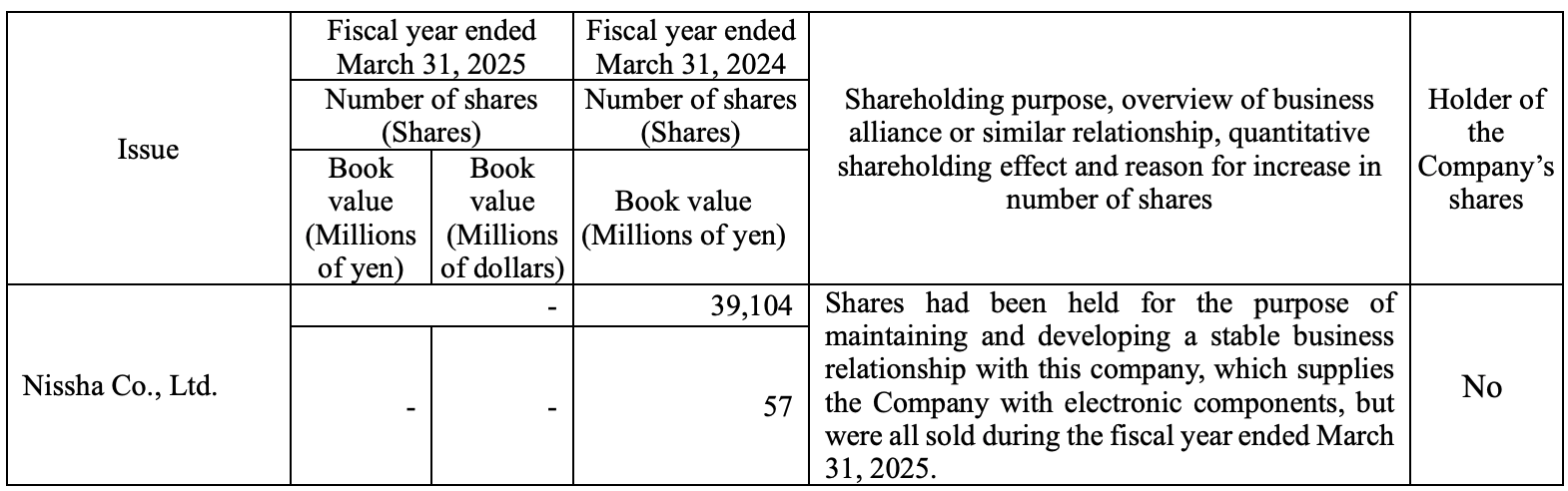

- Number of Issues and Book Value:Overview of Investment Shares Not for Purely Investment Purposes (as of March 31, 2025)- Unlisted Stocks: 17 issues, book value ¥7,406 million JPY ($49 million USD).

- Other Stocks excluding Unlisted Stocks: 11 issues, book value ¥128,002 million JPY ($859 million USD).

- No increase in the number of share issues in this fiscal year, but a decrease in the number of shares for 2 issues.

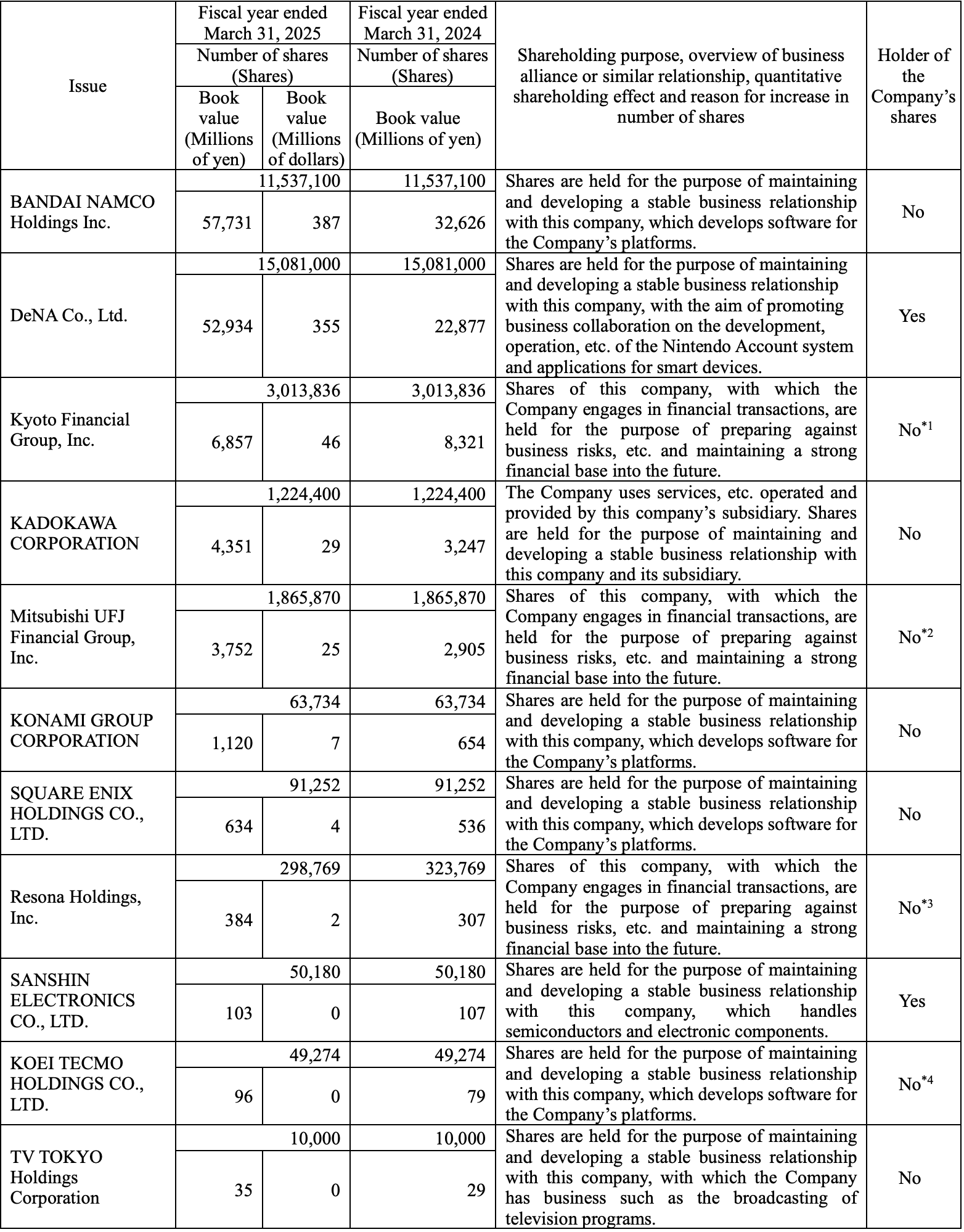

- Specific Investment Share Information:List of Specific Investment Shares (as of March 31, 2025)

- DeNA Co., Ltd.: Book value ¥52,934 million JPY ($355 million USD), the largest single investment, held for promoting business cooperation in Nintendo Account system and smart device applications.

- BANDAI NAMCO Holdings Inc.: Book value ¥57,731 million JPY ($387 million USD), the company's equity stake increased, held for maintaining business relationships for platform software development.

- Financial Institutions: The company holds shares in Kyoto Financial Group, Inc., Mitsubishi UFJ Financial Group, Inc., and Resona Holdings, Inc., aiming to address business risks and maintain a strong financial foundation.

- Nissha Co., Ltd.: Its shares were all sold in fiscal year 2025, previously held for maintaining business relationships with electronic component suppliers.

- Multiple companies' shares are held for maintaining business relationships for platform software development, including BANDAI NAMCO Holdings Inc., KONAMI GROUP CORPORATION, SQUARE ENIX HOLDINGS CO., LTD., and KOEI TECMO HOLDINGS CO., LTD..

- The quantitative effect of these holdings is difficult to describe, but the Board of Directors evaluates their holding purpose and rationality annually.

- Multiple invested companies also hold shares of Nintendo.

- List of Specific Investment Shares (JPY)

- List of Specific Investment Shares (USD)

CN

Nintendo FY2025 Annual Report - Part I

Key Logic

Nintendo在2025财年(截至2025年3月31日)的业绩表现不佳,总销售额和各项利润指标均出现显著下滑,其中营业利润同比下降46.6%,主要系缺乏如前一年般强大的爆款游戏带动。尽管核心Nintendo Switch平台已进入第八年运营周期,仍保持稳定销量,且新一代主机Nintendo Switch 2已于2025年6月5日发布,有望为公司提供新的增长动力。为应对日趋激烈的市场竞争和技术进步,Nintendo坚持其独特的娱乐产品战略,并积极扩大Nintendo IP在游戏平台之外的应用(如视觉内容、移动应用、主题公园),同时持续进行研发投入。公司在可持续发展和公司治理方面展现出明确的政策和行动,包括健全的CSR体系、多元化的董事会构成和透明的薪酬政策,以维护长期企业价值并应对全球化运营中的各类风险。

公司概览

主要财务数据和趋势

合并财务数据概览

- 截至2025年3月31日的财年,Nintendo的总销售额同比下降30.3%至¥1,164,922百万日元(USD 7,818百万美元),净资产和总资产持续增长,但营业利润、普通利润和归属于母公司所有者的利润均大幅下降,其中营业利润同比下降46.6%至¥282,553百万日元(USD 1,896百万美元)。

- 营运现金流从去年的¥462,097百万日元大幅下降至¥12,069百万日元(USD 81百万美元),而投资活动现金流则由负转正,变为流入¥753,063百万日元(USD 5,054百万美元),主要得益于定期存款的取出和证券的出售赎回。

- 净资产收益率(ROE)从去年20.15%降至10.47%,而市盈率(PER)则从19.45倍上升至42.22倍。

- 员工人数从上一财年的7,724人增加至8,205人。

公司历史

公司历史沿革

- Nintendo于1947年11月最初成立为Marufuku Co., Ltd.,从事日本纸牌(karuta)和西方纸牌的制造与分销业务。

- 公司的名称经过多次变更,最终于1963年10月更名为Nintendo Co., Ltd.,即公司当前商号。

- 公司上市经历多次演变,包括1962年1月在Osaka Securities Exchange二板和Kyoto Stock Exchange上市,后于1970年7月转至Osaka Securities Exchange主板,并于1983年7月在Tokyo Stock Exchange主板上市,最终于2022年4月随Tokyo Stock Exchange市场重组转至Prime Market。

- 公司在全球范围内拓展业务,相继于1980年4月在纽约成立Nintendo of America Inc.(后于1982年2月合并至华盛顿的子公司),1990年2月在德国成立Nintendo of Europe GmbH,以及2006年7月在韩国成立Nintendo of Korea Co., Ltd.。

- 公司总部曾多次搬迁,最终于2000年11月迁至其目前位于京都的总部地址。

业务描述

- Nintendo Co., Ltd.及其子公司和联营公司(截至2025年3月31日,包括29家子公司和5家联营公司)主要从事娱乐产品的开发、制造和销售。

- 核心产品:主要包括电脑增强型“Dedicated video game platforms”(硬件和软件)、角色商品和扑克牌。

- IP利用:公司还涉足利用IP的业务,如视觉内容(visual content)和移动应用程序(mobile applications)。

- 主要参与方及其职能:

- 开发:Nintendo Co., Ltd.、Nintendo Technology Development Inc.、Nintendo Software Technology Corporation、Retro Studios, Inc.、Next Level Games Inc.、Shiver Entertainment, Inc.、Nintendo European Research and Development SAS、iQue (China) Ltd.、Nintendo Cube Co., Ltd.、1-UP Studio Inc.、MONOLITH SOFTWARE INC.、Mario Club Co., Ltd.、SRD Co., Ltd.、Nintendo Pictures Co., Ltd.、Nintendo Systems Co., Ltd.。

- 制造:Nintendo Co., Ltd.。

- 销售:Nintendo Co., Ltd.、Nintendo of America Inc.、Nintendo of Canada Ltd.、Nintendo of Europe SE、Nintendo Australia Pty Limited、Nintendo of Korea Co., Ltd.、Nintendo (Hong Kong) Limited、Nintendo of Taiwan Co., Ltd.、Nintendo Sales Co., Ltd.。

- 单一业务分部:Nintendo作为单一业务分部运营,因此省略分部信息。

子公司和联营公司

- 合并子公司:

- 截至2025年3月31日,共有29家合并子公司,其中24家在附图中列出。

- 主要子公司详情:

- Nintendo of America Inc. (美国): Sales业务,Nintendo Co., Ltd.持有其100%投票权,与其他Nintendo实体间存在产品制造和采购业务。

- Nintendo of Europe SE (德国): Sales业务,Nintendo Co., Ltd.持有其100%投票权,与Nintendo实体间存在委托制造和采购业务。

- Nintendo Technology Development Inc. (美国): Development业务,Nintendo Co., Ltd.持有其100%投票权,负责硬件OS等的委托开发。

- iQue (China) Ltd. (中国): Development业务,Nintendo Co., Ltd.持有其100%投票权,负责软件委托开发。

- 财务表现突出的子公司**:主要合并子公司财务信息- Nintendo of America Inc.销售额最高,达¥462,202百万日元($3,102百万美元),同时也是净利润最高的子公司,为¥44,110百万日元($296百万美元)。

- Nintendo of Europe SE销售额次之,为¥272,893百万日元($1,831百万美元),但却录得亏损,净亏损¥4,101百万日元($27百万美元)。

- Nintendo Sales Co., Ltd.在销售额和利润方面均低于前两者。

- 合并子公司信息(部分)

- 使用权益法核算的联营公司:

- 除The Pokémon Company外,还有3家其他联营公司使用权益法核算。

- The Pokémon Company (日本): **Sales和licensing of Pokémon related goods业务,Nintendo Co., Ltd.持股32%,并与其存在产品采购和委托制造业务。

- 联营公司信息

员工

- 集团员工总数:集团员工总数

- 截至2025年3月31日,Nintendo集团员工总数达8,205人。

- 本公司员工信息:本公司员工平均信息

- 截至2025年3月31日,Nintendo Co., Ltd.员工总数2,962人,平均年龄40.2岁,平均服务年限14.4年,平均年薪为¥9,666,256日元(USD 64,874美元)。

- 劳资关系:

- Nintendo Co., Ltd.内部没有工会,但部分合并子公司有工会。劳资关系良好,无值得注意事项。

- 性别构成与薪酬差距:

- 本公司:本公司女性管理层比例、男性育儿假及薪酬差距- 截至2025年3月31日,Nintendo Co., Ltd.女性管理层比例为5.1%。

- 男性员工育儿假使用率为91%。

- 整体员工的男女薪酬差距为69.2%,正式员工为70.1%,兼职和临时工为91.8%。

- 公司解释薪酬差距主要由于服务年限和平均年龄差异,而非薪酬或评估系统存在性别差异。

- 本公司女性管理层比例、男性育儿假及薪酬差距

- 合并子公司:主要子公司女性管理层比例、男性育儿假及薪酬差距

- Mario Club Co., Ltd.男性育儿假使用率为100%,MONOLITH SOFTWARE INC.为71%。

- 薪酬差距解释与母公司一致,主要归因于服务年限和平均年龄差异。

- 合并子公司女性管理层比例、男性育儿假及薪酬差距

业务概览

管理政策、管理环境、需要解决的问题

- 基本管理政策:

- Nintendo致力于作为一家“创造笑容的娱乐公司”,通过引入前所未有的娱乐形式,为全球消费者提供激动人心的体验,同时保持稳健的企业管理。

- 目标管理指标:

- 公司致力于持续提供新颖有趣的products and services,通过维持强劲增长和增加利润来提升企业价值。

- 由于娱乐产品和内容在研发上存在固有的不确定性,Nintendo没有设定具体的管理指标目标,以保持在高度竞争行业中的决策灵活性。

- 管理环境与中长期战略:

- 市场环境:全球娱乐需求增长,技术进步导致娱乐形式多样化,游戏行业竞争加剧。

- 核心战略:

- 以集成硬件和软件的Dedicated video game platform业务为核心,提供独特原创的直观娱乐体验,不限年龄、性别或游戏经验。

- 持续扩大Nintendo IP的受众群体,通过视觉内容、移动应用、主题公园和周边产品等多种领域,深化消费者对Nintendo IP的喜爱,从而激发他们对核心游戏平台业务的兴趣。

- 通过Nintendo Account维系与消费者的长期关系,该账户是跨平台世代并连接多种娱乐体验的关键连接点。

- 新产品发布:新一代游戏主机Nintendo Switch 2已于2025年6月5日发布,旨在继承Nintendo Switch的成功用户基础,并进一步扩大全球用户群。

- 核心理念:娱乐的真正价值在于其独特性,Nintendo旨在通过发挥自身优势,适应时代变化,珍视创造精神,实现可持续增长和企业价值提升。

可持续发展方法和倡议

- 目标:以“为所有被Nintendo触及的人带来笑容”为目标,全面推进CSR活动。

- 四大CSR优先领域:Consumers(消费者)、Supply Chain(供应链)、Employees(员工)和Environment(环境)。

- 治理体系:

- CSR Promotion Project Team:公司设立CSR Promotion Project Team,在General Affairs Division高级总经理的监督下,负责协调和支持CSR活动。

- 全球协调:海外主要子公司设有CSR teams,共享活动信息。

- 汇报路径:CSR Promotion Project Team向Executive Management Committee汇报CSR重要事项,并根据指示开展活动。Board of Directors则接收CSR报告并监督进展。

- 公司CSR活动治理结构

- 各项CSR优先领域具体举措:

- 消费者:

- 确保产品质量和安全:在开发、生产和售后服务中实施广泛举措。

- 儿童友好:重视游戏软件开发中的安全性,创建家长/监护人使用检查功能,消除通信功能中的不当内容。

- 供应链:

- 与合作伙伴合作:与全球生产合作伙伴合作,提升质量、技术能力和生产效率。

- CSR采购:制定基本采购和业务伙伴选择政策,通过Nintendo CSR Procurement Guidelines,确保采购符合法律、法规和社会标准,尊重人权和环境。

- 员工:

- 人才发展:以Nintendo DNA(原创性、灵活性、真诚)为基础,通过工作经验最大化员工个人发展,强调团队合作,鼓励员工独立行动、灵活应对变化、挑战自我。

- 多元化:积极招聘和晋升不限性别、年龄、国籍、残疾、性取向或性别认同的人才。

- 工作环境优化:鼓励思想交流,提供及时建议,促进协作和沟通;积极完善支持系统,包括鼓励员工利用育儿假平衡工作与生活。

- 环境:

- 减少环境足迹:在办公室和产品层面减少环境影响,从设计阶段到售后维修和回收。

- 具体措施:设计考虑能源和资源效率,选择易回收包装材料,高效运输,提供售后维修支持。

- 应对气候变化:根据1.5°C和4.0°C全球变暖情景识别风险和机遇,评估财务影响,并按照Task Force on Climate-Related Financial Disclosures (TCFD)的建议进行信息披露。

- 消费者:

- CSR风险管理:

- CSR Coordination Team与海外子公司的CSR负责人合作,识别CSR问题,分析风险和机遇程度,并根据对社会和Nintendo的影响来确定优先级别。

- 定期评估,灵活应对社会和环境变化。

- CSR指标和目标:CSR相关指标和目标

- 女性员工的育儿假使用率目标:在从2022年3月31日结束的财年开始的5年累计期内,维持100%的使用率。

- 实际结果:截至2025年3月31日,累计使用率为105%,已达成并超出目标。

- 男性员工的育儿假使用率目标:在从2022年3月31日结束的财年开始的5年累计期内,达到50%或以上。

- 实际结果:截至2025年3月31日,累计使用率为81%,已达成并超出目标。

- 注:育儿假使用率的计算方式可能导致高于100%,因为其基于“开始使用育儿假的员工数量”与“同年婴儿出生数量”的比率。

- 女性员工的育儿假使用率目标:在从2022年3月31日结束的财年开始的5年累计期内,维持100%的使用率。

风险因素

- 经济环境风险:

- 外汇汇率波动:Nintendo超过70%的销售额来自日本以外,大部分交易以当地货币进行,且持有大量外币资产。汇率波动可能对其财务状况、经营业绩和现金流产生不利影响。公司通过持续进行外币采购来降低影响。

- 业务活动风险:

- 市场环境波动与竞争:

- 娱乐市场竞争激烈,消费者偏好转向其他形式的娱乐或技术创新导致新竞争者出现,都可能对视频游戏市场造成不利影响。

- Nintendo通过其独特的硬件和软件一体化Dedicated video game platform业务以及拓展Nintendo IP接触点(如Nintendo Account)来应对。

- 新产品开发:

- 软件开发成本高、周期长、消费者偏好不确定,无法保证所有新产品都能成功。

- 硬件开发耗时,技术更新快,可能无法及时获取所需技术。

- 产品发布延迟,开发中断或计划变更都可能对财务业绩产生不利影响。

- 公司持续努力开发独特且有吸引力的新产品。

- 产品估值与库存采购:

- 游戏产品生命周期相对较短,受消费者偏好和季节性影响大,过剩或过时库存可能造成不利影响。

- 需求预测不准确可能导致业务机会流失或供应不足。

- Nintendo通过预测生产和推广可下载软件版本来保证供应。

- 对外部制造商的依赖:

- 关键零部件和产品组装依赖外部公司,可能面临供应商破产、及时供应不足、成本上升、质量问题等风险,这可能损害Nintendo与消费者的关系。

- 供应商多位于海外,可能受当地安全、自然灾害、流行病等因素影响。

- 公司通过从多个供应商采购零部件和材料,并将生产外包给多家公司来分散风险。

- 季节性波动:

- 销售额高度集中于年末和新年销售旺季,若期间未能发布有吸引力的新产品或及时供货,可能影响业绩。

- Nintendo通过开发长期可玩的游戏和提供数字业务中的付费服务来力求全年稳定业绩。

- 系统问题:

- 在线游戏、数字软件销售和信息服务等通过互联网提供,面临网络攻击、系统中断、数据泄露等风险,可能影响业绩、声誉和财务状况。

- Nintendo通过增加内部资源、招聘人才、与外部专家合作等方式加强应对系统问题的能力。

- 影响业务活动的其他因素:

- 全球化运营面临政治经济因素、税务系统不一致、人才招聘困难、劳资纠纷、恐怖袭击、战争和自然灾害等风险,可能阻碍产品和服务的规划、开发、制造、分销和销售。

- 市场环境波动与竞争:

- 法律法规和诉讼风险:

- 产品责任:产品缺陷可能导致大规模召回或产品责任赔偿,影响公司声誉和财务业绩。

- 知识产权强制执行限制:在某些地区难以有效打击未经授权的网络上传和假冒产品,可能对业绩产生负面影响。

- 未经授权的系统访问和机密信息泄露:消费者个人信息及公司机密信息可能因未经授权访问而泄露或被不当使用,影响业绩、股价和财务状况。

- 法律法规变化:法律法规、会计准则或税收制度的意外颁布或变更,以及与税务机关的争议,可能影响业绩和财务状况。

- 诉讼:全球运营可能面临诉讼、争议和其他法律程序。

- 其他风险:

- 应收账款无法收回、金融机构倒闭、环境法规、企业品牌受损、政治局势变化、气候变化、自然灾害或流行病等不可预测因素。

管理层对财务状况、经营业绩和现金流的分析

- 重要会计程序和估计的假设:

- 合并财务报表根据日本公认会计准则编制,管理层基于历史表现和未来事件的可能性进行合理估计。实际结果可能与估计存在差异。

- 经营业绩描述和分析:

- 销售业绩:

- Nintendo Switch业务:截至2025年3月31日的财年,Nintendo Switch硬件销量为10.80百万台(同比下降31.2%),软件销量为155.41百万套(同比下降22.2%)。

- 畅销游戏:

- 《Super Mario Party Jamboree》销量7.48百万套。

- 《The Legend of Zelda: Echoes of Wisdom》销量4.09百万套。

- 《Paper Mario: The Thousand-Year Door》销量2.10百万套。

- 《Mario Kart 8 Deluxe》在本财年销售6.23百万套(累计销售达68.20百万套)。

- 本财年共诞生24款百万销量游戏(含第三方发行商)。

- 业绩下降原因:销量下降主要是由于上一财年有《The Legend of Zelda: Tears of the Kingdom》(2023年5月发布)和《Super Mario Bros. Wonder》(2023年10月发布)等爆款游戏带动。

- 数字业务:数字销售额为¥326.0亿日元(USD 2,187百万美元),同比下降26.5%,主要受Nintendo Switch可下载版打包软件销售下降影响。

- 移动和IP相关业务:销售额同比下降27.0%至¥67.6亿日元(USD 453百万美元),主要原因是《The Super Mario Bros. Movie》(2023年4月发布)相关收入减少。

- 财务总览:

- 净销售额:¥1,164.9亿日元(USD 7,818百万美元),同比下降30.3%。

- 营业利润:¥282.5亿日元(USD 1,895百万美元),同比下降46.6%。

- 普通利润:¥372.3亿日元(USD 2,498百万美元),同比下降45.3%。

- 归属于母公司所有者的利润:¥278.8亿日元(USD 1,871百万美元),同比下降43.2%。

- 日本以外销售额:¥890.0亿日元(USD 5,973百万美元),同比下降32.0%,占总销售额的76.4%。

- 毛利润:同比下降25.6%至¥710.1亿日元(USD 4,765百万美元)。

- 销售、一般及管理费用:同比增加¥2.2亿日元(USD 14百万美元),主要由于研发费用和退休金费用增加。

- 非营业收入:净非营业收入为¥89.7亿日元(USD 602百万美元),主要来自利息收入。

- 销售业绩:

- 财务状况描述和分析:

- 总资产:增加¥247.1亿日元(USD 1,658百万美元)至¥3,398.5亿日元(USD 22,808百万美元),主要得益于现金及存款和存货的增加。

- 总负债:增加¥126.6亿日元(USD 849百万美元)至¥673.0亿日元(USD 4,516百万美元),主要由于应付票据和应付账款的增加。

- 净资产:增加¥120.4亿日元(USD 808百万美元)至¥2,725.4亿日元(USD 18,291百万美元),主要由于留存收益的增加。

- 现金流描述和分析:

- 截至2025年3月31日,现金及现金等价物余额为¥1,414.1亿日元(USD 9,490百万美元),本财年增加¥560.6亿日元(USD 3,762百万美元)。

- 经营活动现金流:增加¥12.0亿日元(USD 80百万美元),主要受存货增加和所得税支付的负面影响,但有收到的利息和股息等正面因素。

- 投资活动现金流:增加¥753.0亿日元(USD 5,053百万美元),主要由于定期存款的取出、短期和长期投资证券的出售和赎回收益高于相关的支付和购买。

- 融资活动现金流:减少¥195.1亿日元(USD 1,309百万美元),主要由于股息支付。

生产、订单接收和销售信息

- 生产业绩:生产业绩概览

- 截至2025年3月31日,Dedicated video game platform生产额为¥967,426百万日元(USD 6,492百万美元),同比增长3.3%。

- 其他产品生产额为¥14,342百万日元(USD 96百万美元),同比下降34.1%。

- 总生产额为¥981,769百万日元(USD 6,589百万美元),同比增长2.5%。

- 生产业绩

- 订单接收状况:

- 除部分Dedicated video game platform软件外,生产主要以“按库存生产”为主,因此省略订单接收信息。

- 销售业绩:销售业绩概览

- Dedicated video game platform销售额为¥1,083,534百万日元(USD 7,272百万美元),同比下降30.9%,其中Nintendo Switch平台销售额为¥1,050,296百万日元(USD 7,048百万美元),同比下降31.5%。

- 移动、IP相关收入等为¥67,673百万日元(USD 454百万美元),同比下降27.0%。

- 总销售额与此前财务数据一致,为¥1,164,922百万日元(USD 7,818百万美元),同比下降30.3%。

对经营业绩有重大影响的因素

- 核心业务影响:家庭娱乐领域中,爆款产品的出现与销量对经营业绩有重大影响。其他非游戏类娱乐形式的流行也可能产生影响。

- 汇率波动:超过70%的总销售额来自日本以外市场,主要以当地货币结算。尽管Nintendo通过外币采购等方式对冲汇率风险,但仍难以完全消除其对财务业绩的影响。

- 产品组合利润差异:Dedicated video game platforms及其兼容软件是Nintendo的主要产品,但硬件和软件的利润率差异很大,它们在总销售额中的比例波动可能影响毛利润和毛利率。

研究与开发活动

- 研发重点:主要致力于Dedicated video game systems的硬件和软件开发,并拓展amiibo、视觉内容及智能设备应用程序的规划、开发和运营。

- 硬件研发:

- 软件研发:

- 充分利用硬件功能进行产品规划,专注于图形、音乐和游戏脚本的游戏设计和程序开发。

- 推动系统基础设施扩展,支持Nintendo eShop等网络服务。

- 建立智能设备软件研发架构,促进智能设备应用程序和后端服务器系统的规划和开发。

- 生产与采购:在零部件采购和制造过程中,推广采用新测试方法和技术的零部件批量生产,并与制造合作伙伴合作研究相关法律法规。

- 研发费用:本财年研发费用为$143.7亿日元(USD 964百万美元)。

- 主要研发成果:

- 新主机发布:新视频游戏系统Nintendo Switch 2于2025年6月5日发布,具有更大、响应更快的屏幕、新型磁性Joy-Con 2控制器、更强的处理速度和图形性能。

- 新主机伴随软件:随Nintendo Switch 2硬件同步发布了《Mario Kart World》和《Nintendo Switch 2 Welcome Tour》。

- 老游戏重制:发布了《The Legend of Zelda: Breath of the Wild - Nintendo Switch 2 Edition》和《The Legend of Zelda: Tears of the Kingdom - Nintendo Switch 2 Edition》,增强了原版游戏。

- Nintendo Switch固件与服务:为Nintendo Switch硬件提供了固件更新以增强便利性和操作稳定性,发布了特别版游戏系统,并持续改进软件开发环境和网络服务。

- Nintendo Switch兼容软件:发布了多款游戏,例如:

- 《The Legend of Zelda: Echoes of Wisdom》(首款以Princess Zelda为主角的The Legend of Zelda系列动作冒险游戏)。

- 《Nintendo World Championships: NES Edition》(将1980年代的Nintendo Entertainment System游戏竞赛带到线上)。

- 《Endless Ocean Luminous》、《Emio - The Smiling Man: Famicom Detective Club》、《Super Mario Party Jamboree》和《Mario & Luigi: Brothership》(各自系列的最新作)。

- 《Paper Mario: The Thousand-Year Door》、《Luigi's Mansion 2 HD》、《Donkey Kong Country Returns HD》和《Xenoblade Chronicles X: Definitive Edition》(高清重制版)。

- 移动业务:持续运营《Fire Emblem Heroes》、《Pikmin Bloom》和《Mario Kart Tour》等游戏应用程序。

- Nintendo Switch Online:为该服务添加了更多作品到Nintendo Entertainment System - Nintendo Classics、Super Nintendo Entertainment System - Nintendo Classics等服务中,并持续改进。

- 其他新产品:发布了Nintendo Sound Clock: Alarmo,一款带有运动传感器的独特闹钟。

- 开发者支持:通过Nintendo Developer Portal为游戏创作者提供持续支持。

设备与设施

资本投资概览

- 截至2025年3月31日的财年,Nintendo的总资本投资额为$39,275百万日元(USD 263百万美元),主要用于研发设施,包括内部使用的计算机软件等无形资产。

- 所有资本投资均通过内部融资,未进行外部融资。

主要设施

- 本公司(Nintendo Co., Ltd.)主要设施:本公司主要设施概览(截至2025年3月31日)

- Corporate Headquarters(京都):总账面价值最高,达¥54,772百万日元($367百万美元),拥有数量最多的员工(2,647人),主要涉及管理、销售、开发和制造。

- Uji Plant(京都):作为主要生产设施,账面价值为¥4,338百万日元($29百万美元),员工141人。

- Nintendo Museum(京都):总账面价值¥9,243百万日元($62百万美元),被列为“其他设施”。

- Tokyo Branch Office租用办公室,年租金为¥1,486百万日元(USD 9百万美元)。

- 本公司主要设施示意图(日元计价)

- 本公司主要设施示意图(美元计价)

- 海外子公司主要设施:海外子公司主要设施概览(截至2025年3月31日)

- Nintendo of America Inc. (美国)的总账面价值¥22,505百万日元($151百万美元),是海外子公司中设施账面价值最高的。

- Nintendo of Europe SE (德国)的总账面价值为¥7,665百万日元($51百万美元)。

- 两家主要海外销售子公司在设施方面也投入了较大。

- 海外子公司主要设施示意图

新设备和设施的安装和退役计划

- 未来资本投资计划:未来资本投资计划(2024年4月至2027年3月)

- 计划总投资达¥158,000百万日元(USD 1,060百万美元)。

- 主要投资用于研发设施(¥58,000百万日元,USD 389百万美元)、模具等生产设施(¥6,000百万日元,USD 40百万美元)以及其他建筑物等的翻新和更新(¥94,000百万日元,USD 630百万美元)。

- 所有未来所需资金均计划通过内部融资解决。

- 新设备和设施的安装计划

公司概况

股份状况及其他相关事项

- 已发行股份总数:已发行股份总数

- 普通股授权发行股数为4,000,000,000股。

- 截至2025年3月31日,已发行股份数量为1,298,690,000股。

- 公司股票在Tokyo Stock Exchange Prime Market上市,每单位构成100股。

- 股份发行趋势:已发行股份总数趋势

- 截至2022年10月1日,因1股分拆为10股,已发行股份数量从129,869千股增加到1,298,690千股。

- 股本和法定资本盈余在此期间保持不变。

- 已发行股份总数趋势

- 股东状况:股东构成(截至2025年3月31日)

- 股东总数为117,423人。

- 外国股东持股比例最高,达51.02%,其次是金融机构(29.25%)和个人及其他(14.95%)。

- 个人股东数量最多,为114,219人。

- 股东构成

- 主要股东状况:主要股东(截至2025年3月31日)

- The Master Trust Bank of Japan, Ltd. (Trust Account)是最大股东,持股比例达16.67%。

- 前十大股东总计持股比例为44.78%。

- 多位外国机构投资者,如JP Morgan Chase Bank和State Street Bank and Trust Company,位列主要股东。

- Nintendo Co., Ltd.的134,441,800股库藏股未计入此表。

- 主要股东

- 投票权状况:投票权状况(截至2025年3月31日)

- 具有完全投票权的普通股数量为1,163,278,600股,对应11,632,786个投票单位。

- 公司持有134,441,800股库存股,不具有投票权。

- 总投票权单位数量为11,632,786个。

- 投票权状况

库存股收购状况及其他相关事项

- 库存股收购:

- 截至2025年3月31日的财年,公司根据Companies Act第155条第7款收购了306股库存股,收购总价为¥2,702,366日元($18,136美元)。

- 库存股处置和持有:

- 在2025财年,公司通过限制性股票补偿计划处置了10,000股库存股,处置总价为¥20,158,400日元($135,291美元)。

- 截至2025年3月31日,公司持有134,441,816股库存股。

股利政策

- 基本政策:

- 内部融资:公司基本政策是通过内部留存资金满足未来增长(包括资本投资)的需求,并维持强大的流动性财务状况。

- 利润回报:股息支付基于每个财期实现的利润水平。

- 每年两次分红:公司基本政策是每年分红两次,包括中期股息和年末股息。

- 股息计算方法:

- 每年每股股息额取以下两者中较高者:

- 将合并营业利润的33%除以年末流通股总数(不含库存股),向上取整至最近日元。

- 根据50%合并利润标准计算,向上取整至最近日元。

- 中期股息每股:将六个月期合并营业利润的33%除以六个月期末流通股总数(不含库存股),向上取整至最近日元。

- 每年每股股息额取以下两者中较高者:

- 2025财年股息支付:

- 中期股息:¥35日元(USD 0.23美元)。

- 年末股息:¥85日元(USD 0.57美元)。

- 留存收益用途:用于新技术研究和新产品服务开发、资本投资、材料采购、广告营销、网络基础设施强化以及适时回购库存股。

- 2025财年股息支付明细:2025财年股息支付明细

- 2024年11月5日董事会决议支付中期股息¥40,748百万日元(USD 273百万美元),每股¥35日元(USD 0.23美元)。

- 2025年6月27日股东大会(预定)决议支付年末股息¥98,961百万日元(USD 664百万美元),每股¥85日元(USD 0.57美元)。

公司治理

- 公司治理概述:

- 基本观点:Nintendo致力于最大化长期持续的企业价值,同时考虑所有利益相关者(包括股东、消费者、业务伙伴、员工、当地社区等)的利益。

- 治理体系目标:建立高度透明和健全的公司治理体系,提升企业道德。

- 体系采用理由:公司采用Company with an Audit and Supervisory Committee形式,以加强董事会的监督职能,并通过Executive Officer System明确业务执行责任,实现管理决策和监督职能与业务执行的分离,以更快适应快速变化的商业环境。

- 公司治理体系:

- Board of Directors:由13名董事组成(包括5名审计和监事委员会成员),其中6名为外部董事。每月召开会议,负责管理决策和监督。

- Nomination Advisory Committee:非强制性咨询机构,由President and Representative Director和所有审计及监事委员会成员组成,旨在提高董事提名和薪酬程序的客观性和透明度。每年至少召开3次会议。

- Audit and Supervisory Committee:由1名全职内部董事和4名外部董事组成。每月召开会议,负责审计业务执行,并交换审计意见。

- Executive Management Committee:由Representative Directors和兼任执行官的Corporate Directors组成,每月召开2次会议,审议董事会提案的基本政策和业务执行政策。

- Compliance Committee:由General Affairs Division高级总经理担任主席,旨在促进合规性,包括制定《Compliance Manual》。

- 风险管理体系的准备:

- 各部门管理其职权范围内的风险。

- Internal Auditing Department:监督风险管理体系,提出改进建议。

- Compliance Committee:推动各部门的合规工作。

- Information Security Committee和Product Safety Committee:分别确保信息安全和产品安全。

- 子公司风险管理:制定内部规章,要求子公司在重要事项上获得公司的事先批准,确保高效风险管理和业务运营。

- 与外部董事的责任限制协议摘要:

- 根据Companies Act第427条第1款,公司与外部董事签订责任限制协议,损害赔偿金额限制在法律法规规定的范围内,前提是外部董事在履行职责时善意且无重大过失。

- 董事责任保险合同摘要:

- 公司已与保险公司签订董事责任保险合同,覆盖公司董事和执行官及其子公司的官员在履行职责时可能产生的损害赔偿和诉讼费用,但故意违法行为等除外。保费由公司全额承担。

- 董事人数:

- 公司《Articles of Incorporation》规定,董事人数(不含审计和监事委员会成员)不超过15人,审计和监事委员会成员不超过5人。

- 董事选举决议要求:

- 董事选举决议需出席股东(拥有1/3或以上投票权)的多数票通过,且不适用累积投票制。

- 股东大会可由董事会决议的事项:

- 库存股收购:董事会可根据Companies Act决议收购库存股,以灵活执行资本政策。

- 中期股息:董事会可决议向每年9月30日股东名册上的股东支付中期股息。

- 股东大会特别决议要求:

- 需出席股东(拥有1/3或以上投票权)的2/3或以上投票通过,以确保特别决议的确定性。

- 公司控制基本政策:

- 董事会认为,公司股票作为流通股票,是否接受收购要约最终应由股东决定。

- 公司认为某些收购要约可能损害公司价值或股东共同利益,并将采取适当措施应对。

- 目前公司未正式引入特定防御措施,但已建立内部应对机制。若出现收购要约,将谨慎评估其潜在影响,并与外部专家协商、进行谈判,必要时组建工作组决定是否采取防御措施。

- 董事会成员:2025年6月26日董事会成员列表

- 截至报告提交日,董事会由9名男性董事和4名女性董事组成,女性比例为30.8%。

- Shuntaro Furukawa担任President Representative Director,Shigeru Miyamoto担任Executive Fellow Representative Director。

- 外部董事包括Chris Meledandri(Illumination Entertainment首席执行官)和Miyoko Demay(前Tiffany & Co.高管)。

- 多名董事兼任公司高级管理职务。

- 女性外部董事包括Miyoko Demay、Asa Shinkawa、Eiko Osawa和Keiko Akashi,其中Asa Shinkawa曾任律师,Eiko Osawa和Keiko Akashi具有注册会计师或税务会计师背景。

- 董事会会议出席情况:董事会和提名咨询委员会会议出席情况

- 截至2025年3月31日财年,董事会召开12次会议,提名咨询委员会召开3次会议。

- 所有Representative Director和Corporate Director均保持100%的董事会出席率。

- 外部董事Chris Meledandri和Miyoko Demay的董事会出席率均为10/12次(83.3%)。

- 外部高管状况:

- 外部董事任命情况:截至2025年6月26日,公司任命了6名外部董事(其中4名为审计和监事委员会成员)。

- 选择理由:

- Chris Meledandri:基于其作为企业领导者和娱乐领域(特别是Illumination Entertainment首席执行官)的经验和洞察力,为公司管理提供宝贵建议和监督。

- Miyoko Demay:基于其作为企业领导者和全球营销品牌战略领域的经验和洞察力,提供管理建议和监督。

- Katsuhiro Umeyama和Eiko Osawa:作为注册会计师和注册税务会计师,在公司会计和税务方面具有深厚知识和经验,有助于确保董事会决策的适当性,并丰富审计和监督体系。

- Asa Shinkawa:作为律师,在公司法律事务方面具有深厚知识,有助于确保董事会决策的适当性。

- Keiko Akashi:曾担任税务局长及注册税务会计师,在公司税务方面具有深厚知识和经验,有助于确保董事会决策的适当性。

- 独立性:所有外部董事与公司之间不存在重大利益冲突,且均被认定为Tokyo Stock Exchange, Inc.规定的独立高管。

- 但Chris Meledandri先生计划在2025年6月27日股东大会通过其续任后,将不再被注册为Tokyo Stock Exchange, Inc.规定的独立高管。原因是他所代表的Illumination Entertainment与Nintendo共同制作新的Super Mario Bros.动画电影,尽管双方无资金或IP使用许可的直接交易,但鉴于视觉内容业务的重要性以及Chris Meledandri在这领域的专业知识,其与Nintendo的关系重要性增加,不再符合独立性标准。

- 外部董事监督与内部审计、会计审计及内部控制部门的协作:

- 外部董事每月出席审计和监事委员会会议,听取会计审计师的审计简报并交换意见。

- 在审计和监事委员会会议上,外部董事会收到内部审计部门的报告,并定期交流意见。

- 定期审查会计审计师的审计计划和结果,并就审计适当性发表意见。

审计状况

- 审计和监事委员会的审计状况: