Customer Validation and ROI-Driven Intel Manufacturing Strategy Transformation - Analysts Insights on Intel's Potential Fabless Shift and Semiconductor Ecosystem Impact - 客户验证与回报驱动Inte制造战略转型:Q2财报会议后分析师解读潜在Fabless化及对半导体生态的影响

Click to see a more reader friendly version of this content (点击查看视觉效果更好的中文版本)

EN

Key Thesis

Multiple analyst reports indicate that Intel clearly articulated a significant adjustment to its manufacturing strategy during the Q2 earnings call. This shift dictates that future capital expenditures will be strictly contingent on customer validation and capacity reservations. Furthermore, investments in external customer business for 14A and subsequent process nodes will only proceed if an acceptable return on investment can be achieved. This strategy is interpreted by the market as a "challenge" issued by Intel to its external customers and the US government, underscoring the critical importance of external support for its diversification in leading-edge foundry services and the US's strategic technological advantage. It also subtly suggests a potential future transition towards a more Fabless-centric model. Although Intel's Q2 revenue performance benefited from tariff-driven demand pull-forward, gross margin remains under pressure, and its strategic transformation process is slow, lacking near-term catalysts. This has led analysts to adopt a cautious stance on Intel's future performance and investment rating, anticipating a broadly negative impact on the semiconductor equipment market (especially the EUV supply chain), while benefiting foundries like TSMC and Samsung Foundry and their associated material suppliers.

Intel's Core Manufacturing Strategic Shift and Financial Performance Analysis

- Intel announced that the deployment of its capital expenditure (capex) will be strictly dependent on customer validation and reservations for required capacity.

- J.P. Morgan analyst Harlan Sur noted that Intel reaffirmed its commitment to the wafer manufacturing business:

- The 18A process is progressing well and is planned for use in Intel's next three generations of products.

- The first skew of the 18A process is expected to be launched later this year with the Panther Lake processor.

- Nevertheless, the 18A process will have a much slower production ramp-up speed, with peak capacity not expected until the early 2030s.

- Development of the 14A process is proceeding smoothly, with the company learning from mistakes made in the 18A foundry business.

- The focus for 14A is on securing external customer validation and addressing broader market demands.

- Intel explicitly stated that the company will only invest in the 14A process if it achieves an acceptable return on capital, driven by both its own products and meaningful external customers.

- Morgan Stanley analysts pointed out that management believes if it were solely to support Intel's own products, the company would not have sufficient scale to invest in 14A technology (expected for volume production in 2028-2029).

- Morgan Stanley expressed surprise at this statement, as Intel had previously indicated that its foundry business could break even even without external customers.

- Both J.P. Morgan and Bernstein believe that this comment suggests that Intel might abandon its leading-edge wafer manufacturing business if acceptable returns cannot be achieved, posing a certain risk to the semi-cap industry.

- Intel is curbing the fragmentation of its manufacturing operations, halting manufacturing projects in Germany and Poland, and consolidating operations in Costa Rica to create a more streamlined manufacturing footprint.

- J.P. Morgan analyst Harlan Sur noted that Intel reaffirmed its commitment to the wafer manufacturing business:

Analyst Interpretations and Potential Impacts of Intel's New Strategy

- Intel's Intent and "Challenge":

- J.P. Morgan analyst Harlan Sur believes that Intel's pursuit of an acceptable return on investment is a very fair and reasonable corporate perspective.

- J.P. Morgan noted that Intel explicitly stated it would not invest in 14A unless there are "meaningful external customers." This poses a "challenge" to external and potential customers: they need to actively collaborate with Intel at this stage to help improve its processes, making them usable for both internal and external customers.

- J.P. Morgan believes that this may also be a message to the US government: without external customers, Intel will not invest in leading-edge semiconductor technology crucial for the US. This implies that the US government might need to assist customers who are engaging with Intel but have not yet made further decisions, or who have not engaged with Intel at all.

- Bernstein analysts suggested that a somewhat plausible view is that Intel's move is a subtle plea for assistance to the government, coupled with an implicit threat.

- Possibility of Shifting to a "Fabless" Model:

- Morgan Stanley analysts believe that Intel's somewhat half-hearted approach to its Foundry business could lead it to transition towards a more "Fabless" strategy.

- J.P. Morgan (second report) indicated that Intel will transition to a more Fabless model within the next three-four years, which analysts view as a positive development.

- Bernstein analysts noted that while Intel will remain committed to the current 18A node, abandoning future more advanced nodes suggests that Intel may ultimately become a Fabless company.

- Morgan Stanley believes this statement effectively rules out Intel's return to the "IDM 1.0" model after five years.

- Challenges for Intel's Own Operations:

- Bernstein analysts noted that Intel disclosing this information itself might make it harder to attract major customers, as customers may have doubts about its commitment, potentially becoming a self-fulfilling prophecy.

- Bernstein analysts believe that retaining 18A while abandoning 14A may simultaneously create disadvantages on both fronts: 18A still requires capital expenditure, while outsourcing could lead to potentially significant incremental gross margin erosion.

- J.P. Morgan (second report) noted that Intel's multi-year transformation story is progressing slowly. During this period, Intel will continue to burn cash and cede more market share to AMD in the PC Client and Server business segments.

- Morgan Stanley noted that Intel's new CEO Pat Gelsinger (erroneously stated as Lip-Bu Tan in the report) might adopt a more conservative strategy, learning from the lessons of the previous management team, whose "5 nodes in 4 years" plan led Intel to invest $90 billion in capital expenditure, dragging the company into financial difficulties while yielding minimal incremental revenue.

Profound Impact of Intel's Strategic Adjustment on the Semiconductor Ecosystem

- Impact on the WFE Market:

- Bernstein analysts believe that Intel's potential abandonment is a negative factor for the overall WFE market, especially the EUV supply chain.

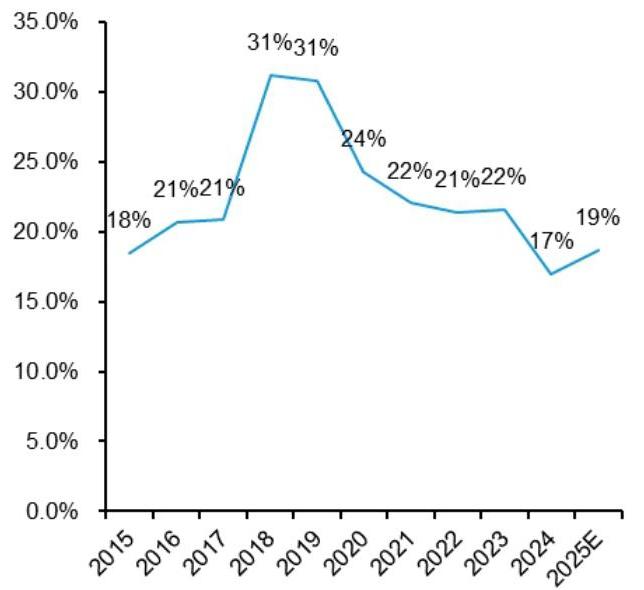

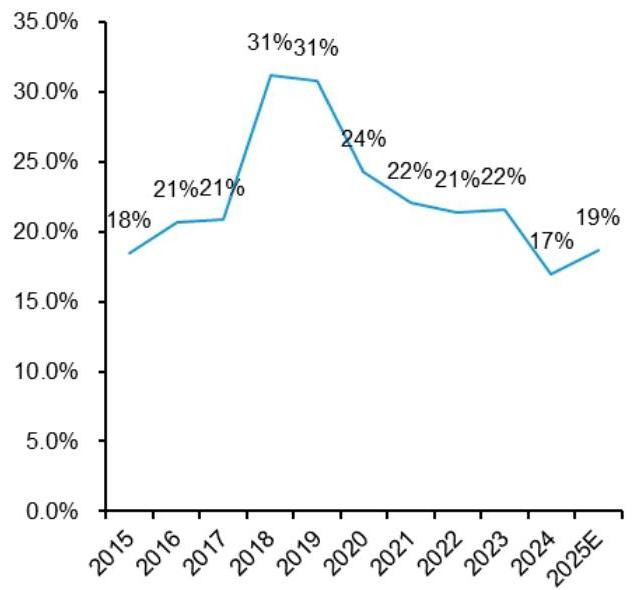

- Intel is a major semiconductor capital expenditure contributor, with its capex accounting for 20-25% of logic/foundry capex and 10-15% of total semiconductor capex.

- Intel's Capex as a % of Logic/Foundry Capex

- Intel's Capex as a % of Total Semiconductor Capex

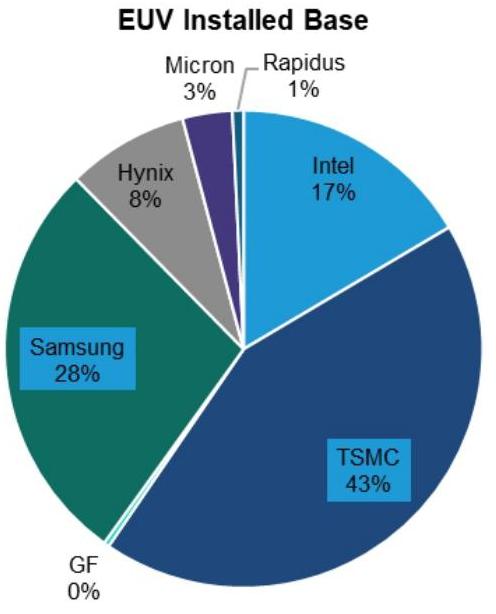

- Intel is particularly crucial for the EUV supply chain.

- Intel was an early adopter of potential High NA EUV technology. If Intel ceases to advance new nodes, the adoption of High NA could be delayed until TSMC's A10 node (around 2030).

- In the long term, Bernstein analysts believe that although Intel's capital expenditure will be replaced by other foundries (especially TSMC), this shift could still result in a net negative impact on the WFE market to a certain extent, estimated at a low single-digit percentage (LSD %), due to TSMC's higher efficiency in capex and utilization.

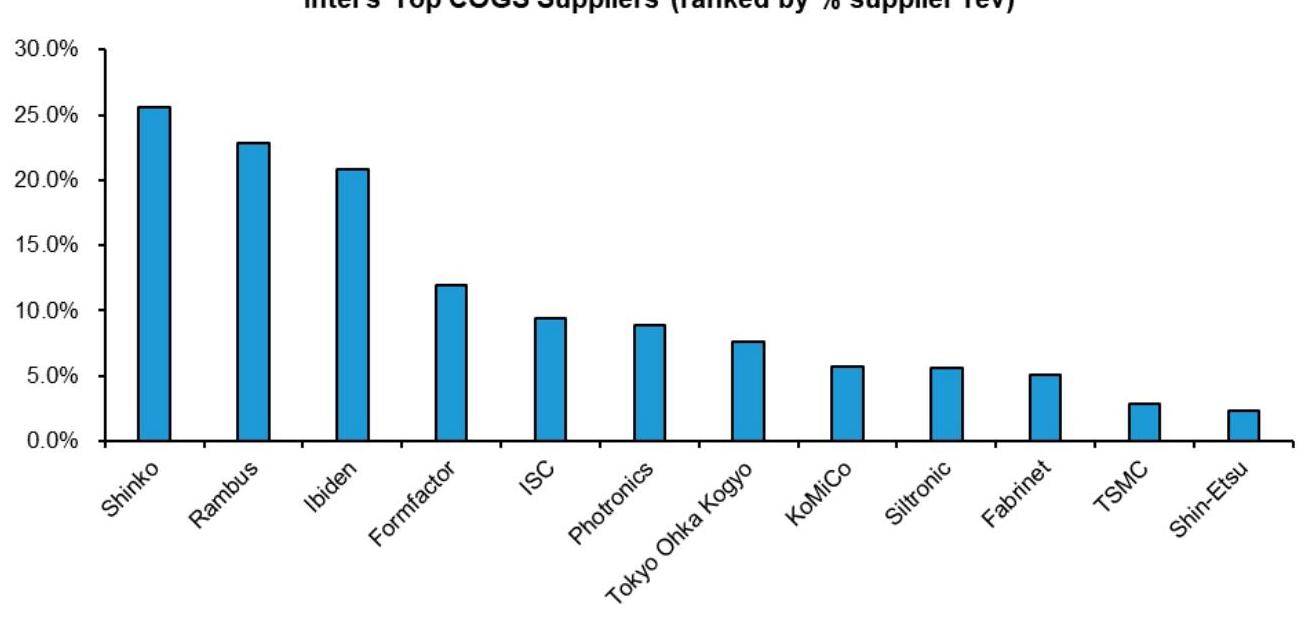

- Impact on Semiconductor Material Suppliers:

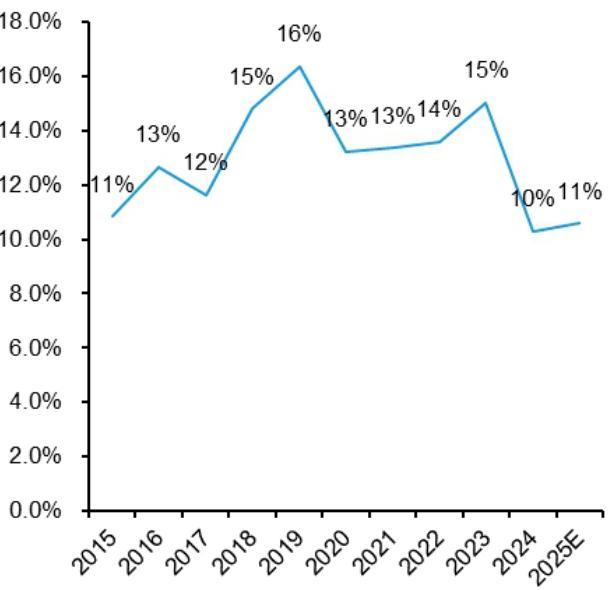

- Bernstein analysts believe that Intel's shift will benefit TSMC's suppliers, with Hoya being the most notable.

- Ibiden also has considerable exposure to Intel, but is expected to remain unaffected, provided Intel continues to advance its back-end packaging technologies.

- Intel's Key COGS Suppliers (ranked by % of supplier revenue)

- Impact on TSMC and Samsung Foundry:

- Bernstein analysts noted that there is a time lag between Intel's decision and the actual transition, due to the need for chip redesign and capacity establishment.

- If Intel shifts to a Fabless model, TSMC will clearly benefit.

- Bernstein believes that the information shared by Intel confirms its view that leading logic chip manufacturers strategically need alternatives to TSMC, and Samsung Foundry is the best-positioned alternative. Therefore, Samsung Foundry will also be a beneficiary.