2025 W29 Global DM Selected Reports from a Top-down scope

Click to see a more reader friendly version of this content (点击查看视觉效果更好的版本)

EN

Key Logic

Goldman Sachs' two latest reports delve into the profound impact of key macroeconomic policies in the United States (immigration policy and trade tariffs) on its domestic labor market and the economies of international trade partners (especially Japan). Elsie Peng's report indicates that the net migration pace in the U.S. has stabilized, but a shift in enforcement focus towards internal operations has led to a significant increase in Immigration and Customs Enforcement (ICE) arrests. Furthermore, the slowdown in immigration will contribute to a further decline in the labor market breakeven rate. Meanwhile, Tomohiro Ota's report reveals that while conventional wisdom suggests tariff burdens are ultimately borne by consumers in the importing country, certain Japanese industries, particularly passenger car and steel/aluminum exporters, are absorbing most of the additional tariffs by lowering export prices to maintain market share. This alleviates upward pressure on domestic selling prices in the United States, but it could negatively impact Japanese corporate profits and Nominal GDP, challenging prevailing views on who bears the tariff burden and emphasizing the need for continuous monitoring.

United States Immigration Policy and Its Impact on the Labor Market

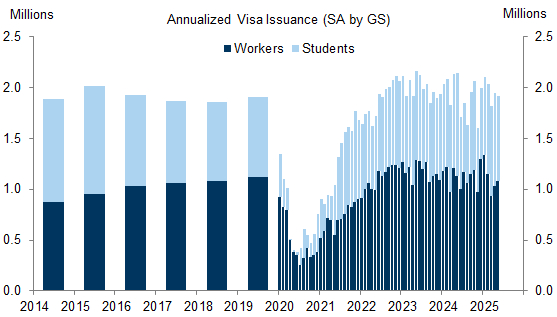

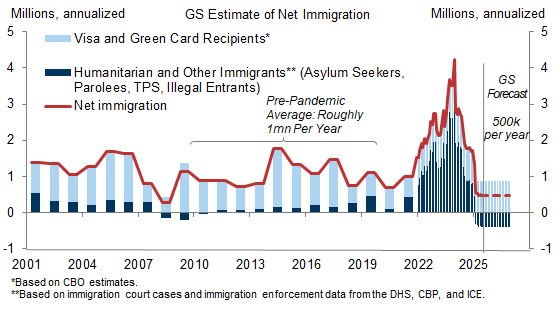

- Goldman Sachs, through Elsie Peng's analysis, notes that the net migration pace in the United States slightly decreased from an annualized 0.6 million people to 0.5 million people in June, and is expected to stabilize at this level, which is below the pre-pandemic trend of 1.0 million people per year.

- This forecast includes net migration of 0.9 million visa and green card holders per year, and a net outflow of -0.4 million humanitarian and other migrants per year (of which 0.7 million outflows offset 0.3 million asylum seekers and undocumented entries).

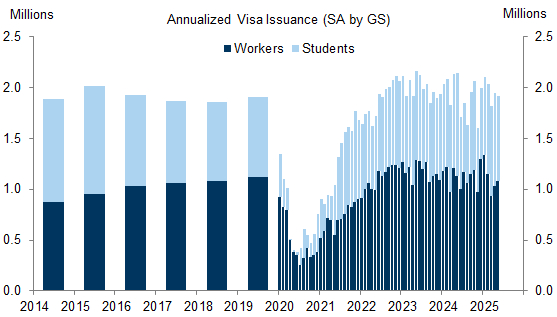

- Legal immigration inflows remain consistent with historical trends. Although the U.S. government temporarily suspended student visa interviews in late May, the short duration of the suspension (slightly more than two weeks) is not expected to have a significant impact.

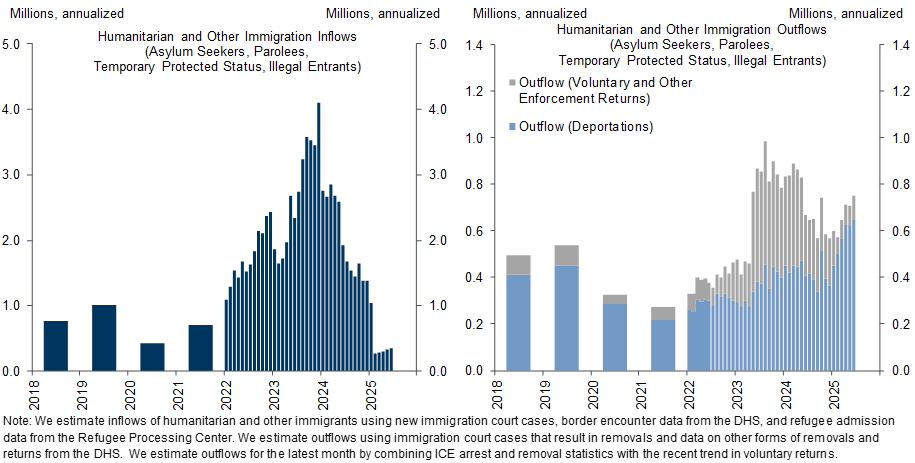

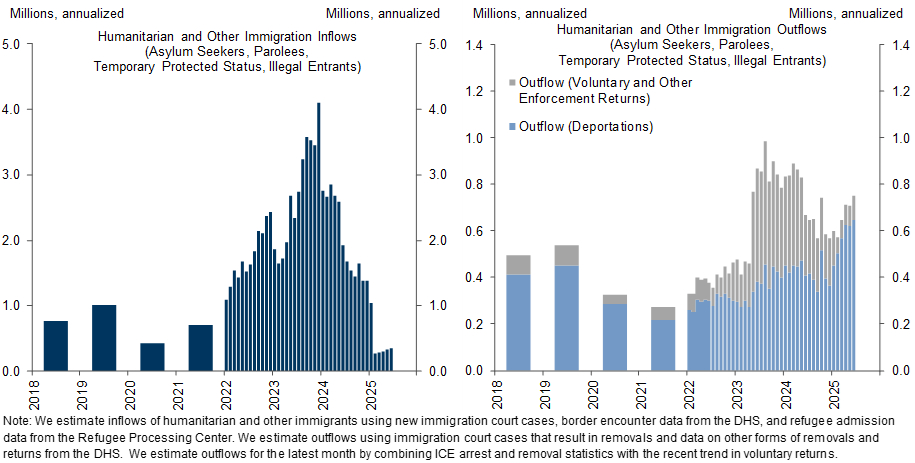

- Changes in Humanitarian and Other Migration Inflows and Outflows

- Source: Transactional Records Access Clearinghouse, Department of Homeland Security, Immigration and Customs Enforcement, Goldman Sachs Global Investment Research

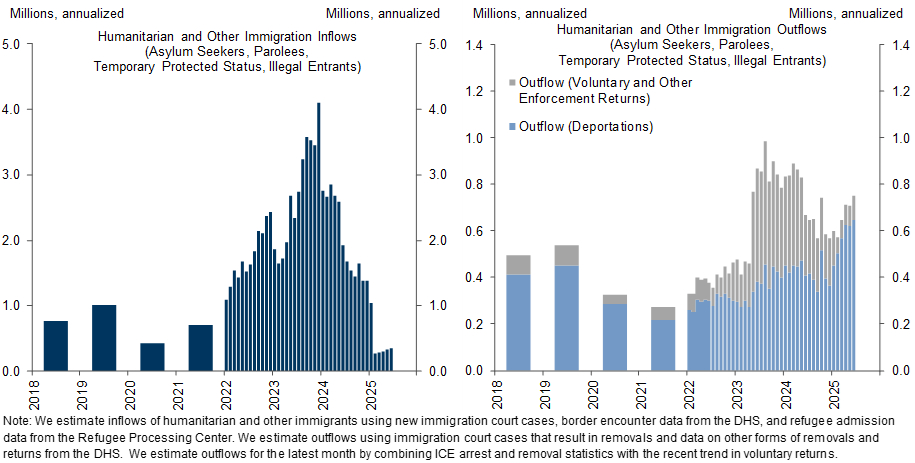

- Visa Issuance Data

- Source: US Department of State, Goldman Sachs Global Investment Research

- Net Migration Estimates and Forecasts

- Source: Transactional Records Access Clearinghouse, Department of Homeland Security, Congressional Budget Office (CBO), Goldman Sachs Global Investment Research

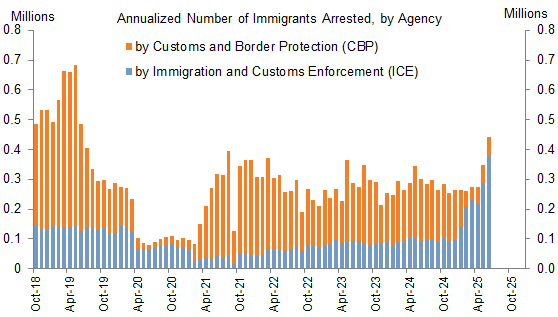

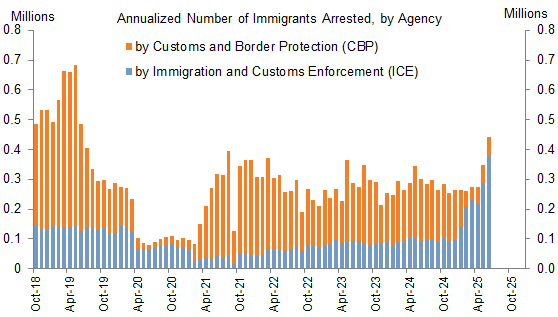

- Evolution of Immigration Enforcement Policy: Since the beginning of this year, the focus of immigration enforcement has shifted from the border (Customs and Border Protection (CBP)) to internal operations (Immigration and Customs Enforcement (ICE)).

- The number of migrants arrested by CBP has sharply declined, while the number of migrants arrested by ICE has significantly increased, from an annualized 0.1 million in January to 0.4 million in June, far exceeding historical trends.

- Although Goldman Sachs expects legal and capacity constraints to limit a further increase in expulsions and repatriations of migrants already in the United States, the continuous rise in ICE arrests and recent additional funding for immigration enforcement suggest upside risks to deportation forecasts and downside risks to immigration forecasts.

- Annualized Number of Migrants Arrested by CBP and ICE

- Source: Department of Homeland Security, Goldman Sachs Global Investment Research

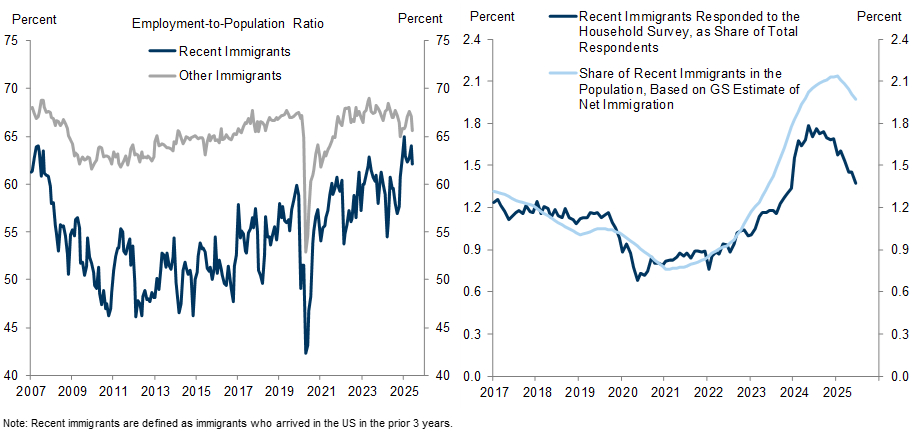

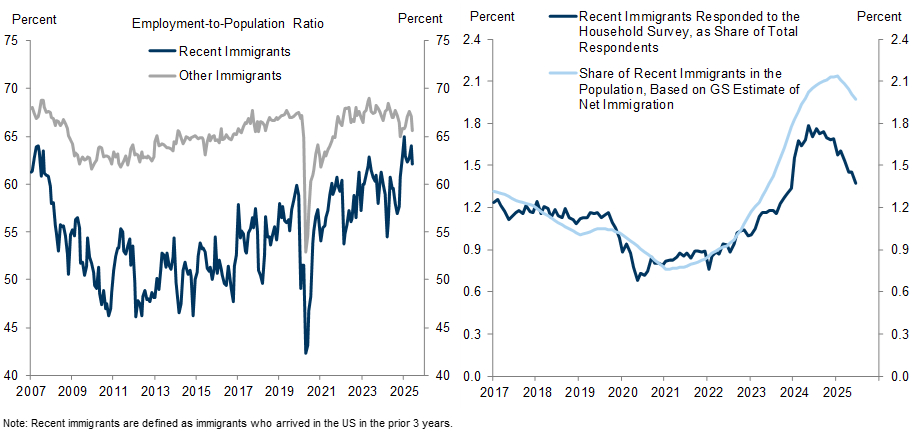

Immigration's Impact on the Labor Market: Despite tighter immigration policies, the labor market performance of immigrants already in the United States has remained quite healthy so far.

- Analysis of detailed household survey microdata for June shows that the employment-to-population ratio for recent immigrants has remained stable at approximately 62% over the past few months, only slightly below 64% at the beginning of the year.

- The continued decline in survey response rates among recent immigrants raises concerns that tighter immigration policies might lead many unauthorized immigrants, fearing repercussions, to stop responding to household surveys.

- However, even under an extreme assumption that all newly non-responding individuals have left the labor market, this decline would only represent a modest impact of 6% (approximately -200,000 people) of the total employment of recent immigrants.

- Employment-to-Population Ratio and Survey Response Rate of Recent Immigrants

- Source: Department of Labor, Goldman Sachs Global Investment Research

- The sharp slowdown in net migration has already reduced the breakeven rate (the employment growth rate required to maintain a stable unemployment rate) from 200k people per month at the beginning of 2024 to approximately 90k people per month in June. Goldman Sachs expects it to fall to about 70k people per month by the end of 2025.

Comparison of Net Migration Forecasts by Goldman Sachs, Brookings, and American Enterprise Institute (AEI)

- Goldman Sachs forecasts net migration of 0.5 million people in the second half of 2025, lower than the 2014-2019 average of 1.1 million people.

- Brookings and AEI's forecasts are more pessimistic, estimating net migration at -0.2 million people.

- The main difference between Goldman Sachs' forecast and the Brookings/AEI study lies in the net estimation of "humanitarian and other migrants": Goldman Sachs forecasts -0.4 million people, while the latter forecasts -0.9 million people.

United States Trade Policy (Tariffs) and Its Impact on Japan's Economy

- Goldman Sachs, through Tomohiro Ota's analysis, points out that after the Donald Trump administration postponed the implementation of reciprocal tariffs until August 1, it sent a letter to the Japanese government indicating its intention to raise tariffs to 25%. This leaves high uncertainty surrounding Japan-U.S. negotiations.

- Who ultimately bears the tariff burden is a key concern for market participants and economists. Whether it is borne by U.S. consumers, U.S. importers, or exporters to the U.S. not only affects inflation trends in the United States but also influences Japan's future export volume and corporate profitability.

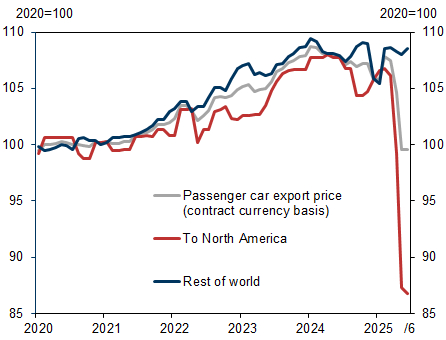

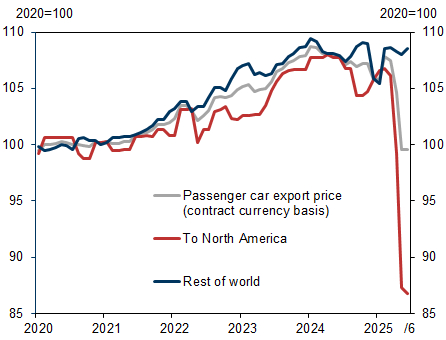

- Implications of Declining Japanese Passenger Car Export Prices: Japanese passenger car export prices to North America cumulatively decreased by approximately 20% during April-June 2025.

- This suggests that, at least for now, Japanese automakers have chosen to absorb the vast majority of the additional 25 percentage points of tariffs themselves, thereby mitigating the increase in U.S. selling prices.

- This phenomenon contradicts the recent view that U.S. consumers and businesses ultimately bear the entire U.S. tariff burden through higher domestic prices.

- Passenger Car Export Prices to North America Have Fallen Sharply Since April

- Source: Bank of Japan (BoJ)

- Possible Explanations for the Decline in Passenger Car Export Prices:

- Intense Market Competition: The passenger car market is highly competitive, making price increases more difficult than in intermediate goods markets; most cars exported by Japanese automakers are mass-market models with high price elasticity.

- Price Revision Lag: Passenger car prices are typically revised with model updates, and less frequently, which may lead to U.S. price increases lagging behind other products; thus, the current downward price trend might be temporary.

- Waiting for Diplomatic Negotiations: Japanese automakers might be waiting for the outcome of Japan-U.S. diplomatic negotiations, avoiding price revisions until uncertainties are resolved.

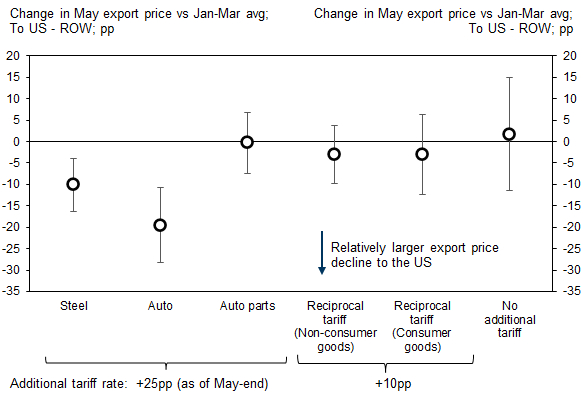

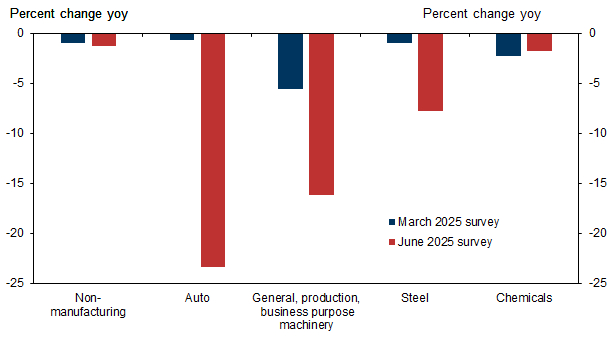

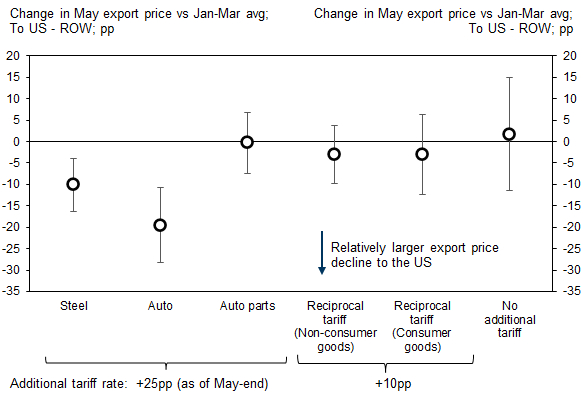

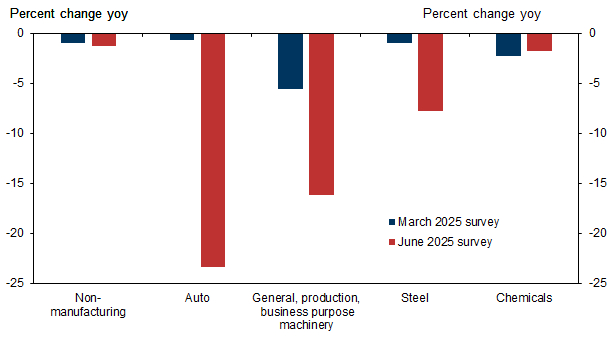

- Market Differentiation and Industry Impact of Tariff Burden Absorption: There are significant differences in the impact of tariffs on export prices across industries.

- Only Passenger Car and Steel/Aluminum Export Prices Show a Statistically Significant Decline

- Source: Ministry of Finance, Goldman Sachs Global Investment Research

- Only Passenger Car and Steel/Aluminum Export Prices Show a Statistically Significant Decline

- Passenger Cars: Export prices have declined particularly sharply, with all 6 engine types of passenger cars experiencing price drops of 10% to 30%, averaging approximately 20%, consistent with Bank of Japan data.

- Auto Parts: Despite being in the same industry as passenger cars and facing the same tariff rate (an additional 25 percentage points), export prices have not significantly declined.

- Steel and Aluminum: Export prices also showed a statistically significant decline, similar to the situation during the first Donald Trump administration.

- Consumer Goods and Non-Consumer Goods (e.g., capital goods and industrial parts, etc., intermediate products): Although export prices marginally declined, the drop was not statistically significant due to relatively lower tariff rates (10%).

- Goods Not Affected by Additional Tariffs: Such as semiconductors, pharmaceuticals, copper products, and chemical products, have not experienced particular changes in export prices.

- The report emphasizes that the current trend of exporters lowering prices to maintain U.S. selling prices (bearing the tariff burden) is limited to specific industries. The current results are preliminary, and future situations may change. For instance, the decline in Japanese automaker export prices might be influenced by temporary factors, with prices expected to gradually recover in the future.

- Negative Impact of Persistently Low Prices on Japan's Nominal GDP and Corporate Profits: If passenger car export prices remain depressed, it will lead to a decline in Japanese corporate profits, potentially causing Japan's Nominal GDP to fall below current expectations.

- The Tankan Survey conducted by the Bank of Japan on June 12, 2025, showed a significant deterioration in the ordinary profit outlook for the automotive manufacturing industry, consistent with the substantial decline in export prices.

- Ordinary Profit Outlook for Tariff-Affected Industries Significantly Deteriorated Over Three Months Ending June 2025

- Source: Bank of Japan (BoJ)

- On the other hand, the impact on Real GDP is unclear: limited increases in U.S. selling prices might curb the decline in passenger car exports; export volume also depends on other countries' pricing strategies; a decline in Japanese corporate profits could lead to a decrease in domestic demand (e.g., private consumption and capital expenditure).

CN

美国移民政策及其对劳动力市场的影响

Key Logic

- 高盛的两份最新报告深入分析了美国关键宏观经济政策(移民政策与贸易关税)对其国内劳动力市场和国际贸易伙伴(特别是日本)经济的深远影响。Elsie Peng的报告指出,美国净移民速度已趋于稳定,但执法重点转向内部导致ICE逮捕人数显著增加,同时移民放缓将促使劳动力市场盈亏平衡率进一步下降;而Tomohiro Ota的报告则揭示,尽管传统观点认为关税负担最终由进口国消费者承担,但日本部分行业,尤其是乘用车和钢铁/铝的出口商,为了维护市场份额,正通过降低出口价格来吸收大部分额外关税,从而缓解了美国国内销售价格上涨的压力,但这可能对日本的企业利润和名义GDP产生负面影响,并挑战了当前关于关税负担承担者的流行观点,强调需要持续监测。

签证发放数据

- 净移民估计与预测

移民对劳动力市场的影响:尽管移民政策收紧,但已在美国境内的移民的劳动力市场表现至今仍相当健康。

- 对6月的详细家庭调查微观数据分析显示,近期移民的就业与人口比率在过去几个月保持稳定,约为62%,仅略低于年初的64%。

- 近期移民对调查的响应率持续下降引发担忧,即移民政策收紧可能导致许多害怕上班的未经授权移民停止响应家庭调查。

- 然而,即使在极端假设下,即所有新增未响应者都离开了劳动力市场,这种下降也仅意味着近期移民总就业的6%(约-20万人)的适度影响。

- 近期移民就业与人口比率及调查响应率

- 高盛预计2025年下半年的净移民为0.5mn人,低于2014-2019年平均的1.1mn人。

- Brookings和AEI的预测更为悲观,其净移民估计为-0.2mn人。

- 高盛的预测与Brookings/AEI研究的主要差异在于对“人道主义及其他移民”的净值预估:高盛预测为-0.4mn人,而后者预测为-0.9mn人。

美国贸易政策(关税)及其对日本经济的影响

- 高盛通过Tomohiro Ota的分析指出,特朗普政府推迟互惠关税实施至8月1日后,致函日本政府有意将关税提高至25%,这使得围绕日美谈判的不确定性依然很高。

- 日本乘用车出口价格下降的启示:日本乘用车对北美出口价格在2025年4月-6月期间累计下降了约20%。

- 对乘用车出口价格下降的可能解释:

- 市场竞争激烈:乘用车市场竞争激烈,提价难度高于中间品市场;日本汽车制造商出口的大多是大众市场车型,价格弹性较高。

- 价格修订滞后性:乘用车价格通常随车型更新而修订,频率较低,可能导致对美国价格上涨滞后于其他产品,因此当前价格下降趋势可能是暂时的。

- 观望外交谈判:日本汽车制造商可能正在观望日美外交谈判的结果,在不确定性消除前避免价格修订。

- 关税负担吸收的市场分化与行业影响:关税对不同行业出口价格的影响存在显著差异。

- 仅乘用车和钢铁/铝出口价格出现统计显著下降

- 乘用车:出口价格下降尤为显著,6种发动机类型的乘用车价格全部下降了10%至30%,平均下降约20%,与日本央行数据一致。

- 汽车零部件:尽管与乘用车同属一个行业且面临相同的关税税率(额外25个百分点),但出口价格没有明显下降。

- 钢铁和铝:出口价格也出现统计上显著的下降,这与第一任特朗普政府时期的情况类似。

- 消费品和非消费品(如资本品和工业零部件等中间产品):虽然出口价格略有下降,但由于关税税率相对较低(10%),统计上不显著。

- 不受额外关税影响的商品:如半导体、药品、铜制品和化工产品,出口价格没有发生特别变化。

- 报告强调,目前出口商为维持美国销售价格而降低价格(承担关税负担)的趋势仅限于特定行业。目前的结果是初步的,未来情况可能会发生变化,例如日本汽车制造商出口价格的下降可能受到暂时性因素的影响,未来价格预计会逐渐回升。

- 持续低价对日本名义GDP和企业利润的负面影响:如果乘用车出口价格持续低迷,将导致日本企业利润下降,可能使日本的名义GDP低于当前预期。

#us_economy #japan_economy #macroeconomics #immigration_policy #trade_policy #labor_market #tariffs #corporate_earnings #nominal_gdp #employment_rate #net_immigration #breakeven_rate #export_prices #market_competition #policy_impact #goldman_sachs #economic_analysis #data_analysis #global_trade #economic_indicators